Yet Another Workplace Anecdote (YAWA?)

Another coworker of mine just put the family house up for sale. They are asking $490,000 for their 2,000 square foot home built in 1998 on 0.35 acres in rural eastern King County. They purchased in July of last year for $410,000. The previous owner bought from the builder for $240,000 in 1998, and sold 7 years later for a 71% profit. Dang.

They are selling because they are moving to northern California in late July because they both got "good jobs" there. Although the town they're moving to is relatively rural and a decent distance from San Francisco and Sacramento, I can still see why they would want to squeeze as much cash as possible out of the place.

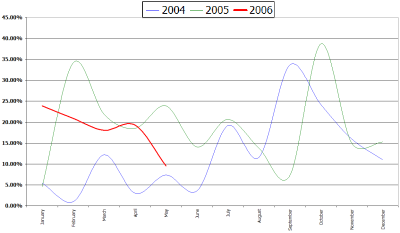

May NWMLS stats show area 550 (which contains their house) as having a 23.7% increase in inventory and a 11.5% decrease in sales compared to last year, with the median price increasing by "just" 9.5% (compared to a 16.9% increase for King County as a whole). Here's a graph of the monthly year-on-year percent change in median price for area 550 for 2004-present:

This brings up an interesting question. My coworker told me that when they bought the house last year "we had no idea that we would both be moving to California in a year." If/when the market takes a tumble, what will people like my coworker do? Will they just not consider jobs outside their area? Will they somehow manage to sell at a loss and move anyway? Or will they attempt to rent out their house (probably also at a loss) while they wait out the market? Not everyone can just wait out the storm. Many people have compelling reasons that force them to sell their house. The argument that people just won't sell their homes if the market starts to dip, thus preventing the market from dipping further doesn't seem to hold water to me.

53 comments:

It's called being "trapped". Your screwed if you do and your screwed if you don't.

That's one of the reasons why people need to carefully make home buying decisions, taking into account the "value" of the property and how much they can afford to pay. And whether it's an opportune time to buy (ie. which way is the market moving?). Whether they can still pay the mortgage,taxes,upkeep when they lose their job, etc,etc,etc.

Unfortunately, all that logic went out the window in the past several years.

There's a post on the next thread about some folks in Ravenna who bought for 882K in April, now trying to sell for 889K.

Here's hoping they can eat that loss. there's going to be tons more like them across the US. The whole situation is nuts. But people brought this crap on themselves.

The Great ARM Reset of 2007. People don't have the money to cover the new mortgage.Thus, they are forced to sell.

The End.

yeah but what happens when they don't have enough $ to sell?

Somebody's got to pay the bank.

Are banks going to default like crazy over this?

Here's some news on foreclosures...

Beware False Housing Hopes

Beyond the gloomy news for builders, he mentions:

If you're looking for truly good news on housing, it's that foreclosure rates remain reassuringly low. The Mortgage Bankers Assn. said on June 19 that just under 1% (0.98%) of all loans were in foreclosure as of the end of March, vs. 0.99% at the end of December. Foreclosures are low because the economy has been strong, enabling most people to keep up with their payments. And because home prices have been rising, even those people who fall behind can usually get enough money from selling or refinancing to cover their debts. If prices fall or unemployment rises significantly, foreclosure rates could switch from being the silver lining to the dark cloud of housing.

The previous owner bought at $240k in '98 and sold at $410k in '05. That's an 8% increase per year, not far from the average.

Why should the agent be fired? The price is set high to be lowered later if necessary. If a buyer shows interest, he'd think he is getting a great deal at $475k. That's just psychology. If there is a bidding war, jackpot!

Nice try above anon but friends of mine had a stupid realtor who set the price too high.

Not that they were any smarter than their realtor mind you.

They got estimates from a few different realtors, varying between 430-480. They chose to go with the realtor who went the highest. She also assured them it would "sell within a week".

What a frickin joke. That place sat on the market for months before they lowered it to 420 and sold a month or so after that.

This is not your steaming hot market anymore.

Thank god they got out when they did.

There are some bozo realtors out there advising people to price too high and telling them it'll sell in a week.

Good luck to your friends Tim.

And to this Meshugy- tell that cheery foreclosure news to the one in 440 households in WA that are currently being foreclosed on.

If it's one in 440 now, what do you think it'll be in another couple months?

Think those numbers are going down as more and more ARMs reset? To the tune of, what is it 3 trillion dollars worth nationally in '07?

If WA. is spiking now, what do you think it'll be like next year?

Yeah I know, you're high on housing.

Some banks will get hit pretty hard, based on their exposure.

A lot of these mortgages were bundled and sold off on the open market, so the majority of those hurt will be the ones holding the paper-principally the Koreans. For some reason, they've taken a liking to US MBS's.

Suggie, I wish I could drink the kool aid as you have. The problem is that I know it will kill me.

I don't know why you bother to publish this about foreclosure rates being low. The shit hasn't hit the fan yet. As I said earlier, WAIT TILL THE GREAT ARM RESET OF 2007.

Let me break this down as succinctly as possible for you.

Seattle had a serious runup in RE prices during the tech bubble. Why?

Lots of jobs paying lots of money allowed for higher prices.

Lo and behold, a lot of these gigs were short lasting. Nasdaq pops, layoffs ensue. Housing should have corrected at this time.

Instead, we have 9/11, Greenspan drops his pants and floods the markets with super cheap money.

This creates a massive credit bubble and tremendous asset inflation.

