Listings Way Up, Sales Continue Descent

It's time for April statistics from the NWMLS. King County SFH summary:

April 2007

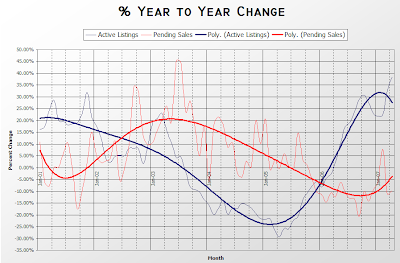

Active Listings: up 38% YOY

Pending Sales: down 10% YOY

Median Closed Price: $465,000, up 11% YOY

Sales continued their descent, making April the 17th of the last 18 months to register a YOY decrease in pending sales. Likewise, inventory continues to balloon, registering the highest YOY increase to date.

Despite the downward pressure of increasing supply coupled with decreasing demand, median prices still rose $10,000, for a 10.85% YOY increase. Apparently the increasingly small number of people that are still buying are all too happy to continue paying higher prices. Perhaps they're frightened of being priced out forever.

Months of supply bumped back up to 3.00.

As is the custom, I have uploaded an updated copy of the Seattle Bubble Spreadsheet that contains the relevant data. Here is the recap NWMLS pdf.

Here's the supply/demand YOY graph:

Tick, tock, tick, tock...

35 comments:

I predict that the $10,000 increase in median prices will be the primary focus of our friends at the Times and P-I.

Tick, tock, tick, tock...

Actually, Aubrey over at the PI was pretty balanced.

It's worth noting that closed sales are up YOY in every single Seattle neighborhood except Queen Anne/Magnolia (area 700).

First # is April 2007, second is April 2006.

Area

710: 120 93

705: 195 181

700: 65 70

390: 100 82

385: 30 24

380: 69 65

140: 171 157

Sales up AND prices are up. Looks like we're in for another strong year of appreciation. There seems to be insatiable demand that the current inventory can't meet.

The breakouts show Seattle closed sales up YOY 14% and pending sales up YOY 8%. WOW!

Tim, I think you should have said that there's an INCREASING # of people willing to pay MORE for a house, as that seems to be the case.

Breakouts - KING COUNTY SECTORS - Northwest Multiple Listing Service APRIL 2007

And yet, Seattle registered the smallest YOY price increase (SFH + condo) in all of King County, at a mere 4.88%.

Unlike you, I consistently discuss the same data set: King County SFH. And in that data set, inventory is soaring, while sales are consistently decreasing. I'm not interested in cherry-picking whatever data makes my point look the strongest.

If Meshugy's point is that in transitioning or declining markets, in city properties should outputperform county properties, I would have to agree.

Just as data in bubble markets such as San Diego, deterioration in prices is more pronounced the farther one gets from the urban cores.

Seattle Metro has 2 areas: Ballard and not Ballard. Unless of course some of the areas that are not Ballard are displaying Ballard like attributes, in which case they can be included in the "Ballard" bucket.

Ardell has a similar classification method except that it's "Areas within 2 miles of Microsoft" and "Areas that are not within 2 miles of Microsoft".

Elizabeth did some fine editing on her piece. I particularly liked this sentence!

Spring traditionally is the strongest month for sales. Whether April will be the strongest month remains to be seen.

Ah, the month of Spring.

I consistently discuss the same data set: King County SFH. And in that data set, inventory is soaring, while sales are consistently decreasing. I'm not interested in cherry-picking whatever data makes my point look the strongest

Personally, I think of the market as King/Snoho/Pierce counties. Cross county commutes are a fact of life. That description is also consistent with the Case-Shiller data, which is more accurate than discussions of median

BTW Tim - do you have access to $/sq foot data? It doesn't seem like NWMLS publishes this.

The only place I've seen $/sqft data is on the ZipRealty blog, and they've only been tracking it consistently since April of last year.

