(Absolute) Inventory vs. Pending Sales

Here's another question from a reader regarding inventory:

I have a question about the "houses on the market" stat that you called the press to task on for not reporting. Is it an absolute measure or a relative measure? Because certainly hundreds of new houses came on the market last year- definitely enough such that the case is that inventory has DECREASED as a % of total homes. It sounds as if you are saying that it's purely an absolute measure, which doesn't seem very helpful to me. And not only have the number of houses increased, but I'm guessing that the population increased also.Yes, the NWMLS figure of "active listings" (inventory) is an absolute measure. Unfortunately figures like "total homes in region X" isn't something that we have available to us, so we can't really know what percentage of "total homes" the "active listings" represents. The reader brings up a good point though, that when compared to factors like total homes and population, an inventory that is holding steady is actually decreasing, and even a slightly increasing abolute inventory is relatively decreasing. However, even though we don't have a "total homes" figure, we do have one useful thing to compare inventory to in order to gauge the market: pending sales.

Just to make my case using extremes, suppose last year there were 4 million people in the area and 5,000 homes out of, say, 1.5 million total. That would be a "for offer" rate of 3.33%. Now let's say 200,000 net new residents moved into King County, 5,000 net new homes were built, and 5,100 were "for offer". OK, so the "for offer" rate would have increased to 3.38%- a 1.4% increase in listings. But the population has increased 5%. So, when considering all the moving parts, have they really "gone up". I don't know, you tell me.

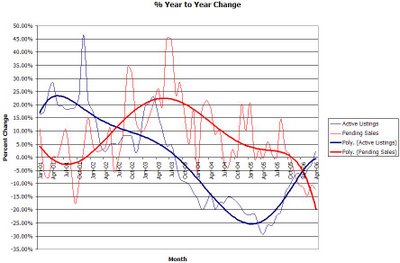

To try to understand the inventory versus pending sales situation a little better, I created this chart using the NWMLS data for "res only" in King County from 2001 to the present. I plotted the year-to-year percent change in inventory and pending sales. The thin lines are the actual data for each month, and the darker lines are a smoothed average using Excel's polynomial "trend line" function.Here's what I find interesting about this chart. Around July 2002—arguably around the time that the Seattle market really started to heat up—the trend lines crossed, meaning that pending sales were increasing faster than new listings were being added. That is probably at least one of the reasons behind the extreme ramp-up in prices. However, about halfway through last year the active listings started on the road to recovery, and around December or January the lines crossed again in the opposite direction. Pending sales have been on a steady downward trend since late 2003, but now (absolute) inventory is actually increasing at the same time.

This is what I was referring to when I pointed out the positive numbers in the "% chg. Total actv" column and negative numbers in "% chg Pending sales" column. Despite the lack of statistics on population or total homes, increasing inventory coupled with decreasing sales volume is a clear sign of a slowing market, and it's frankly quite disappointing that the local press is turning a blind eye to it. If this trend continues, there is no possible way that the median price can continue to rise like it has been lately. It's just not economically possible.

48 comments:

The chart of pending sales to the number of listings is very interesting. I think it would also be fascinating to compare total listings to housing starts.

If the housing starts are going down and listings are rising, it would indicate there was some real weakness.

Population of total homes doesn't matter. The ratio of available homes to serious buyers does matter, but it's an awfully difficult figure to pinpoint. So we have to go with what we know: total population, and total listings.

We know that between 2000 and 2004 (approximately), population in Seattle declined significantly. The local economy was hostile, and people fled the northwest. Meanwhile, home prices were skyrocketing.

You tell me: does this sound like a sustainable trend?

Hi Tim,

That's a cool chart....it shows some interesting relationships. Would you also be up for making a similar chart using the actual inventory and pending sales numbers? I think using only the percent changed figures exaggerates some relationships while diminishing others.

Thanks!