Have you noticed all the advertising around you about $200k mortgages for $458 per month? Many fools have, and they believe to this day that that is all they will ever be asked to pay. They do not understand that these teaser rates expire, and then what they have is a suicide loan staring them in the face.

Multiply this by tens of thousands, and what we get are people dumping their houses on the market before the increased monthly payment bankrupts them.

Everyone will do it at the same time, with the most desperate dropping their prices the most.

Think there's latent demand?

There is, but one the prices start falling, people will not buy. They will wait until prices stop falling.

Some fools will rush in of course, and get hammered.

The Seattle market is 35-40% overvalued. This was created by cheap money, criminally unscrupulous lending practices, and a surplus of fools.

It may take 5 years or more, but Seattle will eventually revert back to the mean.

This is an absolute certainty. The only thing that is uncertain is the level of bailout imposed on the taxpayer.

Seattle Slacker-

What can these foreign holders of the MBS do to protect themselves?

Can they do anything?

It seems crazy that they can't do anything but wait for the sh@t to hit the fan and then take the loss.

Isn't there some way they can make the US pay? Some economic thing they could do to us to throw it back at us?

To anonymous who wrote:

"Why should the realtor be fired?" I agree that the realtor was doing a bad job. The agent's job is to ensure that the house SELLS, and the houses that are priced appropriately for the market will sell. Overpriced houses will not.

I have a pair of friends, married couple, who are moving to a nearby city soon. They had a handshake agreement, soon to be a contract, on a FSBO, for a set price (don't remember exactly, but 325k is close). Seller decided to check on how much his house was "worth" and went to three different realtors. First one said, "Oh, I can sell this for $400k." Second said "Oh, I can sell this for $425k." Third said, "Oh, I can sell this for $420k." Seller promptly started advertising his house for $400k, despite the previous handshake agreement on price. I will add that this price increase was against seller's wife's better judgement, but hey, who was she to question a professional realtor, let alone three?

Needless to say, my friends did NOT buy that house. The husband was livid, foaming at the mouth livid. He described the situation perfectly:

"If I'm taking you to the prom, I'm going to tell you you're good looking, right?"

A realtor wants that 6% commission--so the more overvalued your house, the more money the realtor makes. A smart realtor WILL value a house appropriately so that it will sell. An overambitious, greedy, stupid, or inexperienced realtor will overvalue it to go for the cash, at the expense of the seller.

OK - time for a question. I'm unconvinced that prices are going to drop a lot.

After living in the bay area for quite a while, I've seen the possibility for affordability to be sustainably much lower than it is here.

My question for all of you 30%+ drop forecasters is: are you buying housing futures to capitalize on what you are believe is going to happen? If not, why?

"A realtor wants that 6% commission--so the more overvalued your house, the more money the realtor makes."

That's actually been proven incorrect and leads to the idea that even the seller's agent doesn't have the interest of the seller in mind.

First of, it isn't 6% (but I'm sure you knew that and were assuming there would be a buy in there as well). The commision difference on a $400k vs $450k is $1500. Assuming the final price actually is 450k, the house will have to sit on the market for how long? 60+ days? I don't know any reatlor who work an extra 60 days to get $1500 when he could drop the price sell in 2 weeks and make almost as much and then move on to the next house.

After living in the bay area for quite a while, I've seen the possibility for affordability to be sustainably much lower than it is here.

The bay area has more concentrated wealth than almost any area of the industrialized world. Seattle has a bunch of middle-income people who think it's a cheap place to live...compared to the bay area.

You know the educational level required to get a realtor license. Don't you?

Anon 7:36-

Not buying stocks to short because I don't understand stocks.

I do, however, understand RE and have made a bundle off of it in the past.

I also understand Seattle. And I can tell you, that cute bungalow at 450K may look like a deal to a Californian, but anyone from the area knows how inflated that price is. Let alone a cute bugalow for 650 or 850.

So I'm waiting for these prices to drop before getting into this market.

Hint: Stay away from RE until they 've lopped off at least '04, '05, '06 appreciation. They were overinflated before that, but the past 2 1/2 years have been out of control and are going out the window when this corrects.

I wish I did understand shorting stocks! No better time to understand that than right now.aieyzmkx

"They are selling because they are moving to northern California in late July because they both got "good jobs" there."

I hope they come down here to rent for a while because the market is decidedly tippy. If the market goes flat, most professionals have little prospect at finding a comfortable home--even with "good jobs".

Marin Explorer-

Probably time to call for a moratorium on buying out of one's own familiar area- no matter where you are moving to or from.

Unless you are from that place, you have no idea where the local market is headed in the next year or two.

The bay area has more concentrated wealth than almost any area of the industrialized world. Seattle has a bunch of middle-income people who think it's a cheap place to live...compared to the bay area.

Sure, in Palo Alto, Atherton, etc. Most of the bay area is filled with middle-class people who can afford it less than middle-class people can here.

Unless you are from that place, you have no idea where the local market is headed in the next year or two.

Agreed. Exhaustive research helps, but there's nothing like living there and sensing the trends day by day. FWIW, I used to live on the Sound, but that was years ago. Even w/ recent visits, I don't get the local pulse, especially that Seattle will survive the market change we're seeing down here.

Marin explorer-

If what you mean is that Seattleites are under the curious delusion that the market here will continue to appreciate as CA tanks, yeah it's an unsubstantiated assumption.

I think it's more like they are in denial that CA is tanking.

Once they get that through their heads, they'll start to notice the price reductions here and lack of bidding wars.

Right now we're still in denial about that.

We're just a little slow to come to grips with facts here.

Then again, I'm sure there's plenty people in FLA AZ CA, etc that are also ignoring the elephant in the room.

anon 0308...