For those that are interested, I have recently added a new tab to the Seattle Bubble Spreadsheet with the ZipRealty data.

For those that are interested, I have recently added a new tab to the Seattle Bubble Spreadsheet with the ZipRealty data.

Thanks Tim

I have seen the Zip data. Unfortunately, their trending seems to bear no resemblence to any other source on the market, as discussed here

When I worked in consulting, we used to have a joke about a source of data called "PIROOMA", which stood for "Pulled it right out of my a$$". Seems a fitting description for their numbers.

Holy cow...did anyone look at the condo sales figures?

Ballard, area 705 had 33% YOY increase in closed condo prices! A 9% YOY increase in sales. As I figured, all those new condo complexes on market street are selling like crazy. No wonder they've got several more in the works.

Neighborhood of the month is definitely Laurelhurst/View Ridge (area 710):

YOY sales increased 29%

YOY Price increased 14%

Funny to think Seattle Price Drop said Laurelhurst was crashing this time last year...were is he now?

The most interesting sentence from the Cohen piece:

"Including houses and condos, 2.6 percent of homes are listed for less than $200,000, 32.6 percent are listed for $200,000 to $399,999, 29.8 percent are $400,000 to $599,999, 13.6 percent are $600,000 to $799,999 and 21.4 percent are $800,000 and up."

Didja catch that? Not one, but two bumps in the sales graph: from $200k to $600k, and from $800k upward.

In statistics-speak, we refer to this as a bi-modal distribution. It's one of the situations where median is not a good summary of the data. If that latter "bump" is growing faster than the former, then you'll see a rising median price where none exists.

I leave the rational drawing of conclusions as an exercise for the reader....

"As I figured, all those new condo complexes on market street are selling like crazy. No wonder they've got several more in the works."

Considering that the number of listed condos in Ballard doubled between this year and last, I'd say that there's plenty of crazy to go around.

"Ah, the month of Spring."

And, of course, whichever month happens to be strongest will be held up as representative of the whole thing. Unless, of course, a stronger month comes along afterward.

One more thing: pending condominium sales dropped by 30 percent in Ballard.

Sweet. My landlord doesn't know it yet, but my rent is about to go down....

pending condominium sales dropped by 30 percent in Ballard.

Yeah, that's because they had an amazing amount of sales last May: 72. The pending for May 2007 is 52 sales, which is still a MOM increase from April. Looks strong to me...

As I figured, all those new condo complexes on market street are selling like crazy.

Considering the 4 largest ones (Canal 1 & 2, Hijarta and NoMa) are totally vacant so far and most of the units were pre-sold months ago it's not much of an indicator.

It's going to be a few months before we know anything about the absorbtion rate of these new properties, and there are somewhere in the neighborhood of 700 units between the 4 projects.

Check out the urbnlivn blog - one of the disgruntled NoMa buyers backed out of her contract. Noma told her to screw off as they had other buyers "waiting in the wings". They listed her unit on the MLS, then after no bites begged her to come back.

I can't think of another neighborhood that has nearly as much unfinished inventory floating around as the areas bordering Market street.

"Yeah, that's because they had an amazing amount of sales last May: 72."

I agree: it's pretty amazing that there are 30% fewer sales when there are 100% more properties available.

Amazingness is certainly a powerful statistical concept; I should use it more often. Now, if only I could find the formal definition....

For the record: I also like "Awesomeness", "Incredibleness" and "Astoundingness" as rigorous measurements of statsitical stupendous-ity.

Oh, what the hell: let's just get our incredibly stupendous and awesomely powerful terminology down, mmkay?

Note: I may be off on the total units in Ballard in those 4 projects - On recount it's 450 total units - one of the sources I found had Canal 1&2 listed as 290 units each, rather than total.

Interesting though, Canal Station is built by the same folks that developed Cosmo, which has the dubious distinction of having the most vacant flips of any new project currently listed in the MLS.

