WCRER: Affordability Continues To Drop

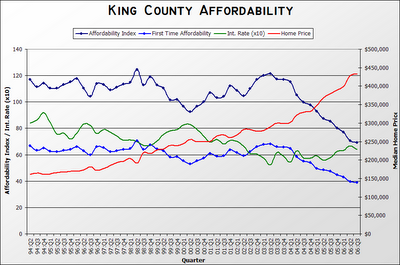

The Washington Center for Real Estate Research (WCRER)has released their latest affordability statistics. Unsurprisingly, home affordability in King County dropped yet again, reaching a new low of 69.2. Here's your latest graph of WCRER's index since 1994:

The decline in affordability from Q2 to Q3 was relatively minor, due to lower interest rates in Q3, combined with a smaller increase in the price of homes than previous quarters.WCRER Director Glen Crellin is quoted in the Associated Press article about these latest figures as saying "home ownership depends on the ability to purchase the first home, and too often that is more a dream than a reality." First time buyer affordability in King County also reached a new low, coming in at 38.8 for the quarter. In a "normal" market in King County, first time buyer affordability tends to be in the 60's. If first-time buyers really do get priced out forever, who will existing homeowners sell their homes to when they want to upgrade?

I don't see how this trend can possibly continue for much longer.

(Nicholas K. Geranios, AP via Seattle P-I, 11.22.2006)

15 comments:

With reference to the graph - I detect a distinct inverse correlation between House Price and Affordability Index. That's a real shocker!

The Tim -

I have been expressing the same sentiment (for a few months now).

I joke to my gf that in any normal market, I'd be able to find a reasonable starter place. Heck, even a decent place that was inspiring and offered enough value to stretch (a little bit, nothing unsafe) for.

The irritating thing is that even if I wanted to go get a giant loan and buy a place, there is nothing but CRAP available at anywhere within $150k of my price point. And my standards aren't unrealistic. In other high-priced markets, even if there isn't "value" in the pricing, there are at least some inspiring properties. Here, it's just a load of crappy bungalows, condos, and quick-flip shoddy remodels.

I don't even need to go look at the listings, I can see from the grainy, ultra-wide angle (to enhance the illusion of "space" in these tiny bungalows) images that so many places are quick-turnaround "throw some paint on the walls, and replace the rotting steps to the front door, maybe dump in a granite countertop" remodels. The low quality of workmanship and architecture can be seen without leaving my web browser.

I've walked through some in-city places listed even at $1M+ and the hurried, shoddy workmanship was evident even to my untrained eye. Recessed light fixtures potruding past the ceiling clearance. Blistered "new" paint in out of the way places. Woodwork that didnt quite line up. Deck railings that didn't even get sanded. Exposed screw heads everywhere. Cheap-ass "ikea" light fixtures intended to make the place look saleable. Give me a break. Seriously, why even perform the remodel? I'm just going to have to rip the shitty work out and re-do it myself later.

It's surreal. I'm sitting on a cash downpayment of about 30-40% of what would be in my price range. Dual income, no kids. Stable job with a solid company. By renting, I've been able to sock away a pretty good load of cash - but it's almost humorous that the recent market trend (as sales slow) is accelerating faster than I can (aggressively) save. That's how I know that normalcy has been inverted, and that this market is some sort of bizarro-world. In normal times/locations, I'd be a prime candidate for a first-time home purchase, but in the near future, I wouldn't dream of it.

I also didn't buy MSFT at 120 :)

So there's my complaint. Even if I WANTED to stretch, there is nothing worth stretching for! No offense to the crowd of people trying to flip their rotting-from-the-inside Ballard sh*tbox, or their "greenlake" (read: f*cking Northgate) bungalow, etc. There's loads of inventory, but the quality is INCREDIBLY low, and the asking price totally unrealistic. It's going to be amusing to watch as peoples expectations get adjusted...

B-

That's exactly how I feel.

perhaps more unfortunate is the loss of cute, starter home bungalows in all of the NW seattle neighborhoods. Watching what happened in the bay area 10 years ago, its deja vu all over again.

