Inventory Eases (Very) Slightly In October

The NWMLS has posted October statistics. Although residential (excludes condo) inventory did indeed follow its usual October downward course, the decrease of less than 1% of listings was the smallest since at least 2000 (I don't have reliable inventory statistics further back). The YOY increase in inventory stands at almost 31%—a new record—while the YOY decrease in pending sales eased to 10% (from 20% last month).

The statistic that I find most bizarre is the median price of closed residential sales, which increased $15k (3.5%) from last month. The median price has only increased by more than 3% from September to October one other time since 1993—in 1995.

Anyone out there care to venture a guess as to what the heck is going on? Have home buyers in King County all gone 100% mad? What could possibly have driven prices up another $15,000 in one month?

37 comments:

The statistic that I find most bizarre is the median price of closed residential sales, which increased $15k (3.5%) from last month. The median price has only increased by more than 3% from September to October one other time since 1993—in 1995.

That's interesting...I just looked at the pending sales which show about a $5K MOM decrease. But I guess since it's pending, those #s are subject to change. If I remember correctly the pending sales also showed MOM decrease in the Sept report. But now that they are closed, we actually see an increase.

It could be a big stall in the first-time buyer (i.e. lower price) homes. The majority of the sales activity for the month taking place at the top end could account for the "large" increase is median price.

Hi Flop,

I don't think that's the case. MLS shows that most closed sales were in the $250-$349 range. (2,316 sales)

There were only 277 sales in the $750-$999 range.

See: Closed Sales Report by Price Range and Bedrooms

Stop abusing the statistics, Meshugy.

In order to answer the question (are skewed sales causing an artificial rise in median prices from month-to-month?), you need to compare two histograms. Looking at the histogram from October alone doesn't cut it.

Meshugy,

The stats in the link you provided are interesting, but don't really go very far toward answering my question or flopfolder's theory.

First off, I'm only interested in "residential," while the link you provided is for "res + condo." I would expect the inclusion of condos to skew the figures toward the lower end.

Second, I agree with MisterBubble, in that it's really only useful if we can see how the disribution is changing (or not changing) from month to month.

Hey...how are you guys getting these summary reports? I can't even view the NWMLS site because it has some inane requirement for Internet Exploder (why someone thinks you need a specific browser to download a PDF file, I'll never understand....)

I use Firefox, so I don't know what your problem might be. If you can right-click and "save file as..." you can save the report to your computer and then open it in Acrobat Reader.

If you go back an look through the "Closed Sales Report by Price Range and Bedrooms" over the last year you'll see not much has changed. The vast majority of sales are in the $250-$349 range.

Tim, why don't you make a spread sheet of it all? That would make the trend clearer...

I can download the linked files using Firefox, but Meshugy keeps coming up with reports, and I have no idea where he's getting them.

Is there an index somewhere that's viewable with a non-IE browser?

MisterBubble,

There's no public index of these reports. You either have to be a member of the MLS (i.e., a real estate agent) or really good with Google.

I found most of the reports that I grab from there via the latter method.

Thanks, Tim.

Hmmm....I find it very interesting that Meshugy is a musician who is so brilliant with google that he can pull up years of obscure NWMLS reports almost on demand.

".....The majority of the sales activity for the month taking place at the top end could account for the "large" increase is median price."

As flopfolder mentioned in his post quoted above, an increase in median prices could be a result of the top end of the market being more active than the lower end of the market.

As an example, about a month ago the Kitsap Sun ran an article about real estate in the Kitsap County area. The reporter interviewed a Bainbridge Island Realtor and the Realtor actually said that affluent types from Hawaii were buying up the top end investment properties while sales at the low end were slowing. That kind of sales activity would definitely skew sales statistics upward, but it does not mean that the overall market is appreciating.

