There's an interesting pair of stories in today's Seattle Times Real Estate section. The first article sings the praises of buying dumpy houses in crime-ridden neighborhoods. (Okay maybe that's an exaggeration.)

Many first-time buyers swiftly learn that if they want to get into a home they'll have to make accommodations.

Although there are several types — buying with friends or others, thinking smaller, driving farther — the most popular are buying fixers and finding cheaper neighborhoods.

There's a particularly interesting number given in the article:

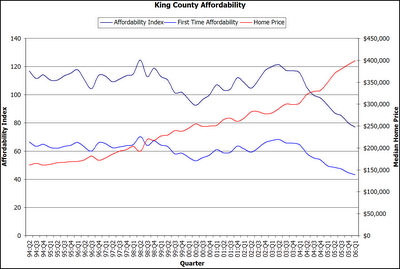

A household of four earning median income in King County can, conservatively, pay $327,180 for a home. But they won't have many options on the single-family home front except along the King County line, said Elizabeth Grebenschikoff, a real-estate agent with Quorum Real Estate Laurelhurst in Seattle.

If you put 20% down ($65,436—tell me, who has that much?) on a $327,180 house, you'll have a mortgage of $261,744. At an interest rate of 6%, the monthly payment on this mortgage would be about $1,570. The median household income in King County is

$55,114, or almost $4,600 per month. $1,570 is 34% of that. Again, I would like to point out that "the generally accepted definition of affordability is for a household to pay no more than 30 percent of its annual income on housing." (

US Dept. of Housing & Urban Development) So, I don't know where Ms. Hodges pulls that $327,180 number from, or how she can consider it "conservative," but whatever.

The second article

focuses primarily on numbers, and leaves me confused as well.

Using conservative lending estimates from the National Association of Realtors, a household would have to bring in $96,428 to buy that $405,000 home — and that's with a 20 percent (or $81,000) down payment. With nothing down, make that $120,535.

Now we're actually using the word "conservative" correctly. $96,428 per year is $8,035 per month. 30 percent of that is $2,410. Monthly payments on the $324,000 mortgage ($405,000-$81,000) would be just under $2,000. So by my calculations, that actually is a conservative estimate. The way I figure, you would "only" need to make $77,000 (and somehow have $81,000 in the bank) to afford the median home in King County. Again, whatever.

While Seattle isn't considered a "bubble" market, the median price of single-family homes in King County has been rising by double digits every year for several years — 11.9 percent (from $362,000 to $405,000) from March 2005 to March 2006 alone.

Median income in King County hasn't risen as quickly as home prices. Last year, median income in King County was $77,900 for a family of four; $63,120 for a two-person household; and $55,230 for singles.

Okay on this one I'm going to have to call bull. The most recent figures that I've seen are from 2004, and as I said above, they put the "median household income" at

$55,114. How could the median household income be lower than even the median single income quoted above of $55,230? Furthermore, the

most recent data (again, 2004) on "median family income" for King County puts it at $71,814,

not $77,900. Either the author of this article has seen some new numbers that are quite a bit higher than the 2004 data, or they're just making things up.

Can anyone shed some light on this? Where are these numbers coming from?

(

Jane Hodges, Seattle Times, 05.14.2006)

(

Jane Hodges, Seattle Times, 05.14.2006)