Also posted at Priced Out Forever.

Buy If You Must. Why Must You Buy?

by guest poster Eleua (with contributions and spreadsheets by Tim)Click here to download the Excel Spreadsheet that the numbers below are based on.I need to take a step back and insert a personal note. While I disagree with the motives and actions of the faceless Real Estate Industrial Complex (REIC), there are genuine, honest, intelligent and wonderful people that work as RE agents, mortgage planners, title agents, contractors, appraisers, granite counter fabs, etc. It might be difficult to find one of these in an sub-prime boiler-room, or on a CNBC interview, but there are those out there making a living that are just as much of a victim as their customers. Please separate my disdain for the high priests and the overall entity from the

honest people that believe they are trying to help someone achieve a dream. Second, difference of opinion does not constitute condemnation. I enjoy a healthy, spirited, raucous discussion more than most. At the end of the day, drinks are on me.

With that said, let's get on with the flogging.

I will be the first to say that buying is a good idea if you intend to live in the house for the bulk of the mortgage period, you can afford it, and it is viewed as your nest, rather than your nest egg. If you are a transient, or you are trying to save for retirement by living in your 401(k), you might get lucky and you might get ruined. Houses are homes. They should not be investments.

200-7! You Crapped Out.For the past several years, we have been living in a speculative economy. During the late '90s, this was manifested in stocks, and now it is takes the form of residential real estate. Everyone wants in on the fun. Why not? Real estate, like stocks, always goes up in value. It is a great investment, and the way for normal people to build wealth. At least that is what the Real Estate Industrial Complex (REIC) wants you to believe. They don't make as much money if you are skeptical.

At first glance, it sure seems like a dynamite investment. Everyone has a grandmother that bought her $600,000 home back when it was $60,000, and if you live in California or Seattle, you can't go 15 minutes without running into someone yammering on about how much their home has gone up in value. Some idiots treat a daily visit to Zillow like they would a call from their stockbroker.

By Your Lease, My LandlordThe new homeowners are buying into the idea that America does, in fact, have a class system: the Landed Class, and the Perpetual Renters. The Landed Class have unlocked the secret to passive wealth, and the Perpetual Renters are condemned to the outer darkness of blowing their savings on their landlord's mortgage - a double insult.

All current living generations in America have been force-fed the idea that home ownership is absolutely essential to financial freedom. It is an article of faith in the national religion. Question this and you are branded a heretic. Somehow, through an Orwellian twisting of the language and a corruption of the educational system, debt became wealth. The last two generations that would have disputed this have passed on.

Morons + Money = LumpeninvestoriatThe REIC sells homes as investments to the Lumpeninvestoriat. Homes are more expensive if the parties attach a high speculative premium. The higher the speculative premium that accompanies a property, the higher the price will be. This reinforces the validity of the speculation. Normally, this is called a bubble. The REIC makes a lot of money fomenting a bubble.

Is a home a good investment? If by investment you mean that it throws off the dividend of a place to call home, then yes. Renting provides the same benefit. If you are seeking a "forced savings program" and capital appreciation, you might be better off with payroll deduction and a quality, value oriented, contrarian investment portfolio.

Pay No Attention To The Details Behind The CurtainLet's examine a common exercise that many in the REIC like to conduct to shore up their position that your home is your nest egg.

A gracious local mortgage planner responded to my stunned disbelief that someone would refer to a mortgage as a "forced savings plan" by posting a comparison between a hypothetical renting scenario and buying the same house.

This is her example that shows how a house can be a great savings plan.

Owning a home is not right for everyone. There are certain benefits to not owning the home you live in. If something goes wrong with the property, you simply ring up the landlord and they get to fix it. You pretty much know what your cost are going to be month to month (unless your landlord decides to sell the property, increase rent, convert the condo, etc.). On comments from last Friday’s post on interest rates, there is a discussion debating if one could consider having a mortgage as a forced savings plan. I know I'm going to seem biased since I am a Mortgage Planner…and I fully expect all of the number-crunching-junkies out there to have a heyday with what I'm about to post…but here goes!