What can foreign holders of MBS do to us for default?

Not much.

If they dump MBS and refuse to buy more (very VERY high probability), it would crank the rates on MBS to the moon, regardless of the flaccid response of the FED.

THAT is what will deepen the trough in the housing bust. When borrowers must pay 10-15% or more, on their mortgages, it will cause sellers to drop prices to a level where borrowers can afford the homes.

That is the ball. Keep your eye on it.

LOL! thanks for the educational story Eleua.

(repost, now that I have a snappy new picture)

anon 1250...,

Quick Short Selling 101.

Selling short is exactly the opposite of buying long (which is what 99% of amateur traders do).

Let's take a hypothetical stock, Ballard Inc. (NASDAQ symbol: BLRD)

BLRD has been on a three year run, so some local musician decides to buy 200 shares at $20 a pop, thinking he is bullet-proof. The thing is, he only has $2K, thus can only afford 100 shares. His broker opens a margin account and buys 100 shares for him, in addition to the 100 shares the musician buys. Now, our local minstral controls 200 shares of BLRD, but has only put up enough money for 100. His broker holds the 100 that they bought for him, and holds his 100 shares as margin (collateral).

So far, so good?

Now, our musician goes to the YAHOO message boards and starts pimping his stocks, and telling everyone what a great buy they were at $20.

BLRD now sells for $30/share, and our musician now has $6K worth of stock that he purchased for $2K, of which he would have to pay off his margin account for the original $2K (plus nominal interest).

So far, so good?

Now, some angry crank from Bainbridge Isl. thinks anyone who holds BLRD stock at $30 must be dropping some bad acid. He watches the stock and BLRD gets gunned to $35. He goes to the YHOO message boards and starts to talk about the fundamentals of BLRD. He notes that BLRD has not had any fundamental increase in their bottom line in 9 years, back when it sold for $5. He notes the corporate officers are selling BLRD stock like they are trying to leave town in a rush. He notes that the widgets that BLRD makes are more plentiful then ever, and that BLRD's competitors PHNX, FLDA, SDGO, and VGAS are in a inventory driven tail spin.

Our BI crank calls his broker and asks to short 150 shares of BLRD. The broker tells the BI sourpuss that he must have a head injury, as no sane individual would short BLRD at the new price of $40. After much begging and pleading, the broker says it is OK to short BLRD.

So far, so good?

The broker has to 'borrow' shares for the BI boor to sell. In a 'long' transaction, you only have to find someone that want's to sell the actual shares they own, but in a 'short' sale, you have to borrow shares to sell into the market. The only shares available to 'borrow' are ones that are held in margin accounts by people that go aggressively long and have their broker buy shares on their behalf.

Fortunately, the broker found only 100 shares that some dude in Northwest Seattle bought on margin, but he could not find any others. The broker tells our BI guy that he can short 100 shares.

Done.

Now, that 100 shares was sold into the market at $40, placing $4K into the BI dude's margin account at his broker's firm.

Let's check the scoresheet:

MESHUGY: controls 200 shares of BLRD at $40/share - he owns 100 shares outright for $4K, and his broker holds 100 shares in his name for $4K. He owes his broker $2K, and had his original stake at $2K. He is up $4K.

ELEUA: is short 100 shares, which means at some point in the future, he will have to buy 100 shares to close his account. Think of him as controlling -100 shares. He has $4K in his margin account from the sale of the 100 shares at $40/share, plus his broker made him front another $2K in collateral, in the event the stock goes up in value. He is at break even.

The stock goes to $50/share on the basis of some bought-and-paid-for 'analyst' at a big NYC financial house issuing an upgrade on the stock from "speculative buy" to a "you are f-ing nuts not to own this stock." Never mind that the big financial house in NYC owns 16% of BLRD stock...

So, our scorecard reads:

MESHUGY: 200 shares at $50 = $10K. He still owes his broker $2K. He is up $6K.

ELEUA: -100 shares that have gone against him $10. He still has the original $4K from the short sale, but the $2K that he had to stake the broker has been reduced by $1K to cover what the cost would be to buy 100 shares at $50. His broker calls him and says he needs another $1500, to bring his 'margin' up to 50% of the value of the shorted stock. ELEUA is now down $1000.

The large NYC brokerage house that owns 16% of all outstanding BLRD stock sees a large short interest in the stock. It is approaching the end of the NYC money house's reporting period, and they want their books to look very good for all the statements that will be sent out. Knowing that short sellers MUST be buyers at some point, they decide to attempt a 'short squeeze.'

Massive buy orders for BLRD hit the market. People that are short BLRD panic and start to buy to close out their positions. Now, we have the dead-fish house in NYC buying with tons of money, plus we have panic induced buyers that are trying to close-out their short positions. Eleua has more guts than brains and tries to ride it out.

BLRD now sells for $75/share.

MESHUGY: 200 shares at $75 for $15K. He owes $2K to his broker. He is up $11K.

ELEUA: down $3500. He has had to add money to his margin account as the price has gone against him. He has the $4K from the original sale, plus he has had to add another $3750 to keep his margin open.

BLRD pays a dividend. They pay 5cents per share, so MESHUGY gets another $10, and ELEUA gets another $5 sucked out of his margin account. When you are 'long,' you get dividends, when you are short, you pay them.

BLRD goes to $100.

MESHUGY: is up $16K ($20K - $2K (broker)- $2K (original))

ELEUA: on suicide watch. He is down $6K on a $4K sale. He has sold most of his furniture on EBAY.

Tidal shift.

