So what's in store for the Seattle housing market in 2007? Everyone's got an opinion, and yours truly is no exception. But before I get into my guesses, let's review the predictions of local "experts" that have been trumpeted in the media in the last few weeks.

From a December 22nd P-I article:

"I think very easily by spring this could be an extremely strong real estate market," said Bill Riss, chief executive of Coldwell Banker Bain, in Seattle. He said he was planning on home prices going up an average of about 10 percent in the coming year and about the same number of homes to be sold next year as in 2006.

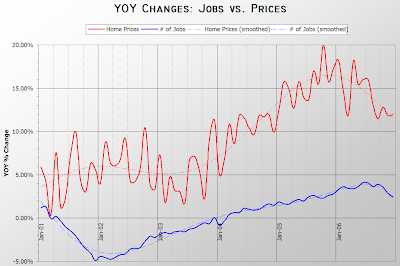

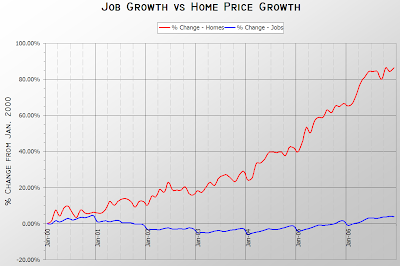

Analysts say strong job growth will continue to drive demand in the area.

"Really, the driver of the housing costs is demand, which is fueled by jobs," said Randy Bannecker, a consultant housing specialist for the Seattle-King County Association of Realtors. He predicted year-over-year price increases would be 6 percent to 10 percent in 2007.

[WCRER Director Glenn] Crellin predicted slight declines in activity in 2007 and year-over-year price increases that would be down around 3 percent to 5 percent by the end of next year.

Matthew Gardner, a local land-use economist, predicted activity would slow from recent highs and price increases would settle to 7 percent to 9 percent in Seattle and 5 percent to 7 percent in rural areas farther from jobs.

Don't forget

Ms. Rhodes' preferred vision,

discussed here earlier.

What will 2007 bring? Here's what Seattle real-estate experts are saying.

...

[Seattle real-estate economist Matthew Gardner] expects closer-in areas to appreciate about 10 percent over the coming year; farther out, 7 percent appreciation will be more the norm for single-family homes and for condominiums.

And of course I have to mention the outlier in the bunch, from

Saturday's P-I:

Michael Simonsen, chief executive of Altos Research, in Palo Alto, Calif., has noticed cooling in the Seattle home market.

...

Simonsen predicted that Seattle would start seeing slight year-over-year price declines this spring or summer, although he said the city had a strong economy, and its housing market would fare better than outlying areas.

So the general consensus among the media's preferred "experts" seems to be a fairly optimistic +7—10% to the median price in 2007, thanks to "jobs." Granted, median price doesn't give us a very complete market picture, but it's the best metric we've got.

As far as the jobs argument goes, I believe it is a false hope to think that as long as the sheer number of jobs is increasing, housing prices will also increase. It is true that a large drop in employment will usually lead to a housing downturn, but housing

can decline despite a strong job market. For evidence of this, see Rich Toscano's investigation of

San Diego's housing market in the 1990s. Of course I'm sure that the local housing bulls would retort that San Diego didn't have Boeing and Microsoft.

Before I tell you what I think is in store for 2007, let's take a look at what I guessed

back in April about the remainder of 2006:

In most parts of King County appreciation slows to a crawl through the end of the year. The closer to Seattle you get, the more stagnant the appreciation. Near the end of summer and into fall, inventory begins to build slightly. Realtors and newspapers proudly proclaim a "soft landing."

"Appreciation slows to a crawl" was clearly incorrect. Appreciation did indeed slow to

12% YOY county-wide and 10% in Seattle (pdf, page 2), but that's hardly "to a crawl." I think prices were held a bit higher than I expected thanks to the unexpected drop in mortgage interest rates. My call on inventory was spot on, with active listings up 20-30% YOY the last three months of the year, and as evidenced by the newspaper quotes above, the press is definitely still pretty optimistic about the market.

Here's my 2007 prediction from April:

Inventory stacks up at an increasing pace, prices are level in some areas, slightly declining in others. By the end of the year, prices in some areas are approaching 2004 levels. Realtors still in denial.

With inventory already increasing over 20% YOY, it will be hard to increase the pace, but certainly possible. I expect to see active listings at least 15% over 2006 levels for the first half of the year. During the same time, I expect sales will decline at least 5-10% from 2006, dropping back to levels last seen in 2002 or 2003.

As far as the median price goes, I doubt that it will be "approaching 2004 levels." That would be a roughly 25% drop from today's price, which is highly unlikely save for some sort of scenario that includes a major natural disaster. More realistically, I guess that the King County "residential" median price at the end of this year will be between five percent down ($418,000) and three percent up ($453,200).

I expect we'll see more toward the low end if interest rates begin to edge upward again, lending standards are actually tightened a bit, and the local economy moderates. If interest rates hold steady or drop, new even-more "creative" financing is brought to market, and the economy goes gangbusters, we'll probably end up at the high end.

Maybe the "experts" are right and prices will go up another ten percent this year. Maybe I am underestimating the willingness of Seattle homebuyers to jump into greater and greater debt for an unchanging product. No doubt they've already demonstrated themselves to be far more willing than I ever would have guessed. However, as the real estate party winds down around the country, I have yet to hear any good, well-thought-out reasons ("Microsoft and Boeing" doesn't count) that we will escape the slow landslide.

Whatever happens, most of the action will probably take place March through May, so we'll most likely have a pretty good idea by June where we'll be in December.

So what are your predictions (and the reasons behind them) for 2007?

(

Aubrey Cohen, Seattle P-I, 12.22.2006)

(

Elizabeth Rhodes, Seattle Times, 12.30.2006)

(

Aubrey Cohen, Seattle P-I, 01.06.2007)