'm

Here are the areas where MEDIAN PRICE declined YOY from March '05 to March '06:

Magnolia/Queen Anne (area 700): -0.2%

Medina (area 520): -30.5%

Seward Park (area 380): -4.1%

It's started, don't sweat it. Just sit back and see where it goes next.

Hi anon,

Two of those areas gained YOY in April:

Magnolia/Queen Anne (area 700):16.27%

Seward Park (area 380): 21.91%

Medina is weird because there is a low # of sales and it's mostly multi million $ mansions. So the stats swing wildly...for example in Feb. 2006 it shot up 62.3%! In Jan 2006 it went up 31.42%...see what I mean?

'm

lesserseattle,

Sorry...you're right. I meant to say that the growth rate declined siginificantly. A growth of 10,000 since 2000 represents and increase of about 1.8% (0.36% per annum). That's dramatically down from the 9% increase seen between 1990 and 2000 (which works out to a 0.87% increase in population per year).

Had Seattle continued to grow at the rate experienced between 1990 and 2000, the current population would be closer to 590,000. Yet still, people argue that the dramatic increase in the price of housing since 2000 is justified by population growth....

"We know that between 2000 and 2004 (approximately), population in Seattle declined significantly. The local economy was hostile, and people fled the northwest. Meanwhile, home prices were skyrocketing."

vs

"According to the Office of Financial Management, the population of Seattle has increased by about 10,000 over the past five years. Population projections for 2005 were 573,000 compared with Census 2000 population of 563,376."

Were you talking about greater Seattle, or were you just trying to use your own anecdotal observations as facts that "we know"?

Not incidentally:

Seattle demographics.

That's where I got the 9% growth number between 1990-2000 (itself taken from the census data for those years).

Nick,

Read the post right above yours.

Thanks for the snarky comment, though. Very helpful and insightful.

"Sorry...you're right. I meant to say that the growth rate declined siginificantly."

Um, no, I don't believe that is what you meant originally. Because in your original post you said:

"The local economy was hostile, and people fled the northwest." FLED!

So you mean to tell us that when you said "fled the northwest", what you REALLY meant was, "well, the population continued to increase, just not at as rapid of a pace"?

Sorry, not buying it counselor. Doesn't pass the smell test.

Grow up, Nick.

You can't just continue to say "grow up" when your obvious dissembling is publicly and convincingly pointed out. Maybe you should stop posting firebombs anonymously and trying to pass it off as actual commentary. This business of making anecdotal claims, and then sneakily trying to shift the meaning of your original words doesn't cut it with the grown-ups. Why not just own up to your mistakes and move on? There is no way you can convince thinking adults that "fled" means "decreasing rate of growth".

And I think this goes for both sides in this debate. A lot of folks in both camps evidently have a really emotional (not to mention economic) investment in being proven right in the end. A lot of us, however, just want to know the truthful situation and are interested in honest dialogue. If one's case is very strong, one should not need to fudge statistics or overstate anecdotes.

{{end patrician diatribe}}

Grow up, nick.

I made a mistake. I left out the word "growth" in my post. I acknowledged my mistake, and proceeeded to make the argument that I was trying to make.

You, on the other hand, are not addressing my argument...you're arguing that I never intended to make the argument that I'm making. In short, you're being a dick.

So again: Grow up, Nick.

Sorry, you said "fled". Try to sell it elsewhere.

Where do we find the YOY's for April for each section of Seattle?

Anyone got a link?

Tim,

Interesting chart. This is somewhat similar to some things that I wanted to trend from the monthly MLS reports from last few years. Are you manually manipulating numbers from their report PDF's or do you have access to the raw MLS summary data? If so, can you share it with me, or point me to it?

I'd like to include the closed sales in addition to the pending from the KC county breakout data in the analysis. Even just looking at one county or MLS map area, takes too much time/energy to manually parse out from the PDF's...

As another reader pointed out a few threads ago, any quantitative analysis using MLS data is sketchy, since it's integrity is somewhat suspect, but still worth looking at for what it is.