BLRD has been shown to have been fudging their earnings, and their accounting sucks.

BLRD now sells for $50. MESHUGY is now only up $6K, and ELEUA is only down $1000. ELEUA's broker put $5K back in his margin account on the back of $50 rollback of BLRD.

Then the news hits the wire that the CEO and CFO of BLRD were selling their own shares of BLRD at the very same time they were burning through shareholder cash with massive stock buybacks. Perp walk. BLRD now sells for $15.

MESHUGY: now down $1000, as he controls 200 shares that are $5 below where he originally bought them. Broker issues a margin call and says MESHUGY owes $500 in order to protect the $2K that he borrowed to buy 100 shares of BLRD at $20.

ELEUA: broker puts back $1000 to bring him to even, plus puts another $2500 in his margin account to reflect the $25 drop in price of BLRD.

BLRD crosses the tape at $10, and Maria Bartirealtor says that this is the best buying opportunity in her lifetime.

MESHUGY: Issued a margin call, as the value of his stocks are $1000 below where he started, and he coughs up another $500 to keep his position alive. He believes this is just a blip and BLRD will skyrocket to $150 a share when BLRD gets new management. After all, BLRD is a quality stock. People want to own BLRD.

ELEUA is now up $3K

BLRD drops. Meshugy is out of cash. Broker sells his stock to cover the borrowed position. Meshugy is out of the market and down over $3K on a $2K investment.

BLRD is delisted, and eventually declares BK.

ELEUA shorted another 100 shares at $10, and attempted to short 100 more at $4.50, but SEC regs prohibit shorting a stock that is below $5.

BLRD is now worth 0, but ELEUA's broker closed him out at $1. ELEUA is now up $3900 from the original short, plus $900 from the additional short. ELEUA's broker bought 200 shares of BLRD at $1 and closed out all interest in BLRD.

Bottom line...

When you are 'long' you have far fewer risks, and your profit potential is unlimited (in theory). You only risk what you put down, unless you go on margin, and then that is limited.

When you are 'short' you have unlimited pain potential, and very defined gains. Stocks only go to 0.

Why short? Longs are notorious for not doing their homework. They buy on emotion, and slick marketing. They go with the herd. That is where the risk is (just like today's housing market).

Short sellers usually do their homework, and are not emotional about shorting. They need to get the timing right, or they will feel it. When there is a huge short interest in a stock (think Krispy Kreme Donuts, or Gateway 2000) there is usually trouble ahead. This is why people like the CEO of OSTK (overstock.com) try to villianize shortsellers.

Mark Cuban has a policy of not talking to 'longs' but will always take calls from 'shorts.' He wants to know where the trouble is. Shortsellers usually have a good nose.

End of tonight's bloviation...

Bush bails out GSEs with money we don't have...

Foreigners quit lending us money...

Either way, we are screwed, but I would hope for the second scenario, as that has the best long term consequences.

The FED is not omnipotent. At some point, they lose. I happen to believe that the FED will lose credibility within the next 6 months, and we will get rising rates with a declining dollar and tanking economy.

As far as Joe and Tina's pension....

I can tell you from experience that middle-Amurikuh's pension is worth $hit to the Bush Administration and the GOP. They will go out of their way to destroy the living standards of middle-Amurikuh. That's what illegal immigration is all about. That is what anti-unionism is all about. That is what offshoring is all about.

When I am on my death bed, I will still regret voting for this POS back in 2000.

If the FED were omnipotent, we would never have any economic downcycle, and all the rules of economics would be out the window. We would be a direct control economy.

All the FED can do (and has done) is to shift judgment day to the future. The more they shift it, the greater the imbalance, and the greater the catastrophe when it does arrive.

Yeah, the FED will probably do their worst when some 3 sigma event happens, thus cloaking their own incompetance.

Either way, it is going to be a real fecal gyro when this finally tips over.

I only wish I owned a bullet-proof house in Ballard.

I'm reading the above & coming up with this:

If the 2 scenarios are:

1) Fed bails us out..or

2) foreigners quit lending us money

and the best long term solution (for the US) is:

Foreigners quit lending us money

Then might not foreigners keep lending us money so we can dig our own grave?

Thoughts?

SPD,

You are sooooooooooo correct. (please note the 10 extra o's in so, to emphasise just how on the spot you are).

THAT IS EXACTLY WHY THE FOREIGNERS (Chinese Communists) are pegging their currency and buying our worthless bonds. They know that if the US gets an extra $2.5B per day (that's Billion with a B and that's per day, not per month). Every day, we go another $2.5B in the hole, and that's $2.5B worth of US productivity and capital going to the shores of people that want to challenge us militarily.

Free trade is a ruse. We THINK we are addicted to it, but in reality, we would suffer a whopper recession, and then rebuild ourselves, while our dip-shit enemies disappeared down a black hole. Free trade does not exist with pegged currencies. Free trade can not exist when one side is a bunch of slaves (unless the other side wants to become a bunch of slaves - but don't get me started on the Bush neo-con GOP gang)

Trust me. China is not doing us any favors by lending us the money. They know we are just buying their crap with it, and all we get to show for it is a big ball of debt (sharecroppers in our own land), an increasingly unstable dollar, and an inflationary oil shock of epic proportions (coming soon). We will look back on $3 gas with fond nastalgia.

The sooner we can tip over this giant house of cards, the better off we all will be.

I've known for years that China wants to knock us off the pedestal and that they'd figure out a way to do it.

The fact that they were holding so much of our debt, I couldn't see how that could be a good thing for them.

So thanks Eleua for this one explanation and I'm open to more ideas.