Any change in the data mix can cause a change in the average / median and not necessarily be indicative of the overall market. Average / median sales statistics can be misleading.

flopfolder was right

terry was right;

Inventory exerts price pressure in the immediate future, but doesn't reveal anything about recent inflation or appreciation. Nor does median price. We want median sq ft price.

I looked at Oct. v. Sept. closed sales for King. Square foot price had increased around 2%. But closed sales are less current than pending. So far I can't find a way to search all pending sales for a full month.

Median price does reflect the affordability of the market. If the median is creeping toward the average, we can sort-of infer that the normal people are getting increasingly priced out. Such was not the case in Oct. The med & avg prices in pending sales (all areas) returned essentially to June levels. Avg went up from Sept, indicating a return of higher-end activity.

I know. That's MOM, but all can follow up on '05 via my previous post on the open thread.

Enough topics for one post.

Speculation among Seattle Bubble contributors?

Tim,

Dalas has a point about new listings. It would be nice to see the curve for those against inventory and pending sales.

Uh...am I the only one who is now getting the August numbers when I click on the "October statistics" link?

I think the NWMLS is monkeying around with the files, Tim.

1) Someone in Seatac entered a sale in October of $244,950 as $24,495,000

2) Number of sales in Oct. vs. Sept. over a million was virtually unchanged while the under $400,000 sales decreased by 13%. In between decreased by about 5%.

So few sales, but more with higher sale prices than the previous month.

Dalas has a point about new listings. It would be nice to see the curve for those against inventory and pending sales.

Yes, dalas has a point. It's just not the point that he thinks he's making.

It is perfectly reasonable to expect that new listings would decline -- it's nearly winter, after all. Few people want to sell their homes during the holiday season. Fewer want to begin the process in October.

But dalas goes too far -- he is trying to suggest that this means that there are no "panicking" sellers, and therefore, no bubble. Neither conclusion follows from the evidence. Aside from the fact that he is mischaracterizing the discussion (no one has mentioned "panic" except for dalas), inventory is up fairly dramatically, indicating that a larger number of people are trying to sell their homes in the winter months -- an unusual phenomenon. These sellers could very well be worried about their propects. Likewise, rising inventory and slowing sales are both strong indicators that the market is cooling.

In other words: nothing new to see here. The world continues to rotate on its axis, the sun continues to rise in the east, and dalas continues to troll.

dalas & mrbubble both correctly cite the facts. New listings are down YOY, but up MOM. The latter seems quite unusual. I buy most of mrbubble's analysis, noting that:

... rising inventory and slowing sales are both strong indicators that the market is cooling.

is the correct inverse of the present case. Further, I decline any implication of dalas' trolliness or non-trolliness.

Ardell,

I infer that you're citing closed sales, which were lower in Oct. than Sept. Citing those without mention of pending sales is confusing at this point; pending sales are back up in Oct. The discrepancy is due to time lag.

Tim,

Any chance of getting that curve of new listings on the chart?

New listings are down YOY, but up MOM. The latter seems quite unusual.

Don't forget active listings! They're up dramatically YOY.

Also, I'm not sure I follow your logic regarding the "inverse of the present case." I think it's absolutely clear that the market is cooling.

I think it's absolutely clear that the market is cooling.

The 2006 market has been consistently cooler than the 2005 market, i.e. cooled YOY.

Oct. pending sales & volume were unexpectedly up MOM, part of the strange direction shift that prompted this thread.

Cooling would only apply if you lump Oct. in with the rest of the year. You seem to be the only one doing that.

"Cooling would only apply if you lump Oct. in with the rest of the year. You seem to be the only one doing that."

I don't see your point.

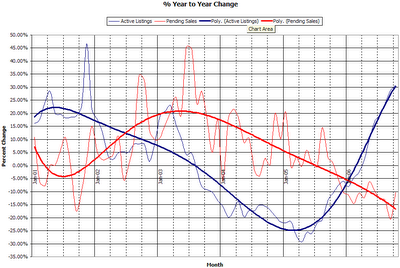

Look at the graph attached to this post. The YOY increase in inventory has been increasing linearly since January. That's a cooling market -- inventory is accumulating at a faster YOY pace with each passing month.