Thanks,

~pete

meshugy & pete,

Unfortunately, all I have access to is the NWMLS pdfs, just like you. However, I have been manually inputting some of this data into an Excel spreadsheet. If you want it, I've put the current version online here. It has a graph of the "actual" inventory and pending sales numbers as you mentioned, meshugy.

Tim...that's awesome!

It seems pretty clear from that chart that drops in pending sales always accompany drops in inventory.

For real price reductions we need to see drops in pending sales and an increase in inventory. Doesn't seem like we're there yet.

Tim, would it be possible to create an inventory tracking part of the site? Post the MLS inventory for King Co, Seattle, etc...every day. That way we could get a play by play account of the market. We'll see rising inventory way before the MLS stats come out.

Too bad we can't get daily sales data from the mls too.

Anyway, just a suggestion...

'm

Eastside 520 (Medina) YOY April median down again this month. That's 2 months in a row.

April '05 > 588,475

April '06 > 528,000

That's minus 10.4%

Tim, thanks for the nice quantitative analysis. I think it's great that you go do the research and analysis to bring real objectivity to the debate surrounding the housing market in Seattle.

It's also nice to see your site heat up in recent weeks with many postings (I believe you've been active every day).

I think the debate around housing in Seattle is only going to persist for a couple of more months as it will soon become evident that the slowdown will eventually reach the PNW.

Also, there is much data and history showing that even with increasing population and strong economy that housing doesn't necessarily increase in value. As a matter of fact, over several hundred years of analysis have shown that housing historically only rises at the rate of inflation. So the past few years have been an extreme anomaly. I firmly believe that the credit situation (i.e increased restrictions on lending, defaults, high interest rates, etc.) will create the necessary conditions to deflate the bubble.

It's not normal to experience double digit increases for many years. This is no different than any other speculative bubble, and is one that will end poorly for many people.

Amen to that.

There is absolutely NOTHING that supports the massive home price increases- nothing.

It's a total, foolish, house of cards that will end badly for many.

NY Times:

"Polite, soggy Seattleites have become blood-thirsty cannibals," he said.

Lander-

What is this article about?

Unfortunately, the NYT online always crashes my computer! D*mn!

I think I can guess tho- we are RUTHLESS when it comes to doing EVERYTHING we can to (at least pretending to) keep those housing prices humming- including sham local TV news!!

Complete with actors who "can't find a house cuz everything's bidded up".

Yes, I'm sure Seattle takes the cake on dishonesty.

Nothing we like better than doing anything we can to get those few last straggler FB's in to buy a house that'll be worth half in 3 years and they'll be stuck paying thru the nose for for the rest of their lives.

We are RUTHLESS here in Seattle.

If you believe in economics 101, you can assume that the ratio of serious buyers to available homes is going up, because prices are climbing.

It's called the law of supply and demand - if supply is up slightly, and price escalation is rising more quickly, then demand must be increasing faster than the supply.

Interest rates, employment figures, incomes, and demographics are key factors affecting supply. Interest rates are up only slightly, income is up, people keep moving into the area on a net basis, unemployment is down, so increasing prices are no big surprise.

A bubble can only occur when a significant number of people can leave a market readily. You can sell off your tulip bulbs or stock, and still go home, cook your dinner, watch TV in your living room,and retire to your bed. You can't do that if you sell your home!

So, a real estate bubble requires a high percentage of non-owner occupied homes. Seattle doesn't have many of those, though I'd look out for the Florida and Phoenix markets, which do have a high percentage on non-owner occupied homes.

When reading about real estate markets, remember, real estate markets are LOCAL, unlike the stock market, which is international.

When Warren Buffet says look out for FLORIDA real estate, and some clueless reporter writes a headline, "Warren Buffet says look out for REAL ESTATE" notice the discrepancy.

This blog was started about 9 months ago. In that time, the median home in King County about 12%, and the average home in King County has gone up even more.