I really don't believe they want to get into a military struggle with us, or anyone else for that matter.- I think they just yearn to be top dog in the world economy.

Any chance though, that as holders of some of our bad RE loans, they could end up owning a bit of US property? Kind of like the bank does when it's debtors go belly up?

I think the Chinese would be very satisfied with that: Economic control and a bunch of US property.

Absolutely no need for a war.

SPD,

True, but world history shows that people want military dominance as well as economic.

Having economic dominance does you no good if your adversary can shut down your entire shipping industry and cut off your oil supply with 1/10 of its naval assets.

If we ever go to prison rules, China is toast. Unless it can get a bunch of solid fueled ICBMs, it is as much of a military threat as is Costa Rica. They know this.

China's economic ascendency is only to fuel its military aspirations. It needs MIRV technology, launch technology, and solid rocket boosters. Its navy is a joke, and its army would be taken apart by our Air Force in a matter of days. It has no ability to project force.

Cut off China's economic growth, and you strangle its military in the cradle. Of course, our leaders are too dickless and brainless to do anything. I guess it would be better to refight the Cold War.

If China wrapped up so much of its money into US real estate, it would be so easy just to nationalize it away from them. If we were at war with them, it would be so easy.

Think Iranian funds in the US in 1979....

China wants military dominance. It could lose 300,000,000 people and come out stronger.

If China were to experience a huge rollback in their economy, they would likely undergo a very bloody internal revolution. All we would have to do is keep their ports bottled up, and contain the damage.

Why GWB passed on the opportunity to revoke MFN status of China back in 2001 remains a mystery. It's a mystery unless you buy into the notion that the GOP intelligencia wants middle-Amurikuh to roll back its lifestyle.

Don't you think that, while we've been out making enemies, China's been making an awful lot of friends?

The US may be a threat to China if it stands alone, but what's the US to do if everybody gangs up against us?

Can we bomb our way out of that? And still survive ?

OK. It's getting OT, but an interesting conversation.

I'm thinking we overestimate what our military can actually accomplish.

I'm hoping that, if China does ascend economically, that we will have the sense to just live with that.

Japan went through decades of economic growth after it's military was shut down by the world at large.

Weak military and economic growth can happen- right?

Yeah, this might be OT, but this thread has grown stale.

Japan has had a great economic expansion, and it is still defended by the most powerful military in world history. Japan's biggest trading partner is the biggest economy in the world. I don't know if Japan is a real bell-weather for your premise.

The US is 4% of world population and it consumes 25% of the resources. That equates to a fabulous standard of living. Bringing 2.5B peasants into a middle-class lifestyle, and doing so almost exclusively at the expense of the US/Europe, will definitely cause a severe rollback in the US standard of living.

Some say this is good. Some look at Amurikunz and say this won't wash. I guarantee you that the average US citizen will be screaming for blood if they lose their house, lose their retierement, and work 3000 hours per year just to meet the basics. $10/gal gas will get Amurikunz rioting in the streets to nationalize all the mid-East/Western Hemisphere oil.

Free trade tends to bring both trading partners into balance. How would Joe Six-pack do with knowing his middle American lifestyle was sacrificed to bring 2.5B peasants a greater standard of living?

Not well.

The US economy is the US religion. The president is the high priest.

I doubt J6P will go gracefully into a peasant lifestyle. All the average Amuhrikun needs is a rapidly shrinking standard of living, and a pretext for military action.

I really don't see any room to just "deal" with the economic ascendency of 2/3 of the Third World.

It's not a PC/hip-n-trendy/uber-chic position, but the truth rarely is. Wars are fought over money and resources, but under the pretext of freedom and the glory of the state. The US is a docile bunch, provided its belly is full. If it is only half-full, it will become fairly surly.

Your turn.

That is one grim scenario! And is an explanation of why the US is dangerous.

But it doesn't explain why the Chinese would suddenly go batsh#t with war over us.

So, are you also thinking that, in reality, it is not us we need to be afraid of the Chinese, but the Chinese who need to be afraid of us?

Because we simply could not handle the material deprivation that most of the world lives with today and that even we ourselves used to live with in the past?

If the rest of the world needs to fear Americans dropping bombs on them because our standard of living goes down for a decade or so, then they should be very worried indeed.

And if we bomb them, they'll bomb us.

So are Americans so nuts that they'd prefer being bombed to being poor?

I know, they might be that nuts, but I'm hoping that they'll get a grip before that happens, grow up and realize that bombs over your community, disrupted and broken infrastructure, death and destruction are worse than being poor.

The US DOES have the resources it needs to get through an emergency. Some countries do not, but the US does. We don't need to start a war over basics.

Wow, I hope Americans are not as whimpy as you fear. I hope they can handle some hardship without going berserk on the world.

I should add: I just don't don't believe that China is itching to go to war.

I think they are itching to up their standard of living.

For 10's of centuries, they maintained their "world dominance" (in their Asian sphere) without going to war.

The US , on the other hand, rose to world dominance through war.

Maybe that's why we have a different mindset about what's neccessary to maintain top dog position.

I also agree though, if pushed into war, China would have no problem disposing of hundreds of thousands of citizens for the cause.

But I do think they'd need to be pushed. And I do agree that if anyone can push other countries into wars, the US can.

Here's one more thing:

I feel like 1) you're right, American wages will go down as Chinese wages increase- the 2 will become more on par.

And 2) the financial powers that be in the West WANT it that way.

So it may be hard to find political will in the US for war against China just because they're getting richer while we're getting poorer.