My own personal barometer to how the Seattle housing market is changing is by the increase in Seattel RE cheerleaders that have joined the bubble blog here.

A year ago or so, it was the arch-bears ruling the roost, no one seemed that interested because no one had the notion that 'googling', SEATTLE and HOUSING BUBBLE, would give you any hits...

Now its a year on, and it seems like the more voices that argue there isn't a Seattle bubble, merely lend credence to the fact that there IS one....

If I started a blog, "Ranier to blow within 5 years", and posted geogological facts, my guess is I'd be ignored, why? because it seems far fetched... given a few earthquakes here and there, and I bet I'd start getting megahits.

Yes, active listings are increasing absolutely, one can see this very clear in the field without having to see it on paper.

Did you look at the Oct MLS report? Inventory is down MOM....and continuing to plummet.

Dalas said:

"Another stat to point out, total new listing YOY on both monthly and YTD are lower this year than last."

Ahem. From the first page of the October report -- new residential listings (total / KC only):

10/2005 - 9,724 / 3,364

10/2006 - 10,065 / 3,373

New residential listings, year-to-date (total / KC only):

10/2005 - 103,453 / 36,804

10/2006 - 108,416 / 35,682

And just to drive home the point, total active listings (total / KC only):

10/2005 - 21,652 / 6,014

10/2006 - 31,739 / 7,865

As I said, it is perfectly reasonable to expect that new listings would decline. Meshugy (among others), has made this argument extensively. Instead, active listings have increased, and new listings have increased or held steady.

I suppose I may not know your definition of "YOY," dalas, but I know how to read a table.

Meshugism:

"Did you look at the Oct MLS report? Inventory is down MOM....and continuing to plummet." (emphasis mine)

Meshugy, I'm impressed. Most people don't know how to determine the slope of a line from a single data point!

My own personal barometer to how the Seattle housing market is changing is by the increase in Seattel RE cheerleaders that have joined the bubble blog here.

-grivetti

I agree, but for different reasons. More posts by RE cheerleaders (ie: loan originators, speculators, Realtors, etc.) means that these people have more time on their hands to troll the blogs. This means that they're not out their conning buyers out of money they don't have yet.

People are wising up and staying away from the market. You can smell the rancor of desperation from the NAR ad in the New York Times. You can see the desperation in the posts here, where the trolls start talking about MOM comparisons, when YOY has been their watchword since day one.

Keep posting here, trolls. It makes me feel better that you're off the streets.

Meshugy, I'm impressed. Most people don't know how to determine the slope of a line from a single data point!

HI Bubble...you can watch the inventory plummet daily on zip realty. All the gains of Oct are now gone....

You can also see the decline in inventory here:

HousingTracker.net

Shug,

Repeat after me:

YOY

YOY

YOY

YOY

Just looking over some of the Seattle neighborhoods. Some absolutely huge gains in price last month.

Ballard (705)

Sep res Median:$450,000

Oct res Median:$529,950

Queen Anne/Magnolia (700)

Sep res Median:$588,500

Oct res Median:$725,000

Laurelhurst (710)

Sep res Median:$480,000

Oct res Median:$499,950

Bellevue (530)

Sep res Median:$546,950

Oct res Median:$599,950

Nearly every area experienced big gains....I think it's pretty clear that the Seattle market is still pretty hot. I don't know how else you could explain such huge MOM appreciation.

I should also mention that Res sales are also up YOY in most of these areas....more sales then 2005, amazing.