If real estate prices in the Seattle area were to decline 5% tomorrow, would the Tim claim victory for forcasting a decline? Or, would he acknowledge that by holding off waiting nine months to purchase real estate, that he had made a mistake and is paying 7% more?

How about it, The Tim?

If you want to buy or sell real estate in the Seattle area, check out my website at dunnanddunnrealtors.com - where I offer rebates, discounts, and full service.

My answer to Mikhail - Finding land to build on is tough, and regulatory obstacles to building keep increasing. Demand is not the only factor affecting new home starts. Ask a spec. buider. They are desperate for land.

Mr Dunn, if you truly believe that real estate is only going to decline 5% in Seattle, then nothing anyone says here is going to convince you otherwise. However, in time we will see who is right, and who is broke.

Tim Dunn says "Finding land to build on is tough, and regulatory obstacles to building keep increasing."

Are there any statistics to show that housing starts in the Puget Sound area are lower than they have been in the last decade? If it is true that it is so tough to build in the Seattle area that building in the last few years is MUCH lower than in the past, then there might be some truth to the supply shortage theory.

Hi Everyone...

Inventory is slightly down today:

King County: 7,205

Seattle: 2,095

Yesterday's #s:

King County: 7,214

Seattle: 2,107

Sunday:

King County: 7,249

Seattle: 2,127

It seems to be inching down this week..

'm

Mr. Dunn-

Warren Buffet warned that RE everywhere in the US would drop. He pointed out the reasons- shoddy lender practises (RAMPANT here in Seattle) and general overvaluation.

If you can't tell the truth, better to just keep your mouth shut.

Lying to the public will not get you to where you want to be by the time this thing is over.

Mr Dunn-

Median may have gone up but there are a eck of a lot of price reductions out there and people are having a hard time selling their homes.

If you want to keep your reputation intact, better to tell all sides of the story.

Why a realtor would want to be remembered as "the guy who lied to the public" is beyond me.

So how do you feel about Merit going under? Good sign for Seattle RE right? Ameriquest closing all Seattle branches- good sign, right?

Fannie May and Freddie Mac cooking the books- good sign, right?

Get out of your tiny world and take a look at the big picture. THEN present yourself as an RE "professional".

I looked at Dunn's profile - he has a Masters in Psychology, which explains both his poor grasp of economics and his presumption to know more than he does.

Pity him. His alternate vocation of realtor will prove to be just as much of a dead-end as his PhD aspirations.

"If real estate prices in the Seattle area were to decline 5% tomorrow, would the Tim claim victory for forcasting a decline? Or, would he acknowledge that by holding off waiting nine months to purchase real estate, that he had made a mistake and is paying 7% more?"

This is beyond poor reasoning. It's terrible. Good decision making is all about process. You don't judge it based on some resulting data point. This is like if you don't wear your seatbelt, get in an accident, and are somehow miraculously thrown clear and survive. You then go back to all the seatbelt wearers and try to get them to admit their "mistake".

Seriously, this is investing 101. Process, process, process.

A bubble can only occur when a significant number of people can leave a market readily.

"Can" leave? Or will it be, "must" leave? Defaults are going to go through the roof next year.

And it's not only interest rates that are rising, it's also lending standards. Less easy money = less buyers = less demand.

Also, it doesn't have to bubble for prices to go down. This isn't rocket science or magic. Prices for housing are determined by what people can afford. Loose lending and bizarre new loans have given fiscal morons the ability to outbid each other with impunity--until now. Despite rumors to the contrary, there isn't a limitless supply of California millionaires ready to infiltrate Seattle and prop up the market. Housing prices will correct to the historic mean, meaning what people can afford to pay. This may happen very fast (okay, it was a bubble), or it may happen over a decade (okay, it was a hot market for awhile). Just as people speculated on the way up, people will speculate on the way down . . . I predict a lot of movement in the next six months.

I also predict a

'lot of movement in the next six months"- and I like the way you put that!

