Zealous Optimism = Growing Equity Borrowing

At least someone in the Seattle media is paying attention to the dangerous situation that a lot of people are getting into so they can afford a home around here:

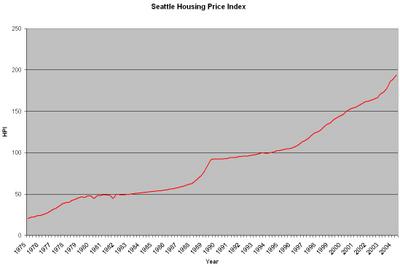

The housing market around here has been so hot for so long that some homeowners assume prices will always go up."So hot for so long." I suppose if you're twenty-something (like me) and unable to do a little bit of research (unlike me) then it would seem that way. As you can see in the graph below, it's only really been "so hot" since about 1996.

But the experts warn: some day that bubble could burst.

Source: Office of Federal Housing Enterprise Oversight

"Don't borrow against your home equity," McBride advises. "The equity that you have is going to be a valuable cushion and you need to build upon that equity." The way you build equity, he says, is through principal repayment of your mortgage.This sort of thing ought to be obvious and common sense. I guess it's true what they say about common sense though: Common since isn't common:

"This means don't just skate by on that interest-only mortgage payment or the minimum payment. You need to be knocking down some of that principal every month so you are building that cushion that will be so valuable if prices go the other way."

Homeowners across the country are looking to cash in on the booming real estate market. That's created a surge in home equity loans. Since 2000, home-equity borrowing has doubled.Do people not realize that this is money they eventually have to pay back? Yikes.

It now tops $900 billion dollars a year.

(Herb Weisbaum , KOMO 1000 News, 08.19.2005)

1 comment:

FDR made it very clear that this is a country of deficit spending. On a grand scale (congratulations to the current administration for demonstrating this concept) and on an individual scale. Hence the mortgages. Still, if one is smart about it, managed debt can be valuable. A home equity loan applied toward a permanent equity increase is a good choice.

Post a Comment