I'm thinking that, if there's a grand plan, that's it. Make everybody around the world kind of lower middle class, with a small group of REALLY fat cats at the top. Running the whole show.

But! Maybe there's no plan at all and maybe these people couldn't put a full plan together if their lives depended on it!

SPD,

I think you are on to something. Yes, there are a group of fatcats that want the world poor, and they want to control it all.

Watching the GOP over the last decade has convinced me of this. I think many like the plantation model of economics. One wealthy landowner, and a bunch of serfs seems to be the goal. Most of world history is built on this model. The ascendency of the Western Middle Class is the exception, and the WMC has been itching to give it away, so they will feel safe and well fed.

Reagan said, "Freedom is one generation away from extinction." How true.

Right now, only the Russians and Brits are any credible nuclear threat to the US. The Brits would never aim their missiles at us, and the Russians know it would be the end of them if they tried a first strike. Better than half of the Russian missiles would die in their silos, as they are not well maintained. Much of the triggering material in the old Soviet warheads is decaying to the point of unreliability.

The Chinese missiles, while pitiful few, are liquid fueled. It would take almost two days to get them fueled for launch, while it would take us less than an hour to detect and destroy them.

We don't need to bomb them. We only need to divert the oil headding to their ports, and we have the naval assets to do just that. We wouldn't even break a sweat.

The rollback in the US economy would be more than just a few decades. 300M people are not going to take a rapidly shrinking economic pie very well. Given the fractured multi-cultural nature of the US (that we now celebrate), many are going to start massive civil unrest, and do so along racial lines.

There is no good scenario. I think that a near term, US recession would bring blurry socio-economic issues into much greater clarity. Hopefully, free-trade with slave nations, anti-unionism, borderless immigration, and Wall Street criminal activity go by the wayside. This would undercut the cornerstones of the Western Fatcats, and tip the balance back to the US middle class.

It would also put 2.5B peasants back to a subsistance living, and they would have little need for oil, steel, rubber, and concrete.

As bad as it sounds, 6B people can not all live like Americans. Unless we want to live like Indians, that is what we have in our future.

As rural as Bainbridge Isl is, how can 20K people eek out a subsistance living here? How could Manhattan and Long Island do it? Los Angeles? A rollback of the US economy to Third World standards, would mean the death of tens of millions of Americans.

It's a grim thought, but we can't go back, just to be good guys.

Forcing the issue today, while the US controls its destiny, is far preferable to facing reality when we no longer can.

In 1991, the US was in a teensy-weensy recession, and had a flimsy military pretext, to go to war to keep oil prices low.

In 2003, the US went to war again. Again, the economy was in a fart of a recession. The military pretext was with Afghanistan and Saudi Arabia, but we went to war with Iraq.

In 1994 the economy was not doing so well in the enlightened wonderland of California. Pete Wilson had an 8% approval rating at the beginning of the year, and was running against a female from California's governing family (Kathleen Brown). He rode the anti-immigration sentiment to a victory with room to spare. Once California got a rapidly expanding economic pie, immigrants and outsourcing didn't matter any more.

Hunger makes Americans, (to use a Brooking Institute word), more insular. It also makes them more belligerant. Is that dangerous? Yes, but it will be far more dangerous when the scenario is more developed.

Do you really think Americans couldn't handle subsistence living?

In large parts of Maine (and the SE too I think) they're doing it already- have been for years. They barter for this that and the other thing.

Most Americans have got running water- that's a huge plus- and likely to keep it most days, unless it gets bombed into oblivion.

Electricity? Hard to live without once you're used to it, but not impossible.

In a climate like ours, we could grow food nearly all year around. Winter would be uncomfortable but not fatal.

The people I worry about are the ones in the NE and Upper midwest, Rocky Mountains who don't have woodstoves and would freeze to death in the winter.

Then again, don't we have 100's of thousands of brand new homes in FLA. Phoenix, CA. that these people could occupy? God knows they're not being sold to anyone!

Manhattanites would mostly have to leave Manhattan. No room to grow food and the climate's rotten for year-round gardening!

But most cities in the US are not nearly as dense as Manhattan. Seattleites could easily grow food in their tiny yards. Ditto for many US cities.

And there are plenty of warm weather places in the US that people could migrate to and survive winter.

I think Americans used to be pretty creative and could find ways to occupy themselves happily, minus a 9-5 job.

The only reason there's unrest now is because everything's so d#mned expensive compared to wages. Quality of life suffers and people get pissed.

But what if it cost next to nothing to live?

Okay. Now I'm sounding really ridiculous: what if there was no such thing as money?

Now pull back to the happy medium between way TOO MUCH money and NO MONEY at all.

I think it would be tricky, but perhaps Americans could eventually get on board with that, once they got over the shock.

This is a total fantasy. Corporations would have to go. Or do their business elsewhere.

Anyway, Eleua, my scenario sounds more "liveable" to me than yours- and I guess that's my bottom line, "liveable"- although I agree it would be a wicked hard adjustment for the average American to make.

Fun talking to you-

Subsitance living would be sustainable for a population that we had 100 years ago, to say nothing about 95% of Americans lacking the skills needed to scratch a living out of the surroundings. This equates to tens of millions dead, starving, and succumbing to exposure and disease. My guess is rolling the dice and taking your chances with a war of survival would be the preferred American response.

I enjoyed talking to you, and look forward to conversing on other threads.

Hey Eleua-

I just realized that I went pretty far afield there without wrapping it back to the original discussion point, which, I THINK had something to do with war with China.

I could be wrong but my feeling is that, although America has superior miltary strength, we are sorely lacking in outside support. I don't see that changing much in the coming years.

