Affordability Continues Downward Slide

Apparently over at WSU there's a group called the Washington Center for Real Estate Research. Last week they released a report on home sales in the first quarter of 2006 in the state of Washington. Surprise surprise, the report shows that home sales are slowing down in Washington! But as the Associated Press is all too happy to remind us, "prices continued to climb."

There are signs the pace of home sales in Washington is slowing down, but prices continued to climb in the first quarter of 2006, according to the Washington Center for Real Estate Research at Washington State University.The full numbers from the report are available in PDF form directly from the WCRER. In my opinion, the most important bit of the report is the "affordability index," which is described by WCRER as follows:

...

The report is produced in conjuction (sic) with Washington Realtors.

[Center director Glenn] Crellin said the raising of interest rates by the Federal Reserve Board is the main reason for the flat statewide market.

But he cautioned that the market appears flat only in comparison to the superheated housing sales of recent years.

"The market remains very strong," he said, especially compared with the rest of the country.

...

Buying a house continues to become more difficult in Washington.

The Housing Affordability Index – which measures the ability of a middle income family to buy a median price home with a 30-year mortgage – slipped further below 100 in the first quarter.

The statewide rate of 93.3 meant that a typical family had only 93 percent of the income required to buy a median-price home. Buyers in seven counties faced index values below 100, with the problem especially big in San Juan, Jefferson and King counties, which had values ranging from 37.1 to 77.1.

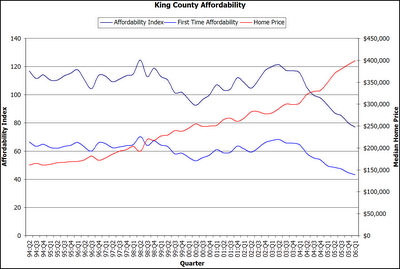

Affordability index measures ability of typical family to make payments on median price resale home assumes 20% down payment. First time buyer affordability assumes a less expensive home, lower downpayment and lower income.A score of 100 means that the "typical family" can afford the median home. Take note that the "first time buyer affordability" rating in King County is just 43 percent. Not that this is particularly new information, I just think it needs to get more press. Seattle has basically become a place where only the rich (or those who already own) can afford to buy a home. Apparently the local press doesn't have a problem with that.

The Affordability Index has never really been all that great for first time homebuyers in King County, hovering between about 60 and 70 from the early nineties through about 2003, but ever since then it's just been tanking. Take a look:I created this graph using the WCRER Build Your Own Report tool, which has data for the Washington housing market going back through 1994. For reference, I have overlaid the median home price (red line). You can see that as soon as the median price started shooting up at an abnormal rate, the affordability index began plummeting.

Rah, rah, real estate!

(Nicholas K. Geranios, Associated Press, 05.16.2006)

25 comments:

I have added this graph and its supporting data to an updated version of my spreadsheet, which is available for download.

Enjoy.

The slowdown here is very apparent. The inventory increased 10.7% from 4/20 to 5/20, but only 4.2% from 3/20 to 4/20 (see Inventory Tracking Blog). Prior to that it was very stable for Feb. and March.

This is a pretty ominous sign since much of the prediction for Seattle I'm sure was based on it's fairly stable inventory while other bubble areas were growing by double digits MOM. Now it seems we may be starting to join them.

Everytime I look at inventory (which is daily) I now notice a continual increase in houses for sale. Therefore, it's clearly beginning to slow down here. If sales fall for May and inventory continues to rise, well then it's only a matter of time till Seattle is on the same trajectory as the rest of the West Coast on a path to bubble hissing (or popping). Either way, double digit growth is not sustainable.

Inventory is definitely on the rise.

King County: 7,556

Seattle: 2,192

On May 1st it was:

King County: 6,977

Seattle: 2,010

Not the huge increases you're seeing in California and Florida. But it's definitely trending upwards. But still far below "normal" for Seattle.

