Sound Familiar? Sales Down, Listings Up.

March numbers from the NWMLS are available, and I managed to get a bit of a break before I head back from Chicago, so here comes the data.

March King County SFH summary:

March 2007

Active Listings: up 33% YOY

Pending Sales: down 11% YOY

Median Closed Price: $454,950, up 12% YOY

After an unusual YOY increase in February, sales resumed their previous course of down, down, down. This was the second year in a row that March sales were down 11% YOY.

If anyone tries to claim that this year is shaping up "just like any other year," or that the sales data points any less toward a softening than it has in recent months, they are either in denial or mentally handicapped. Month-to-month inventory jumped 10.42% from February to March, a larger spike between those months than any other year since 2000 (pre-2000 data is not available). February to March sales were up just 14.11%, making this the smallest increase between those months than any year since 2000.

While months of supply is still relatively low, it has increased 49% since March last year, and days on market has increased 33%. Still-increasing median prices are pretty much the only thing that housing bulls have to be happy about.

As is the custom, I have uploaded an updated copy of the Seattle Bubble Spreadsheet that contains the relevant data. The recap NWMLS pdfs are not available yet, but here is the detailed King County data.

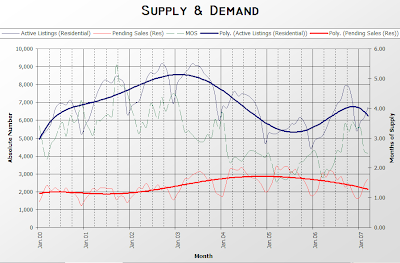

Here's the supply/demand YOY graph:

Here's the chart of supply and demand raw numbers:Here's the graph of YOY percent change in the median sale prices of single-family homes in King County since 1994:You've got a little bit of a recovery last month, with "appreciation" increasing 3 points to 12%. We'll see what happens the rest of the spring.

12 comments:

This is why I love this blog. Thanks for the data analysis, Tim!

Condominium inventory is up 54% YOY.

I'm really disappointed to see the median price is going up. i hope next month it's going to 12% down.

It is still going to take a good number of months like this before we get to the 'standoff' phase, where inventory is high enough and demand is low enough for non-trivial downward price movement. The current credit situation will hasten this.

Don't get me wrong, it will happen. None of us will probably predict the exact inflection point, as Shuggybabe demands, but it will happen. It is going to be a slow unwinding, so sit back and enjoy the ride. I plan to.

So these are year on year changes. The recently released Case- Schiller Price Indices show Seattle prices are flat Dec/Nov and Jan/Dec with a 1 year price change of 11.1%. This would imply that while there was year on year appreciation, the inflexion point has already been reached. The Case-SChiller price indices are far more reliable than the realtor numbers. We will need to wait for next Case-SChiller release to confirm we already are on downward price slope.

http://www2.standardandpoors.com/spf/pdf/index/032707_homeprice.pdf

Damn, and I was serioulsy considering buying a SFR in Seattle. Now I have to hold back to see what happens. I'd hate to be the moron that bought at the true peak.

I am convinced like most of you that we are in an unnatural housing bubble. It might take years, but I think eventually it will end badly. So here is an open question...

In January of 2000, really smart people could have shorted QQQQ in a big way ...and they would have become very wealthy as everyone else watched their stock market wealth evaporate.

How can someone "short" the housing market?

Nofate,

Short any stocks that have any tie to the housing industry. Lenders, builders, etc.

You can trade housing futures / options on CME. Seattle is not currently tradeable but other bubble markets are.

http://www.cme.com/clearing/clr/list/contract_listings.html?type=hng

Got any posts like this showing up in seattle.craigslist real estate listings?

Rubyfan -

The post was "flagged down by craigslist users". What did it say? Was it a foreclosure listing that a bunch of real estate shills got removed as "offensive"?

-E.

What I find interesting is that King County median closed price is up, but the average closed price is down.

That suggests to me that the smart money, those buying at the high end, and stopped buying or aren't paying as much. That, coupled with fewer available low-end, would explain the contradictory trends.

The silly utes are still buying. Those that have been around the block are sitting this out.

The real fun starts when a builder sells a bunch of houses at $500K and then starts to sell the exact same model of house in the same neighborhood for $400K.

Losing $100K overnight is very tough to digest.

On another note...

I am having quite a bit of fun watching all the bulls and Wall Street dead-fish go on about housing numbers that don't include March '07. When they have to release the 2Q numbers, it will be very fun to see just how fast the real estate escalator siezed up.

I don't think they will be able to drink those numbers pretty.

Post a Comment