Kaboom! Watch out below! That's a "lot of movement"!

A bubble can only occur when a significant number of people can leave a market readily.

Like huckster real estate agents with a degree in psychology? (They can always go back to community college, right?)

NY Times:

A Chill Is in the Air for Sellers

Many Americans who planned on real estate as their path to wealth are beginning to find that there are limits to how high is up.

Blame market forces. As higher interest rates dampen demand in cities and suburbs that only a year ago were battlegrounds for fierce bidding wars among numerous buyers, sellers are grudgingly lowering their prices to drum up interest...

Inventories are not high in every city. For a variety of reasons, mostly stronger job markets, sales and prices are picking up in markets like Houston, Boise and Dallas, which did not see a boom in recent years, experts say.

In Seattle, for instance, some buyers are enmeshed in bidding wars that push prices far beyond the asking price — a phenomenon that was common in San Diego, Las Vegas and Washington only a year ago. Glenn Kelman, chief executive of Redfin, a new online real estate service based in Seattle, has hired a champion video gamer, with great thumb-twitching skill, to speed data entry during the multioffer auctions. "Polite, soggy Seattleites have become blood-thirsty cannibals," he said.

A minor point of math:

When something goes up 12%, then down 5%, the result is not 7% higher. It's 6.5% higher. And if it goes down 12%, you've actually lost 1.5%.

A small difference in this case, but consider the case where the price goes up 50%, and then down 50%. Now you've lost 25% of your original amount.....

yes the incivility is redonkulous.

Instead of rebutting what Mr. Dunn has said many posters merely state "you have no idea what you're talking about" or call him a liar.

I'm all for debate but it appears that many posters here cannot articulate a point without calling names.

Ignore the idiots. Many people here welcome your commentary Mr. Dunn. Thanks for having the balls to post here.

Oh, jesus. I'm crying a river for "Mr. Dunn"....after all, it's not as if his post wasn't didactic and patronizing, what with the "Economics 101" spiel.

That said, rather than blowing smoke up his ass for being "brave," let's look at the substance of "Mr. Dunn's" arguments:

1. If you believe in economics 101, you can assume that the ratio of serious buyers to available homes is going up, because prices are climbing.

"Mr. Dunn" is absolutely right...he has a grasp of economics on par with someone who has completed econ 101. Because, in econ 102, you learn that the cost of capital dramatically affects the ability of people to afford big purchases, and...whaddya know...the cost of capital has tanked in recent years.

But more to the point, the orignal topic of debate whizzed right over "Mr. Dunn's" head: we were all looking at a big chart that shows a dramatic reversal in the sales/inventory ratio, and The Tim was talking about "the population of total homes." The post that "Mr. Dunn" refutes wasn't calling into question the "economics 101" of the situation -- it was merely pointing out an error in Tim's post.

2. Interest rates are up only slightly, income is up, people keep moving into the area on a net basis, unemployment is down, so increasing prices are no big surprise.

Interest rates are climbing monthly, new jobs are being created in low-paying fields, median pay is stagnant, the median family income is well out of reach of the median family home, and mortgage payments are nearly double the market rent payments for equivalent properties.

Had "Mr. Dunn" bothered to do even 10 minutes of reading on this blog, he would have known that we have discussed his arguments. He didn't, and I'll tell you why he didn't: he's a shill. "Mr. Dunn" doesn't care what the rest of us think. That's why he calls himself "Tim Dunn, Realtor," and not just "Tim Dunn".

3. A bubble can only occur when a significant number of people can leave a market readily.

"Mr. Dunn" should tell that to the Japanese. They'll know enough english to laugh (bitterly) in his face.

Bubbles occur when there is speculation. There is no other requirement. Be it houses or cars or stamp collections, when large numbers of people get it into their noggins that a particular commodity is a "can't lose!" proposition, they spend more to purchase said commodity, in the hope of future gains. Bubbles are psychological...I guess that makes "Mr. Dunn" an expert.