If this large number of resales has anything to do with the way the presale process was managed (duh!) we may be seeing a repeat performance in Canal.

misterbubble;

amazing = incomprehensibly, stupendously, marvelous. Everyone knows this. Where have you been?

Also, a question - To what Cohen piece are you referring a few posts up?

"....The most interesting sentence from the Cohen piece:..."

Holy cow...did anyone look at the condo sales figures?

Ballard, area 705 had 33% YOY increase in closed condo prices! A 9% YOY increase in sales. As I figured, all those new condo complexes on market street are selling like crazy. No wonder they've got several more in the works.

Golly gee whiz. Those things are selling like hotcakes. To the moon baby. Personally, I like to see more volatility there than for SFH, because goodness knows these condo run-ups never end badly.

The Cohen piece.

It's one of the situations where median is not a good summary of the data.

Mr B -

you are cracking me up today.

FYI, you can get a look at the inventory distribution here. it is for sale inventory, not sold - but should give you some idea of the shape of the distribution. I'd call it more of a Poisson than bi-modal distribution

Excellent comments and analysis on San Diego's latest figures by Rich Toscano. My favorite quote is equally applicable to Seattle:

...once the seasonally strong period has ended, the tightened lending will still be there and may even have gotten worse.

In the meantime, while it's fun to watch the month to month data, overthinking it is not very good use of time. Big, sweeping trends like housing market booms and busts take a long time to play out. But they do play out in the end.

deejayoh:

Nice tool. Do you know where they get the raw data?

I did a histogram of SFH in Seattle, and it looked like a mixture of two bell-shaped distributions: one with a mean somewhere around $400,000, and one with a mean of around $1,000,000.

I can't tell if the variance equals the mean, so I'll stay agnostic on the question of whether or not the distribution is a possion or a normal.

Nice tool. Do you know where they get the raw data?

I think they use MLS data. Same thing they use over at housingtracker.net (which, by the way, showed inventory up another 2% this week)

As I figured, all those new condo complexes on market street are selling like crazy.

pffft... smoke much?

> Pending Sales: down 10% YOY

Can I extrapolate this as 10% of RE agents are out of commission in April? :-)

"Apparently the increasingly small number of people that are still buying are all too happy to continue paying higher prices."

The flip side of this is interesting, too, and that is that sellers are so reluctant to lower their prices, even in the face of a fading market, which is one of the reasons why real estate is sometimes called a safer investment. There are a couple of listings that I have made lower (but still reasonable) offers on where the sellers just refuse to accept that they aren't getting their asking price. Now those same listings are 120+ days on the market and no one new is looking at the listing anymore.

The typical seller mentality in general is odd to me. The selling price comes out of thin air, generally from an agent's guess at where the market is at the time. However, when that guess is proven wrong, the seller clings to a price that never had any foundation in the first place. Once they get the idea that they are getting, say $600,000 for their home, they just can't accept $550,000, even if they only paid $350,000 three years ago (I am just making up these numbers for example). It is also funny to me to watch someone lower a $500,000+ listing by $5,000 as if that is going to bring any new buyers. If you aren't taking at least 5% off, why bother?

In the California market analysis someone speculated that the rise in the median price, coupled with falling sails over the last month or two could be a result of tightening lending standards. The thinking goes that tighter lending standards affect the lower end of the market more significantly, so reducing the lower end volume leaves the higher end sticking out. Again, it will be interesting to continue to watch this.

Home sales in city shoot up 14% in Apri

In the city, sales were up 14.1 percent for all homes, with double-digit increases for houses and for condos.

As for the increased number of homes on the market, Scott said Seattle's inventory in April was enough to supply sales demand for 2.3 months -- up from a year earlier but still far below the normal five or six months' worth of inventory.

"There's generally eight people competing for the same property," John Marcantonio said. "Anything desirable."

A Windermere Real Estate analysis showed that the typical Seattle house that sold in April was on the market for 30 days or fewer and fetched 99.8 percent of the asking price.

Post a Comment