I found two similar homes, both in the north Seattle area. The rental property is available for $1850 per month. The home for sale, with close square footage, rooms, area, etc., is available (actually, an offer is pending) for $499,995.

I found two similar homes, both in the north Seattle area. The rental property is available for $1850 per month. The home for sale, with close square footage, rooms, area, etc., is available (actually, an offer is pending) for $499,995.

With the comparison, I'm going to assume someone has 20% down to either invest in the stock market or to buy a home. The current rate for a 30 year fixed is 5.75% (APR 5.904%). Principal and interest is $2,334 plus taxes and insurance equals a total payment of $2623. First year monthly tax benefits are $606 (mortgage interest benefit will decrease, property tax benefit will most likely increase).

The prospects are in the 28% tax bracket; they have a gross income of roughly $8000 per month and can have $700 in monthly debts with credit scores at 680 or better. The investor will receive 11% from the stock market and the homeowner will benefit from an appreciation of 7% on their real estate.

| Rent | at 5 years | | Homeownership | at 5 years |

| Total Payment | $117,863 | | Total PITI | $157,396 |

| Principal Paid | 0 | | Principal Paid | $28,951 |

| Tax Benefit | 0 | | Tax Benefit | $35,293 |

| Net Cost | $117,863 | | Net Cost | $93,152 |

| Real Estate Value | 0 | | Real Estate Value | $701,269 |

| Loan Balance | 0 | | Loan Balance | $371,045 |

| Total Home Equity | 0 | | Total Home Equity | $330,224 |

| Rent | at 10 years | | Homeownership | at 10 years |

| Total Payment | $254,498 | | Total PITI | $314,792 |

| Principal Paid | 0 | | Principal Paid | $67,519 |

| Tax Benefit | 0 | | Tax Benefit | $67,893 |

| Net Cost: | $254,498 | | Net Cost: | $179,381 |

| Real Estate Value | 0 | | Real Estate Value | $938,566 |

| Loan Balance | 0 | | Loan Balance | $332,477 |

| Total Home Equity | 0 | | Total Home Equity | $651,089 |

| Investment | | | Investment | |

| Opening Balance | $109,000 | | Opening Balance | 0 |

| 5 Yr Return @ 11% | $188,452 | | 5 Yr Return @11% | 0 |

| 10 Yr Return @11% | $325,817 | | 10 Yr Return@11% | 0 |

| 5 Year Net Worth | $188,452 | | 5 Year Net Worth | $330,224 |

| 10 Year Net Worth | $325,817 | | 10 Year Net Worth | $651,089 |

The first five years with the mortgage provide an average monthly principle reduction of $482.47 per month. Taking out any appreciation factors, the principle principal paid each month is a forced savings plan. With that said, home equity does not earn interest. And I would probably encourage most clients to consider not using the entire 20% for the down payment to stay more liquid (depending on their entire financial picture).

For many Americans who do not have a savings plan (and the statistics show that many do not save), owning a home is as good as it gets for building savings…and it ain't so bad.

Let the games begin!

This is a very common proof put out by the REIC to keep the Lumps feeding from their trough. I've seen it in a dozen different forms. If it was posted on a billboard, and you drove past it at 70 mph, on a crowded freeway, it would make sense. Fortunately for the REIC, the flashbulb attention span, in combination with the economic and historical illiteracy of your average homebuyer makes this work.

Is This Apples-to-Apples, or Salmon to Mullet?Using the provided example as the basis for comparison, we will take out our pencils, calculator, green eyeshade, and a case of Mountain Dew and hammer out a valid side-by-side look at renting vs. owning.