For example: May 2003

King County: 12,295

Seattle: 3,169

Way more houses back in 2003....

Also, it's worth looking back at Sept. 2005

King County: 7,496

Seattle: 2,089

There were almost as many houses for sale back Sept as now. So I don't think we're "tanking" yet...just yoyoing

'm

I've also noticed a marked increase in inventory the past couple weeks. I'm really curious to see what will happen over the next couple of weeks.

It does feel like we are beginning to experience the beginnings of a pile up. Or a marked slow down in sales.

Maybe word is finally getting out to Seattle buyers that the market is turning and they can afford to wait.

There's certainly been a lot of warning lately from the media.

Can't wait to see that affordability index start to climb again.

I'm looking forward to news of Fannie/Freddie and all the foreign backers of our bad loans.

Anybody have news or links to that kind of info?

Wow. Amazing.

Note that the median home price has been trending upward at about $75k per half-decade. True locals will tell you that even that rate of appreciation is nuts (reflecting some frothy gains in the 90s), but for now, let's assume that this is "normal" for King County.

Based on this observation, deviation from normal growth started in late 2003, and has continued until now. In that time, median home prices increased by $100k.

Again, if we assume that the 94-2003 growth rate was "normal," we should then expect that the median King County home is really worth only ~$325k. This implies that a correction of about $75k is in order.

What does $75k work out to? 19 percent.

Again and again, no matter what metric we observe, we see overvaluation of between 20-30%. So tell me again...who doesn't beleive there's a bubble?

And that 19% is conservative.

Over the year, I've seen articles that put Seattle at a low of 26% correction and a high of 46% correction, depending on who was doing the calculations.

In city has appreciated MUCH more than a simple 19% would justify.

FHA loan limits have increased for King/Sno. Counties. This is exactly the kind of crap that will keep the price of RE rising.

There's a blurb about on the Seattle PI RE link.

Isn't that a federal govt. institution? Thanks a lot Fed for encouraging this mess.

The 19% ignores the mortgage product "engineering" that has happened in the current decade. Since these morgages will continue to be available it's difficult for me to believe that the reductions will be so great in the short-term.

Prevcisely why I'd like to get to the bottom of what the heck is going on behind the scenes with these mortgages.

Are Americans going to be floated forever by whoever is backing them up?

I really wish we could get more info and insight on this aspect of the bubble.

It's a really important IMO.

Another thing about the number of listings.

I've noticed that for the past couple weeks it hasn't dropped much after the weekend.

Usually it goes down early week then starts climbing again around Wed.

That pattern may be changing. If it does, that's when the pile up could begin to occur big time.

I think it is important to consider the historical house prices. Check the data:

http://www.housingbubblebust.com/OF

HEO/OFHEO-NorthWest.html

You can see that the nominal YOY price of Seattle homes never went down since 1975. Did we have housing bubbles before? I think one ended around 1980, and another one ended in 1990. What happened after the bubbles? The nominal prices stayed the same for years (or went up a little). I am sure the inventory shot up and sales declined during those periods. But what good does it do to me, a renter, if the nominal prices stayed the same??? So the inflation of wages eventually caught up with the housing prices, and finally people were able to afford a house about 5 years after the end of the bubbles. If the history repeats itself, I, a renter, am already screwed. I would have to wait for my income to catch up with the housing prices, which will happen in about half a decade. Disappointing! to say the least!!!

Let’s say we are expecting 25% correction. As I read WSJ today, they claimed that the inflation is here to stay. Well, let’s say we have a somewhat high inflation of 4% per year. Let’s say house prices stay the same for 5 years or maybe they go down 6% over the period of 5 years. Here we go, now the wage inflation caught up with the house prices. What’s a renter to do? Wait for the house prices to go down some 6% over 5 years? It is not a huge drop.

