Always Trust The 'Experts'

What's the point about worrying about global warming when we're getting all this hot air from Elizabeth Rhodes?

Please enjoy this year end feel good article about our robust housing market here in Rain City.

First, let me introduce the "experts".One of this year's biggest residential real-estate topics was the anticipated slowdown in sales and appreciation.

Would the Puget Sound market tank?

Would prices deflate?

Neither of those things occurred locally, although other parts of the country have seen moderate-to-severe downturns this year.

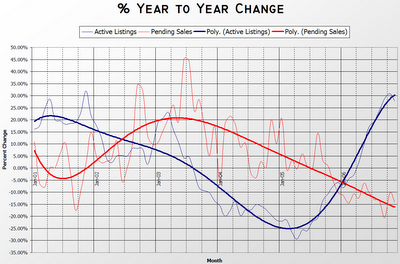

What happened here was a gentler transition in housing activity, from its record 2005 levels to a slower pace by this year's end.

What will 2007 bring? Here's what Seattle real-estate experts are saying.

Elizabeth Rhodes (The Seattle Times and her job depend on a steady stream of advertising dollars from local Real Estate)

Matthew Gardner (Gardner Johnson, a Seattle land-use economics firm; "regularly retained by the region's most prominent developers")

Bill Riss (CEO of Coldwell Banker)

Frank Nothaft (Chief Economist, Freddie Mac)

Mike Scott (Dupre+Scott Apartment Advisors)

Suzanne Britsch (Senior Analyst, New Home Trends)

"This bubble lunacy is still prevalent, but not in Seattle, and I'll keep saying that," said Gardner, of the land-use economics firm Gardner Johnson.What did we have in 2006?

The closer homes are to the major job hubs of Seattle and Bellevue, "the higher appreciation you'll get," Gardner said. "That's because there's intrinsically a value to our time."

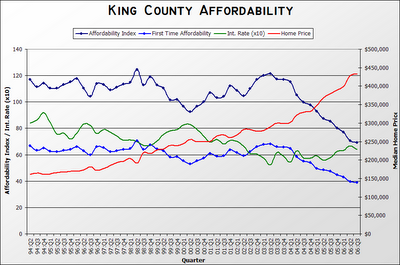

"A more balanced market," said Bill Riss, CEO of Coldwell Banker Bain. That's giving buyers "a little more time to think, plan and write good offers."Sure, no problem affording that $699,000 charmer with your conventional loan: $140K down payment and $4,800 monthly payment!

Riss wouldn't be surprised if spring sales roar to life, causing another feeding frenzy, albeit not at record levels of past years.

A rise in inflation could drive rates up, but that's not a concern now, Frank Nothaft, chief economist for mortgage-money provider Freddie Mac, recently told the Washington Association of Mortgage Brokers.

"Inflation will be tame, and interest rates will not change much in the next six months," Nothaft said. "They may drop after that. We don't see mortgage rates even getting up to 7 percent [by the end of 2007]."

He also anticipates the number of nontraditional loans, such as negative amortization and interest-only, will drop as borrowers choose other mortgage products instead.

The same strong regional economics sustaining the local home-sales market are also fueling apartment demand, said analyst Mike Scott, of Seattle's Dupre + Scott Apartment Advisors.Buy now or be priced out forever! I don't know about you, but even if he's correct I would gladly pay an additional 8% in rent rather than 50% more in mortgage costs while facing the inevitable repossession, bankruptcy and anxiety disorder.

Logically, strong demand should ramp up apartment construction, but it hasn't worked out that way, Scott said.

A year ago, he forecast 3,600 new units would be built in King, Pierce and Snohomish counties this year. Instead, just under 3,100 opened.

In 2007 Scott anticipates even fewer: just 2,600 new apartments.

...apartment rents to jump about 8 percent next year, Scott predicted. Vacancies will fall from their current 4.7 percent to roughly 3.5 percent, he said.

My prediction: Rents will remain flat through 2007 and drop in 2008 as additional housing becomes available. Desperate FB's will have no choice but to rent out properties that do not sell. Condos and condo conversions will face a serious slowdown in sales and many will convert into apartments.

The national news has been full of stories about homebuilders cutting production and prices as the real-estate market cools. In November, for example, building permits nationwide fell to a nine-year low, according to a government report.We're different. Special. A breed apart.

"But that's the national news, not the local news," said Suzanne Britsch, senior analyst for New Home Trends, a construction-analysis and consulting firm in Mill Creek. "We still have job growth and a shortage of lots here, so we have just not had a problem with standing inventory."

In King County, the average price of a new house will be $750,000, she predicted. A big chunk of that expense is the land. The rock-bottom price for a lot in a new King County subdivision is now $250,000.OMG that is so affordable! Isn't it nice to have all these objective opinions?

In Snohomish County, new single-family homes will start at $400,000. And they'll likely be on 3,500-square-foot lots, rather than 6,000 square feet, the norm there until recently.

Happy New Year ;)

(Elizabeth Rhodes, Seattle Times, 12.30.2006)

The

The