Big Boeing Bonus... Bubble Booster?

Given that the housing bubble is so closely tied to the economy, both on a national and a local scale, I feel compelled to mention the $346,500,000 stock infusion that will soon be distributed among 63,000 Puget Sound residents.

If Boeing's stock ends the day near Thursday's closing price of $83 a share, employees will receive Boeing shares worth about $5,500, and the regional economy stands to get an infusion from the bonuses.Just what we needed to stretch this party out for just a little bit longer.

The windfall, worth hundreds of millions of dollars, will go to an estimated 191,000 full-time, part-time, current and retired employees companywide — 63,000 people in the Puget Sound region — who have worked at Boeing during the past four years. Workers who have been with the company for just a portion of that time will get smaller, pro-rated stock bonuses.

...

Bret Bertolin, a senior economic forecaster for Washington state, said the bonuses will have more significance to the local economy than when Microsoft paid out its $3-per-share special dividend in November 2004.

The reason, he said, is that the vast majority of the dividend went to big shareholders like Bill Gates, Paul Allen and Steve Ballmer, rather than to rank-and-file workers. Gates gave his $3 billion windfall to his foundation, which spends its money around the world.

Even so, Bertolin doesn't expect the checks to lead to a big boon in state tax revenue. Even with the rosiest of estimates, he said, it could generate only $20 million of tax revenue, relatively small change for a state that expects to collect $28.9 billion in tax revenue in the current two-year budget cycle. Most of the windfall is expected to be spent in retail.

The bonus represents 6.8 percent of the $5.1 billion payroll for the aircraft-manufacturing industry in Washington state in 2005.

(Luke Timmerman, Seattle Times, 06.30.2006)

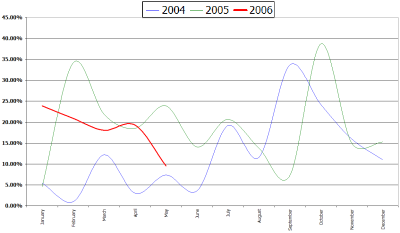

Seattle's strict growth- management policies and an economic rebound are buffering the region's real estate market from cooling trends. The number of new jobs has outpaced building permits for single-family homes and condos by 30% the past 15 months. Though single-family home sales fell about 7% in April, compared with April 2005, there's only a three-month supply of homes in the Seattle market — half the national average. That's largely why prices rose nearly 18% that month, according to the latest data available.

Seattle's strict growth- management policies and an economic rebound are buffering the region's real estate market from cooling trends. The number of new jobs has outpaced building permits for single-family homes and condos by 30% the past 15 months. Though single-family home sales fell about 7% in April, compared with April 2005, there's only a three-month supply of homes in the Seattle market — half the national average. That's largely why prices rose nearly 18% that month, according to the latest data available.