The above numbers are just illustration, please do not pick on my rough calculation. The main point is that according to OFHEO data nominal prices never went down since 1975. I also checked what the prices did since 1963 – same thing, they just don’t go down in Seattle. Sure, the real prices (adjusted for inflation) do go down. But it does me no good. Please tell me I am wrong or I messed up in a big way somewhere. Otherwise I just feel that I have to be a renter for many more years.

By the way, check the price gain of this bubble. According to OFHEO price data, this bubble is actually smaller than what it was before, much smaller. Thank you.

A score of 100 means that the "typical family" can afford the median home. Take note that the "first time buyer affordability" rating in King County is just 43 percent. Not that this is particularly new information, I just think it needs to get more press. Seattle has basically become a place where only the rich (or those who already own) can afford to buy a home. Apparently the local press doesn't have a problem with that.

That comparism seems a bit off to my eyes. Comparing medium house sold to average income isn't fair. Why?

Housebuying has always been a middle class and higher activity. When you're making minimum wage or thereabouts, you rent, no matter what city you live in. Therefore, the median houseprice is not on the same scale as the average income. The former removes all of the cheap options from the equation but the average income includes their salaries.

Yes this is useful for figuring out how prices are changing based on inflation, but I never had the expectation that someone making the average salary would be able to buy the average house in a major metropolitan region. The fact that has been true (and that the median home price as late as 1997 was under 200k? What other city had that?) skews expectations.

and that the median home price as late as 1997 was under 200k? What other city had that

That's what I get for talking before doing the research. I was wrong on this point. A lot of major cities as late as last year had that.

Yes this is useful for figuring out how prices are changing based on inflation, but I never had the expectation that someone making the average salary would be able to buy the average house in a major metropolitan region.

Uhm...not to put too fine a point on it, zzyzx, but who really cares what your "expectations" are?

Affordability indices aren't perfect, but they're objective metrics that can be calculated easily for historical data. As used here, they're a perfectly valid representation of what's going on in the housing market -- the median home is becoming less and less affordable for the median income family.

The fact that you don't think that the median income family should be able to afford the median home is irrelevant.

My own informal observations on my drive to work from Lake Hills to Microsoft show a pickup in home sales in the last few months. There's been several houses sold on my short commute in the last few weeks. A few were only on the market for a week or two. A couple sold for what I consider laughable prices (4bd/3ba for $535k). Every house that goes up sells, it's just a matter of when, and sellers don't seem to be waiting months like they were late last year.

I meant: According to OFHEO price data, this bubble IN SEATTLE is actually smaller than the previous ones in terms of price acceleration, much smaller.

slowdown, who didn't expect that? bubble? slowdown doesn't attribute to bubble.

House Poor http://www.amazon.com/gp/product/0060873221/qid=1148323470/sr=2-1/ref=pd_bbs_b_2_1/103-3878801-1824661?s=books&v=glance&n=283155

I don't really find this book particularly useful, however I did find an interesting page, which listed the chart of all the housing boom and bust for the last 20+ years in US. It listed Seattle real estate boom for 1978 at 51 percent, and 1990 at 38%, and there has not been any bust according to the chart. All of the busts it has listed have been in California, Alaska and New England area. Whether or not you believe the chart, although the number for appreciation is pretty large for last few years, but 51% and 38% boom are still pretty substantial.

dalas,

It seems that the only course of action for me, a renter, is to wait for my wages to catch up with housing prices, right? My hope of QUICK housing prices crash may not come true in Seattle.