4. So, a real estate bubble requires a high percentage of non-owner occupied homes.

Have you heard of forclosure, "Mr. Dunn"? It's an interesting phenomenon. It also clearly satisfies your requirements: the bank owns your home, and you no longer live there. QED.

5. When reading about real estate markets, remember, real estate markets are LOCAL, unlike the stock market, which is international.

Uhm...yeah. And that's why we have the NYSE, the NASDAQ, the NIKKEI, the HANG SENG, the EUREX, on and on...

But, hey...whatever. There's ample evidence that the housing bubble international, too -- just ask the British!

6. "When Warren Buffet says look out for FLORIDA real estate, and some clueless reporter writes a headline, "Warren Buffet says look out for REAL ESTATE" notice the discrepancy."

And I quote:

"Certainly at the high end of the real estate market in some areas, you've seen extraordinary movement.... People go crazy in economics periodically, in all kinds of ways. Residential housing has different behavioral characteristics, simply because people live there. But when you get prices increasing faster than the underlying costs, sometimes there can be pretty serious consequences."

--Warren Buffet, 2005

Funny...I don't see the word "California," anywhere in there (until later in the transcript, when he talks about selling his own California property for way more than it was worth, of course...)

7. This blog was started about 9 months ago. In that time, the median home in King County about 12%, and the average home in King County has gone up even more.

So, Yay! Y'all jump in! The more the merrier!!

Seriously...did "Mr. Dunn" actually sit through econ 101? Did he miss a few days?

When you have a commodity (like housing) that has, for decades and decades, for better or worse, appreciated at a small, uniform annual value (in particular, 2-3%), it should be a warning sign when it suddenly begins to appreciate at rates significantly greater than its historical trend.

Actually, another Buffet quote seems appropriate here:

What the wise man does at the beginning, the fool does at the end.

I leave it as an exercise to the reader to define "Mr. Dunn's" role in the above statement....

8. If you want to buy or sell real estate in the Seattle area, check out my website...

Ahhh...finally. We get to "Mr. Dunn's" real argument: self-promotion.

Frankly, I don't feel the least bit bad for attacking poor "Mr. Dunn," because he probably never read the posts that called his silly ass out. You see, "Mr. Dunn" is far too busy astroturfing housing bubble blogs to waste time actually reading any of the arguments that contradict his twisted world-view. Frankly, I feel a little sleazy spending this long answering his post. Blecch.

Good riddance, "Tim Dunn, realtor". You won't be missed.

Sigh.

Found my first mistake: Where I say:

"I don't see the word 'California',"

it should read:

"I don't see the word 'Florida'"

(how long till Nick jumps on this one, eh?)

Actually...I don't know where "Mr. Dunn" got it into his head that Buffett was talking about Florida, actually...does anyone else know?

Anon 8:04-

thankyou for your post. Mr. Dunn was obviously a self-promoter and we have no need for him on this blog.

Now if a realtor who enjoys the truth would stop by, that would be another matter altogether.

I suppose Mr. Dunn chose FLA. because that's the market that's making the biggest headlines right now as a total stinker.

If San Diego's in the headlines next week then we'll hear "Buffet only said that about San Diego!"

There is a link to the Buffet article right on this blog.

It is in the comments section under the "Dynamic, Sizzling, Crazy" post.

Warren Buffet clearly says there will be an RE slowdown EVERYWHERE.

Mr. Dunn, Realtor, is more clueless than the "clueless" reporter he berates.

He's an RE schill. We absolutely do not need his input here. Because he IS a liar.

Bring on an honest realtor. THEN we can talk.

Gushy said...Ignore the idiots. Many people here welcome your commentary Mr. Dunn. Thanks for having the balls to post here.

Get a room.

"Warren Buffet clearly says there will be an RE slowdown EVERYWHERE."

But he also says there is a bubble "to some degree". Notice that he isn't hysterical like a lot of people on here and calling for 20 cents on the dollar by 2010.