We've pretty much blown that option royally in the past 5 years.

In the meantime, China's hunkering down with Russia,India, Chile, Argentina, Iraq, Saudi Arabia, etc. I'm just waiting for Japan to jump on the China bandwagon and there are slight signs that it's beginning to happen.

As near as I can tell, we've got Dubai and, barely, England.

A few months back, the PM of India basically came out and said, when speaking about India's relationship with the US, "China is our new best friend. It's been a fun ride with you Americans but China is our future." (gross paraphrase).

A couple weeks later Bush gave in to the nuclear thing with India.

Have you ever noticed that when a country is despised by enough people that even former enemies will unite temporarily to go against that country?

If we piss the rest of the world off too bad by bombing just to keep our economy flying high above everybody else's, I can actually see India and Pakistan (!) getting together for a couple months to weed us out, before they return to being enemies.

China and Russia are getting tighter by the minute, and on and on.

So, while it may have been a cakewalk in the past for us to start wars whenever we felt greedy or deprived, it may not be so easy to pull it off in the future.

I know we've got a ton and a half of weapons, but when you put the whole rest of the world's weapons together and turn them on us, wouldn't their weapons add up to a lot?

To escape my bizarre scenario above (of subsistance living in the USA) and yours of war, wouldn't it be better for the US to just let somebody else take the reigns for a while, let them be the big guy on the planet and cut back a tiny bit on our materialism?

I don't think China is out to "screw" us. They won't take away all our oil - not if we're nice!

And think of all the new industries that could be started here if we really got serious about alternatives to oil. Stuff that we could then export around the world.

The days of the US oil wars are, I sincerely hope, over.

Cutting back a bit on our materialism would not hurt us at all. I think it would make us better and stronger as a nation.

SPD,

Your posts are starting to sound a little like John Lennon's "Imagine." While it would be nice, that's not the way the world works. Never has, never will.

As of now, the rest of the world combined (absent nuclear) against the US, it could, on a good day for the rest of the world, be defined as a "fair fight." Add nuclear, and you get the US and Russia destroying everything, with the US having the only chance of survival.

The "rest of the world" (ROW) naval assets are just a mere annoyance compared to the titanic US naval power. Air power? Not a chance. The US is virtually unbeatable in the air.

Land power is a bit of a different story, only if you take it on its own. Combined with naval support and using the air assets as a relly cool artillery piece, and even the Chinese could not throw enough soldiers to defeat a well entrenched US.

Back in '91, Iraq was the 5th largest army in the world. It had the very best Soviet equipment and advisors. They lost almost 200K, while we lost barely 100, and most of that was on a scud missile hitting a barracks.

We used just a small fraction of our total army potential, and it took 4 days. It is the single biggest lopsided military endeavor since Canne in 216BC.

Why is America hated? Fear and envy. Everyone knows they don't stand a chance in a fixed piece battle. Third World militaries rely on the US trying to "win the peace," and doing so in a politically correct manner that looks good on TV and passes muster for Leftist academics.

Winning the peace is a hopeless endeavor. As long as we attempt it, we will fail. Japan and Germany were mercilessly occupied and crushed, prior to what we now know.

One thing is eternal, and that is man's dark heart. One day, when our back is to the wall, we will unleash an extremely bloody counterpunch.

In the 1940s, 1/3 of Americans wanted to kill every man, woman, and child in Japan. This was against a country that was only able to cripple our Pacific Fleet, not invade the US, or divert lifegiving resources.

I am wondering if you are trying to bait me with your posit that China won't treat us poorly, if we are nice. No, world history does not show that to be the case.

Modern China has been bordered by the USSR/Russia to the North, the Pacific to the East, The Himalayas to the West, and not much worth taking to the South. It has also had too much internal strife to mount any serious military offensive, and it certainly didn't have the cash.

Power vacuums are always filled. Russia is in retreat, Japan has been defanged, and Europe has been emasculated by the nanny-state and US protection. The only remaining power in the world is the US.

Islam is attempting to fill what they perceive as a retreating West. This conflict is 1400 years old. Everytime the West showed weakness, Islam marched against it. Once Europe kicked thier ass back to Arabia, they licked their wounds and looked for the next opportunity. That is what is going on now.

Weakness by GB1, and Clinton, has been taken as a green light for their activities. GB2 has had, imho, a very flaccid response to a direct Islamic challenge. This emboldens them.

Muslim/Arabs understand raw power. It is a language they speak and respect. History shows it is the only language they speak or respect. Hamas is about to find out the hard way.

In response to 9-11, a grotesque military reprisal would have kept the peace in the Mid-East for a generation or two, and ultimately saved lives on both sides. Attempting to win the peace will prove to be very costly to both the US and to the Muslims.

As long as they live under the delusion they have a chance, they will continue. With regard to China, as long as they see themselves as eventually overtaking US military influence, they will continue their ways.

Even if that means funding our debts and driving the 10y bond to rediculous lows.

That, my friend, is where we came in to this conversation.

I bid you a good night.

FB Math:

House $410,000

6% RE commission to sell: $24,600

HELOC for Escalade: $60,000

(Assume they used Visa for the spinning chrome wheels...)

Total: $494,600

That's why they "need" $490,00, and of course since they "need" it, the market will supply it ;-)

>>>Can we bomb our way out of that? And still survive ?

Yes we can. Except for the former Soviet Union, one Trident sub can nuke out any adversary, including china's main nuclear force.