Biliruben,

Thank you for the link, we are looking at the same data

HOUSE PRICE GROWTH PER ANNUM

1976 - 15.0%

1977 - 21.1%

1978 - 30.3%

1979 - 17.1

1980 - 9.5

1981 - 1.0

1982 - 0.7

1983 - 3.0

1984 - 3.4

1985 - 3.4

1986 - 3.1

1987 - 4.9

1988 - 7.0

1989 - 16.3

1990 - 27.1

1991 - 3.1

1992 - 2.1

1993 - 1.8

1994 - 2.7

1995 - 2.4

1996 - 3.2

1997 - 6.1

1998 - 9.5

1999 - 8.5

2000 - 8.2

2001 - 6.7

2002 - 4.8

2003 - 4.2

2004 - 8.9

2005 - 17.1

1976 – 1980 compounded price increase: ~ 133% (~26% per year average)

1986 – 1990 compounded price increase: ~ 71% (~14.2% per year average)

2001 – 2005 compounded price increase: ~ 49% (~9.8% per year average)

1998 – 2005 compounded price increase: ~ 91% (~11.4% per year average)

From my above calculations I see that today’s bubble is the smallest based on the “per year average” price increase. Moreover, today’s Seattle bubble is much smaller by any measure when compared to the 1980 Seattle bubble. After 1980 the nominal prices never crashed. Also, usually one would expect the prices to come down fast if prices went up fast. If today’s Seattle bubble grew since 1998, the one would assume that it may take a very long time for it to deflate, which is probably going to happen via wage inflation with nominal prices slowly decreasing or not decreasing at all. Any way you look at it, bubble theory implies fast price acceleration, 1998-2005 is not fast.

Again, I only see the bad news based on this data to me, a renter. I am screwed, I missed the fast price increase. Doesn’t anybody have better news for renters? I think there are many of us here on this blog.

Biliruben,

Thank you, I also feel sorry for me. I guess there is just too much uncertainty, we may have Japanese style deflation if housing crashes the economy and the Fed will have to lower their rate to zero for a decade trying to recover. On the other hand the history tells us that nominal prices in Seattle do not go down, and since I will pay nominal dollars when buying a house, I do not care about the inflation adjusted value when I sign a contract to buy a house.

If Seattle affordability continues to slide, perhaps Seattleites will consider moving to San Diego. The market there is correcting.

John Talbot Builders, in an effort to get out of SD quickly, is offering condos at 190K- new owners just have to finish the floors.

thank you concerned renter, finally somebody is looking at the number instead of feeding to the frenzy. I guess it's hard to accept nay sayers in a blog like this, but I don't see how everyone agreeing with everything is going to improve anyone's understanding.

Yes Seattle had some huge appreciation in the past, and so far there has not been any bust. If you're all waiting for the first one in the history, I guess what's better time than now?

As far as buying into condos even at "busted" price, it just keeps on reminding me of that post regarding condos in vancouver.

I think the one key factor to realize when talking about percent decline is to understand the perspective to realize why a 10 or 20% decline is really significant.

For example: $500,000 going to $1 million is considered a 100% increase in price, yet $1 million going to $500,000 is only a 50% decline. Therefore, the same amount going down is only half the percent going up. So when they talk of "only" 10 or 20% reduction, remember this perspective.

Also, the bubble will be popped not by normal economic dynamics, but the shear fact that homes are unaffordable to the vast majority of people and currently people are only buying by taking out mortgages that require their left limb and a lifetime commitment of debt (i.e. 50 yr mortgage anyone?). These lending practices are rapidly being zeroed in on by the Fed and the media. You'll soon see pressure to stop the risky lending...once it starts to pop, it can't help but drop to where people can really afford them...and that means with full doc loan and 20% down.

Yes, the lending practices are awful nowadays. Unfortunately, I was too young to pay attention to earlier real estate bubbles. I do remember that Savings & Loan had to be bailed out by the taxpayers (sounds like what this bubble will bring, talking about cycles!). What I was trying to do is to compare the history (price action) and based on that one can make an educated guess as to what will happen in the future. I wish somebody shared more info about the previous bubbles, for example, the lending practices of late 80ies and 70ies, the sales decline and inventory increase right before the price stagnation. It is probably difficult to find the numbers re Seattle area. Either way I thought I’d try. If we had this info we could compare today’s bubble to the previous ones. But housing prices along may be sufficient.

Post a Comment