Ballard (705)

Oct 2006 Sales: 291

Oct 2005 Sales: 271

Queen Anne/Magnolia (700)

Oct 2006 Sales: 94

Oct 2005 Sales: 81

Laurelhurst (710)

Oct 2006 Sales: 173

Oct 2005 Sales: 176

Bellevue (530)

Oct 2006 Sales: 80

Oct 2005 Sales: 92

Meshugy,

I think you missed your calling as a political spin consultant. I like how you cherry pick 4 areas of King County. Lets talk YOY for the entire county, otherwise you are wasting our time. Anyone can cherry pick the 4 best or worst areas to try and prove a point.

Either I'm reading his data wrong, or only two of his cherrypicked data acually support his premise.

Hi Matt...

the res/con median for all of Seattle shot up to 420K which back to the peak of July. The median res/condo for all of King County shot up to $391K which is just shy of the August peak of $392K. I think that says it all...the market is still very competitive and people are continuing to pay more and inventory is dropping like a rock. Price declines would be highly unlikely in this scenario...there's just too many buyers fighting over too few houses.

matthew and lake hills renter,

If you look at the YOY inventory of these places from the Breakouts that the 'shugster posted, I can see how you'd be confused. Res+Condo inventories are:

Queen Anne/Magnolia(700): +41%

Ballard(705): +43%

Laurelhurst(710): +28%

Bellevue(530): +33%

Clearly people can't get out of these crack-addict-strewn, trailer-trash havens fast enough. And with anemic YOY closed sales figures coming in at:

Queen Anne/Magnolia(700): -10%

Ballard(705): -10%

Laurelhurst(710): -19%

Bellevue(530): -20%

...these FBs are having a hard time selling. When you get miniscule sampling like this, no wonder the median prices are out of whack.

Personally, I think it's the poor floor plans, vacationing RE agents, lack of jobs, and vanishing population that is driving down the desirability of these 'hoods.

But don't be distracted by the facts and data. Meshugy's gotta sell some homes, so cut him some slack.

Hi Plym...

YOY Increased inventory and lower sales figures only tell us that there is less activity then last year (which was a record breaking year). The market has clearly gone from overdrive to just very active. Historically this is still a very, very good year for Real Estate in Seattle.

So you'll see some negative #s for sales and some increased YOY inventory. But those changes are clearly not enough to send the market into a tailspin. We're still seeing climbing prices and very strong YOY appreciation. We'd need double the inventory and an over 50% drop in sales to see prices come down. We're not even close to that...in fact, inventory is dropping so it's very unlikely we'll see a big drop.

"the res/con median for all of Seattle shot up to 420K which back to the peak of July."

Is this in the report, or is it another Magic Meshugy Number, derived from questionable unknown sources?

"The median res/condo for all of King County shot up to $391K which is just shy of the August peak of $392K. I think that says it all...the market is still very competitive and people are continuing to pay more"

...for now. Inventory is rising, sales rates are falling, and days-on-market is increasing. Yes, prices are also generally increasing, but irrational markets cannot sustain themselves forever.

Also, I would like to take this opportunity to point out that median new condominium sales prices actually dropped YOY in October in King County, despite a significant increase in the number of sales. Can you say "leading indicator", boys and girls? I sure can.

"...inventory is dropping like a rock."

Maybe in Meshugy-world, where perspective is apparently limited to the previous month. In the reality-based universe, nearly all of the inventory numbers have increased, YOY. New listings are up, active listings are way up, and sales (active and pending) are down.

At this point, you have to be shoving your head in the sand not to notice the slowdown.

In the reality-based universe, nearly all of the inventory numbers have increased, YOY. New listings are up, active listings are way up, and sales (active and pending) are down.

Hi Bubbles....

These stats are only relative to last year...we defintly have a slower market then last year. But that's not saying much, since last year was the best on record.

Our inventory stands at 7865.

That's higher then last year, but below most other years:

Oct 2003: 8127

Oct 2002: 8966

Oct 2001: 8302

As you can see, we have historically low inventory right now. We need to see a much bigger build up for a crash. But, as it always does this time of year, inventory is shrinking. Once Thanksgiving hits there will be hardly anything left.

Post a Comment