Today's report is out on Atlanta and it's first for AnalysisGuy. No big bubble. Seattle is now on the calendar!

Daily Home Price Analysis

b,

My pet-peeve with flipped Ballard crap-holes is the vinyl 'photograph-of-real-tile' flooring. I see this everywhere now. This surely will replace the popcorn ceiling as the worst home improvement ever.

WB

To b

I believe alot people feel the same way you do. I am more fortunate in that I live in the Silverdale area and housing prices are not quite as nuts as they are in King County. I would very much like to purchase a residence, and I am quite prepared to take on the finanical responsibility, but I absolutely will not pay $400,000 for a residence that was valued at $250,000 three years ago, so I am waiting. I am a true believer that the current market is not sustainable.

If I am understanding the situation correctly, the Affordability Index speaks volumes about the current state of the market. If the middle income family in the Seattle area has only 69% of the required income to buy a median priced home with a convential mortgage, what more needs to be said? Real estate is simply over-priced. If it weren't for creative financing, real estate would not be selling for the prices that it is. I also think that the recent MSM declaration that Seattle is "bubble proof" may have encouraged alot of the recent specuvesting activity.

Thanks for the graph, Tim. We've seen lots of arguments that Seattle is due a correction. The affordability index looks like the most compelling, i.e.:

Who will existing homeowners sell their homes to when they want to upgrade?

With home affordability approaching half its "normal" level, it looks like strong support for the hypothesis that investors are driving the market. We all know where that leads.

However, I question the significance that Crellin gives "First Time Affordability." With a "normal" FTA of around 60, it's clear that people without real property are historically marginalized. The simple affordability index seems to me a much stronger indicator that the correction is coming.

Somebody tell me if I'm wrong

their "greenlake" (read: f*cking Northgate) bungalow, etc. There's loads of inventory, but the quality is INCREDIBLY low, and the asking price totally unrealistic.

I'm not a flipper, but is $160/sq.ft for an average quality house (grade 7) in a location where one can walk to shopping area/ supermarket/drugstore/library/community center/post office/work with lots of room for gardens in the City of Seattle really that obscenely high priced for 2006?

Unless you're a seal or a duck, I have no idea why you'd want to go through weather like this.

I think the term "mild climate" best describes Seattle...if you've lived through a few winters in Boston or Chicago, you'll find Seattle to be very mild. Even Atlanta has colder winters then Seattle.

Minus, of course, the seven or more months of really nice sunny weather.

Not really that nice in my book. Florida is way too hot for my taste...you have to spend all summer inside with AC on while swatting mesquitos. No thanks....I'll take the beautiful 70 degree low humidity Seattle summer. Not to mention Florida is as flat a pancake...how boring.

I will take this opportunity to voice full agreement with the 'Shug.

Happy Thanksgiving All.

The weather here blows. I've lived throughout the US and I'll take cold and sunny vs. somewhat cold and rainy any day of the week.

Not being able to see the sun is depressing to me. Sun where art thou?

The weather here blows. I've lived throughout the US and I'll take cold and sunny vs. somewhat cold and rainy any day of the week.

Detroit is one of the most "affordable" cities in the US...lots of cold and sun there. What are you waiting for?

Shug,

Detroit is also the second most dangerous city. I'm thinking something more like Denver, CO. How does that sound?

The weather is OK in Denver....but boring as hell. Seattle has a way better cultural scene. I'd skip Denver all together and just live in Breck. At least I'd be closer to the good skiing.

The whole idea of choosing your residence based on weather is a fairly new phenomenon. Probably didn't occur to very many folks till after WWII. Even so, most people still tend to live where they have the best economic opportunity and/or familial connections. Sure, CA has great weather. But can you get a good job, afford a nice house, and avoid getting shot by a gangbanger?

Seattle isn't perfect, especially if you like lots of sun. But all things considered, it's a pretty nice place to live.

Post a Comment