Rent is $1,850/mo. I guess if you show up looking like you just crawled out from a flophouse in Pioneer Square, you would pay full price. In this market, if you showed any semblance of responsibility and wanted to negotiate, you could knock 15% off that price. However, we will go with the $1,850 to keep as close as we can to "apples to apples."

Our poor, pathetic loser renter is on the hook for $1,850/mo + 3% hikes per year. Over the first 5 years he lays $117,863 on the altar of his landlord's good fortune. In 10 years it amounts to $254,498. This assumes that rent tracks at 3%, which with all the building and speculating in real estate is a pretty bold assumption.

Over the same time our budding noble is also shelling out money for his living situation. He paid $100,000 for the down payment, and (according to Rhonda) currently pays out $2,623/mo in principle / interest / taxes / insurance (PITI).

Up until now, I am in agreement with Rhonda. We now need to look deeper into the realities of home ownership to find the true value of each living situation.

Real Estate Always Goes Up - It's In The ConstitutionPerhaps the biggest flaw in the classic "Rent vs. Own" comparison, as put out by the REIC, comes in the form of assumed appreciation of the underlying asset. It is given as an

absolute certainty that real estate always goes up. Yes, in the past few years that has been the case. Will it happen tomorrow? Nobody knows - nobody. To assume this is, at best, irresponsible. Capital appreciation is never assumed when assigning value to an investment. Capital appreciation may be estimated for speculative purposes, but not investment purposes.

I am not against speculation - I do it all the time. However, it is speculation; it not investing, just as meaningless sex is not love. There is a huge difference. It is very important not to have expectations of one when engaging in the other. Assigning a value based upon the dividend or benefit an asset provides is investing. Assigning a value based upon someone else's view of the price is speculation.

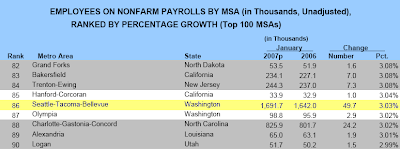

It's Clear Sailing In The Rear-View MirrorI wonder how anyone in the REIC can so confidently forecast an appreciating market? How do we know the market will not shift into reverse? We don't. Yes, we can guess, but we don't know. I would submit that after the breathtaking run in real estate over the past few years, and the problems that we are facing in the mortgage finance space, a very strong argument can be made for a precipitous drop in real estate prices - even in Seattle.

If you run the appreciation at +7%, you would be well served to run it in reverse to give a range of expectations. Back in 2000, many stock bulls (especially those on Wall Street that profit from high priced stocks) believed in the "New Economy." This New Economy was based upon the absolute fact that certain, high quality stocks will always go up in price. Microsoft, Yahoo, Intel, Cisco, Juniper, Qualcomm, eBay, Lucent, Corning, etc. were all touted as fail safes. Seven years later, these predictions look foolish and self-serving. Had speculators prepared for a significant rollback, the pain may have been alleviated to some degree. Going "all-in" at the wrong time is devastating.

Removing the miracle of perpetual appreciation, the 5 and 10-year numbers for owning would have to be reduced by $201K and $438K respectively. If we reduce the appreciation by the same amount as we assume it appreciates, the owner's position is reduced further by $126K at 5 years, and $240K by 10.

This is a pretty wide differential for something we don't know. A prudent analysis would be to not factor in any appreciation. Such was the example in Northern California from the late '80s to the late '90s.

Show Me The Money! - Well…Let's Hold Off On That.In addition to the folly of just assuming that an asset will appreciate, it is incumbent upon the buyer to understand why an asset appreciates. Home prices track incomes as well as the ability to find easy money. Without easy money, homes could not appreciate beyond what incomes could support. A house is not a bank account that accrues compounding interest.