Most of us aren't calling for 20 cents on the dollar, either.

Lesser Seattle- You are being a pick and choose reader, just like Mr. Dunn.

Buffet said: there will be a slowdown EVERYWHERE and then used Broward/Dade as an example.

Do you not understand the meaning of the word "Everywhere"?

And do you not understand the concept of choosing a representative example to make your point?

Read the interview.

Wow! Lots of emotion out there. I didn't say that there wasn't any liklihood of prices stalling our or declining slightly. My best guess is that we are about to see a breather, which is a common pattern in real estate. I also agree that when interest rates go up, home prices slow in growth.

I am not beating a drum, saying buy now, before its too late. I was saying that a year ago, and I have been proven right.

When one poster talks about the home valuations being unrealistic, he betrays a lack of knowledge of the meaning of valuation. How a given market currently values something is its value. There is no other measure.

You can value a stock by comparing its earnings potential to that of other instruments that have earnings potential. People buy homes to live in, not primarily as an investment.

Our local market of homes has few investors buying homes.

How do I know? What do you think I do all day? I talk to home buyers and home sellers. I research market valuations, and I study the property tax rolls.

I know whether home owners live on the properties they own, because the tax rolls have two entries, one for the physical location, and the other for billing. Anyone can do this - the tax rolls are available to the public online.

I make just as much representing a scared seller as an optimistic buyer. If you are a home owner who is scared the market will fall, and this is motivating you to sell, please, give me a call! I'd love to sell your home, and I will charge you less than my competition will.

I own a home, and I have absolutely no interest in selling my home, so my money is definitely where my mouth is. I think that the market value of my home will go up slightly in the next year, but if I thought it would go down 15%, I still would have no interest at all in selling my home. I live in my home, and have zero interest in living in an apartment or a rental home.

What I haven't mentioned in my resume is that my original history was as a trader in stocks and bonds. I got out when markets started trading 24 hours a day. I had to sleep sometime. There are different stock exchanges, but stocks are often traded on more than one exchange. Also, lots of trades take place in-house at large brokerages, or OTC.

I agree that anyone who got a very aggressive ARM with a minimum down is in a risky situation. However, these aren't as common as some posters seem to think. Also, many ARMs have multi-year locks. In my experience, they are used in our area primarily by the occassional small investor who buys a rental property.

As I have stated before when it comes to residential real estate, analogies to stock markets don't work because stocks are very liquid, stocks can be heavily margined, no real attention is paid to the income or financial situation of the margin borrower, and people don't have to find another stock to buy or rent when they sell stock.

As for masssive defaults, why would we get massive defaults? Most people have 30 year fixed loans, unemployment is low, the economy is chugging along despite the high oil prices, and people are moving into the area on a net basis.

Lenders make sure that borrowers have the income to buy and support the homes that lenders take as collateral. This is a huge, huge difference between the home market and the stock market. Nobody worries about some poor fool who sticks his neck out speculating on margin. Nobody makes sure he can afford it. His stock gets sold within hours if he can't increase his collateral if the market turns against his positions.

As for my education is psychology, I can tell you that I have seen people scaring each other on blogs on the internet before. Remember Y2K?

Fear is very contagious, and you have to fight hard to be objective if you start to catch it.

"Good Night, And Good Luck" is a recent film that shows a public struggle between panic and objectivity, and it was a good flick, too.

Dunn: "Lenders make sure that borrowers have the income to buy and support the homes that lenders take as collateral. This is a huge, huge difference between the home market and the stock market. Nobody worries about some poor fool who sticks his neck out speculating on margin. Nobody makes sure he can afford it."

Yah, that never happens with home loans.

You come here making patronizing yet ironically fallacious arguments, are surprised by the indignant response, and then attribute it all to fear. I can see why you're not working in the field of psychology.

You obviously believe your own bull and nothing we say will make a difference. You'll understand later.

Post a Comment