Also, how long do think China's navy and submarines last during a shot out with the US? First hour? Second? I am sure we shadow their subs constantly now that the ex-Soviet ones are mostly in port...

This is why the North Korea cry for attention is so pathetic. Do you believe we don't have a Trident submarine within 10min flight time range from North Korea? Who are the B-2's on Diago Garcia for? (Yes, I know they are also to deter a China invasion of Taiwan as well...)

Eleua, I like how you think and appear to be one of the few who look at the US miltary situation realisticly.

>>>Japan went through decades of economic growth after it's military was shut down by the world at large.

What a Seattle dickhead. Japan was shutdown by the *USA*, while also shutting down the Germans. We had some help in Europe for sure (England as a base, and Russia took huge losses tying up a lot of manpower for Hitler).

We fought an won a two front war against to large military powers. You think things have changed that much? (Yes, they have, the US is now STRONGER)

Yes, one Trident submarine has the capability of killing just about everyone in China within the hour.

One battle group can shutdown every port in China. One Carrier group can cut off all of China's oil.

The only wildcard is China getting solid rocket boosters for thier ICBMs. Clinton/Ron Brown/Loral sold the Chinese the ability to get their rockets into orbit, and thus made the US vulnerable to the spectre of Chinese missile attack.

I used to work in the sub chasing sphere, and also worked at one of the key bases for SDI. If the North Koreans actually give us the chance to battle test our missile intercepts, and it works, then the US will, once again, be absolutely secure from anything other than one-off terrorist attacks.

This missile on the pad in NK is an absolute gift.

Oh brother. No wonder the rest of the world is aching to get nukes.

With warmongers like this in the US, willing to wage war over a dip in standard of living.

Is it that important to own 2 cars instead of one? Two TV's instead of 5?

News Flash: If the money we spend on the military was redirected to other purposes, the US would be a f#cking paradise.

I'm sick of you pro-war for any measly reason people.

And I'm blaming YOU when the rest of the world decides it's had it with the US.

If the US had to live like China or India, we would easily lose over 150,000,000 people due to starvation, disease, exposure, and civil unrest.

There would be no rich nation, like the US, to send us massive aid.

I'm not advocating a war. I'm just saying that continuing on the path we are, will cause an even more massive war when the tipping point comes.

I now return you to your endless rendition of "Imagine."

anon 1146...

While we are on the topic, I thought I'd just shake your cage a bit more...

First, the rest of the world (absent the UK, Isreal, Poland, and Norway), already hate the US. We could bring every US soldier home from abroad, and dial our entire fleet to within 200 miles of our shores, and it would change nothing. In fact, most of the world would ignite in a massive conflict, absent the Pax Americana. For the record, I think that would be just fine.

If I became the Supreme Autocrat of the US, my first foreign policy inititive would be to, as much as practical, put the nuclear genie back in the bottle. China, Pakistan, India, N. Korea, and Iran would have to give up their nukes, launching capabilities, and guidance systems at the point of the US sword.

We would attempt to buy as much of the USSR/Russian nukes as possible. The US already is an aggressive buyer of old USSR nuclear physics packages. I would accelerate that program.

That leaves France, the UK, and Isreal. Isreal does not have, nor does it need ballistic launch technology. France's nuke program is pretty much a joke, and it could probably be bought off. That leave the Anglo-US nuclear parnership, which for now, is pretty stable.

Are you on meds yet?

Then, I would expand the capabilities of our SDI, just as an insurance policy.

I would also expand the roles of the Navy to be able to control any patch of salt water, anywhere in the world, without contest. We are almost there. They would also be charged to ensure that oil from the Mid-East, and the Western Hemisphere would flow where we wanted it.

Finally, I would bring home US troops from overseas. The ROW would be handed the responsibility to determine their own regional fates. Our Navy, and monopolistic nuclear umbrella, would ensure that regional conflicts do not spill over to harm us.

Then, the US would adopt a Swiss style neutrality. People could feel free to kill each other, as they have for centuries, provided they don't threaten the US region, or our resource supply lines.

The last effect would be an incredibly cheap and inviolate insurance policy against the US engaging in another war on the order of WW2 or the Cold War.

Do you need oxygen?

No nukes in enemy hands = no need for bunkers.

No foreign deployed armies = reduction in the DoD budget (liberals, start your onanism...)

Physicists can do whatever they want, but the minute they put the components together in a viable ICBM system, the system gets destroyed. Sorry, but I would rather do that then live under the spectre of global thermonuclear war, and Mutual Assured Destruction. In case you forgot, the 50s-80s really sucked, when it came to nuclear warfare fears.

Free trade with free nations. If you keep free trading with slave and peasant nations, you will only be eating donkey-dung sandwiches anyway. A viable US middle class would make a FAR more prosporous society, then a bunch of serfs and sharecroppers.

To keep the welfare state that our current politicians are promising us, and the rest of the peasant world, you would need a 400% income tax hike. You would be eating donkey-dung sandwiches in that scenario.

You will get no argument from me that we are ruled by a misguided, whack-job as is.

Because of the proliferation of global thermonukes (thanks Rosenburgs), the world almost ended in '62, '78, '83, & '93, and that's all we know about.

Had we strangled the Soviet nuclear program during its infancy, rather than pursue a policy of containment, and detante, we would have avoided all the terrors of the Cold War. Soviet expansion would likely have been contained, and we would have had no need for Ronald Reagan (again, liberals, start your onanism...).

We would not have needed the trillions of dollars spent on the Cold War, and could have spent it on the multitude of social welfare programs. (OK, liberals, I'll let you catch your breath, but don't worry, you won't go blind...)

Post a Comment