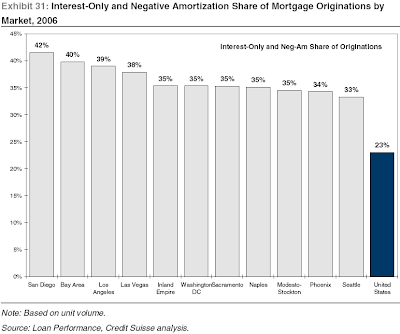

Unfortunately for our prospective homebuyer, both sources of rising home prices are under attack. Mortgage lending has been a festival of economic irresponsibility since 2003. Up until early 2007, anyone could qualify for just about any amount of money with absolutely no documentation or lender vetting. The finance industry made billions selling high fee mortgages and chopping them up for sale in the secondary markets. It was a fundamental blunder to build a business model (or an entire industry for that matter) on lending money to questionable borrowers with lousy collateral. That business is now disintegrating right before our eyes. Lending standards will be increasing dramatically (driven by both government and investors), and rates will certainly rise. The go-go days of insane lending are in the rear-view mirror.

Global wage arbitrage with Mexico, India, China, Russia, and Brazil are keeping a tight lid on incomes. Incomes have been stagnant over the entire duration of the housing bubble, and show no sign of any broad-based increase. Other considerations include rising taxes to pay for the increasing scope of government, immigration pressures, and the retirement of 77 million Mouseketeers.

Comparing With Four Hands Tied Behind Your BackWhile Rhonda was generous with her assumptions of the ROI of the renter's investment portfolio, I wonder why this investment wasn't treated in the same manner as the appreciation on the house? Why can't the investment portfolio also include 4:1 leverage? Why assume 11%? If we are in the business of forecasting good things by looking in the rear view mirror, why not use a real example from another investment that took place over the same time period as the latest housing bubble? A 4:1 leveraged investment on silver bullion would have returned $1,120,000 on a one-time buy-in of $100,000 over the past 7 years.

Tax Benefits Need A Tummy TuckThe tax benefit is overstated. Yes, itemizing mortgage interest and property taxes is a great benefit. If you make $96K/yr, you can do quite well come tax time. The problem comes with the "standard deduction," which is the tax deduction that you get without itemizing. The standard deduction is less for a single man, than it is for a family. Rhonda assigns $35,293 of tax benefit for 5 years and $67,893 for 10. If we correct for the standard deduction for a family, that tax benefit is reduced to $20,873 and $39,053.

Oops, Your PITI is SlippingThe PITI was probably too low. $288/mo for taxes and insurance is probably more like $550. Tax rates are considerably above ½%.

It is doubtful that the county would keep property taxes stable. Even in a period of decreasing values, it is very easy for local governments to keep their bloated budgets going on the backs of the local citizenry. Even if you assume the tax rate holds steady, if your property is increasing in value, so is your property's government-assessed value, right? 5 to 10 % property tax increases are certainly well within normal assessments. Let's say the assessment increases at the same rate as the assumed appreciation, but with a 5-year lag.

So, What Are You Doing This Saturday?Houses are also maintenance intensive. Rhonda assumed that our homeowner never needed to repair his castle, nor make a visit to Home Depot. If the homeowner spends 1% of the value of his home on maintenance and improvements (what's a trendy Seattle home without granite, stainless, and bamboo?), we need to add another $400/mo to the equation.

The Highest Fee BrokerageFinally, the REIC never likes to bring up that a hefty fee exists for cashing out of the home ownership money machine. You need to pay them a minimum of 7% of the gross sale to get at all that wonderful equity. Assuming the home price remained constant, that is another $35,000 out of the piggy bank.

The Bottom LineNow that we have a more complete picture of the situation, let's take a look at the financial bottom line for rent vs. purchase in few possible scenarios. We'll use Rhonda's given purchase price, down payment, investment return (11%), and rental price, varying only the assumed appreciation in each case. "Home Value" refers to the total amount of money you pocket upon the sale of the house (since that is the only way you can get the money).

| 7% | Rent | Purchase | |

| Appreciation | Investment Value | Home Value | Difference | Advantage |

| @ 5 years: | $224,343 | $275,668 | 18.6% | Purchasing |

| @ 10 years: | $402,613 | $574,573 | 29.9% | Purchasing |

| @ 25 years: | $1,662,659 | $1,815,340 | 20.3% | Purchasing |

| 4% | Rent | Purchase | |

| Appreciation | Investment Value | Home Value | Difference | Advantage |

| @ 5 years: | $224,343 | $189,950 | 18.1% | Renting |

| @ 10 years: | $399,918 | $350,060 | 14.2% | Renting |

| @ 25 years: | $1,565,654 | $1,030,024 | 52.0% | Renting |

| 0% | Rent | Purchase | |

| Appreciation | Investment Value | Home Value | Difference | Advantage |

| @ 5 years: | $224,343 | $90,051 | 149.1% | Renting |

| @ 10 years: | $396,625 | $128,619 | 208.4% | Renting |

| @ 25 years: | $2,172,580 | $461,100 | 371.2% | Renting |

| -2% | Rent | Purchase | |

| Appreciation | Investment Value | Home Value | Difference | Advantage |

| @ 5 years: | $227,271 | $45,749 | 396.8% | Renting |

| @ 10 years: | $399,452 | $44,272 | 802.3% | Renting |

| @ 25 years: | $1,454,580 | $156,786 | 827.7% | Renting |

The Million-Dollar Taffy PullSo, did we answer the question of it being better to rent versus own? Not really. It is all based upon how congruent your assumptions about the future are with the reality. Nobody knows what will happen next week, much less 10 years from now. I would say that wildly optimistic assumptions of owning compared to a watered down forecast of the economic flexibilities of renting is not a valid comparison.

People always forget that using borrowed money for investing (whether it is a brokerage margin account or a mortgage) is leverage. Leverage works both ways. It amplifies your success or failures. What turns 4 walls and a roof into the American Dream is the same mechanism that makes it your financial coffin.

Yes, if you get enough appreciation of a home's value, it makes sense to buy. This is true on any investment. However, if the home stagnates in value, or falls, the damage is magnified by the mortgage, taxes, and illiquidity.

Home ownership brings certain benefits like some level of sovereignty over the use of the property and any ephemeral value from "pride of ownership." It also brings other pitfalls, such as illiquidity, maintenance, acts-of-God, or even your overweight, aging hippie neighbors that insist on walking around naked as they oscillate between the hot tub and the "herb" garden.

Renters may need more than just the consultation of a sledgehammer and a case of Mickey's Big Mouth to knock out a wall, but if a heavy-metal band moves into the house next door, they can give notice, pull up stakes and move into a nicer home. If a renter gets transferred, they don't have to put up with the agonizing process of selling a home in a squishy market, and then paying 7%+ to the REIC. At worst, they lose their deposit and move on.

Lending While IntoxicatedAs the mortgage finance industry scraped the bottom of the barrel to find new

suckers buyers to put into homes, they swerved head-on into the world of the financially illiterate. Many of these buyers did not have sufficient savings to pay the standard first/last/deposit as required for most rental contracts. Many did not have sufficient income to qualify to rent, yet the finance industry was able to qualify them for a home. This was done under the pretense of getting them into a beneficial financial situation. Rhonda summed it up as follows:

"For many Americans who do not have a savings plan (and the statistics show that many do not save), owning a home is as good as it gets for building savings…and it ain't so bad."

Yes, I guess you can refer to the principal paydown on a house as a "forced savings plan." It is true that most Americans do not have any form of savings, other than their aging Beanie Baby collections, so I guess this is better than nothing. It also presupposes that most Americans are idiots. With that, I agree, but would like to add that allowing an idiot to juggle a half-million dollar, highly leveraged, speculative savings plan is a recipe for an unmitigated disaster in their personal life. Set this against the backdrop of tens of millions of the very same, and you have the certainty of a national financial disembowelment.

Given the recent activity in the sub-prime mortgage finance companies, this hypothetical is now a reality.