New Number Crunching: Price Breakdowns

With great thanks to Alan (aka PugetHouse), I have added a new weapon to Seattle Bubble's statistical war chest: price breakdowns.* It is fairly common knowledge that although it is the most convenient indicator to discuss, the median sales price does not give a very complete picture of the changing housing market. Price breakdowns, i.e. how many homes sold each month in a given price range, will hopefully give us some additional understanding about what is really going on with home prices.

All the numbers below refer to closed "residential" sales in King County only. As usual, all the data and charts found in this post have been added to the Seattle Bubble Spreadsheet for your number-crunching pleasure.

The NWMLS breaks the data down into 29 different price brackets, but for ease of viewing, I have lumped the figures into the following five price brackets: 0 - <$250k, $250k - <$350k, $350k - <$500k, $500k - <$750k, & $750k & Up. To start off, here's a chart showing the percentage of total monthly sales that each bracket accounted for from 2005 through last month.

The most dramatic change was in the up to $250k price range, which plummeted from 22.2% of sales in January 2005 (median: $330,000) to a mere 3.8% in October 2006 (median: $440,000). Also worth noting is the approximate doubling of both the $500k - $750k range (from 12.7% to 25.4%) and the $750k & Up range (from 6.3% to 13.8%).

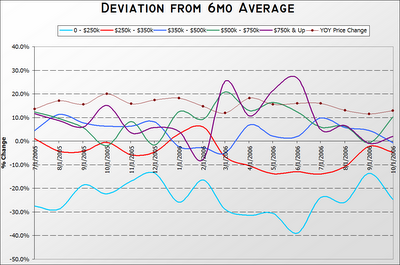

Here is another way of looking at the data:In this chart, I have plotted the percent change of each category's monthly share from its average share over the previous six months. For example, in the six months prior to January 2006, sales of homes in the 0 - $250k range made up 10.7% of all sales, while in January that range accounted for just 7.9% of sales, so the total share of sales for the 0 - $250k range was 25.8% lower in January 2006 than the previous six months. Since theoretically there should be little to no seasonal affects on the price breakdown percentages, I believe that a six-month average is a good way to look at the trend.

As you can see, the $250k - $350k and $350k - $500k price ranges tend to hold relatively steady, not deviating much more than +/- 10% most months. However, the low end (0 - $250k) has been consistently dropping, most months by over 20% of the previous six-month total. Also interesting is the surge in sales of $500k - $750k and $750k & Up during the spring and summer of this year, with the high end breaking the +20% barrier three times.

What does this all mean? Good question. Obviously if all homes were appreciating equally, we would expect to see the percentage of sales in the lower price ranges steadily decline, and the higher price ranges steadily increase. To some degree, that's what we are seeing here. On the other hand, the theory that an unusually large amount of high-end sales might be skewing the median upward certainly seems defensible, given the sustained spike in the upper two brackets since March.

I don't think this particular piece of the puzzle is enough data to draw any strong conclusions, but I definitely find it interesting.

* Although these statistics were gathered via searches of the NWMLS database, I should include the following disclaimer: Statistics not compiled or published by NWMLS.

16 comments:

Very Interesting. Now THAT's a GRAPH worth noting for sure.

A high level of lower price range sales in one month, should push higher price range sales in subsequent months. So they should not move consistently on a monthly basis but in a one following the other pattern.

We watch the first quarter of the year closely with regard to the lowest price, as that pedicts the year. A large percentage of first time buyers, buy shortly after the 1st of the year, after doing their tax return. The second "wave" of condo buyers are older people scaling down and selling their big homes in June and July, moving to condos in August and September.

The graph seems to verify my research in that regard.

Can you confirm that your stats in the under $250,000 category includes condos before I study it further?

Actually, the turquoise line going down like that, reflects the fact that there are fewer properties in the under $250,000 category. Not because of fewer people buying, but because many had to spend more to get the same thing as time progressed.

So the red line is more reflective of the trend, than the turquoise line, and combining those two categories will give you a less skewed result.

Excellent data.

Am I wrong to believe that to determine whether high end sales are skewing median sales prices upward due to increased sales activity relative to the lower end of the market, one would have to do a comparison to asking prices relative to the data you presented here? That way you could determine whether increases in median sales prices are due to overall market appreciation or not, right?

What I mean is if there are fewer houses for sale at the lower end of the market and more houses for sale at the upper end of the market with sales simulating that trend, that would definitely indicate overall appreciation, right?

Am I making any sense? I think I am confusing myself.

A large percentage of first time buyers, buy shortly after the 1st of the year, after doing their tax return. The second "wave" of condo buyers are older people scaling down and selling their big homes in June and July, moving to condos in August and September.

Is there any number associated with your "large percentage" number-wag or is this anecdotal...

The reason I ask is because it seems the local RE press base most of its causality on anecdotal statistics, i.e. the condo market's boom due to 'empty nesters' and 'young professionals'... when I read stats like that I'm thinking okay... maybe, but what about out-of-state specuvestors? what about people buying condo's just to rent them out? etcetera and so on...

I'd say 1st time buyers are more at the whims of what exotic-mortgage products being are being rolled out due to a change in interest-rates than whether or not they have an extra 1K laying around to attempt to buy a house with.

Ardell,

As I said in the post, all the numbers refer to closed "residential" sales in King County only. As in, not "res + condo," but just "res."

Tim,

A townhome on the Seattle side of King County will show as "residential" and an equivalent townhome on the Eastside will show as "condo".

By eliminating condos, and why you do that I do not know, You render all of the stats and info gleaned from the facts, skewed and irrevlevant.

If you are not counting the Generation X buyer who has no interest in mowing lawns EVER and is buying a $650,000 condo as his RESIDENCE, then the numbers are all bogus.

Why do you do that? Why do you count the family that buys a $650,000 SFR and not the one who buys a $650,000 condo? Why are they not equal in your eyes?

If you are going to tell people that "sales" are down...count all of the sales...not just the ones that you deem "worthy" of consideration.

Grivetti,

I've run the numbers for many years in different places, and they fall that way in the lowest price tier. I just checked it about six weeks ago and compared it to the study I did on the East Coast back in 1993...results the same.

Usually the spike is March or April and then again in July August if I isolate lower price range condos from single family homes. Never a straight monthly average without these two "spike" periods.

Good for sellers to know more than buyers. Waiting until May when selling a condo, can be the worst thing you can do as a seller of a low priced condo. A large number of sales for the whole year are completed by end of April and not 4/12 of the sales for the year.

Why do you do that? Why do you count the family that buys a $650,000 SFR and not the one who buys a $650,000 condo? Why are they not equal in your eyes?

Regardless of The Tim's exact reasons for the showing only SFR, I think that by pulling out only the SFR one gains an added dimension to the irresolvable 'median' question. For starters, I think the SFR speaks to the whole health of the Seattle housing market because it speaks to the 'limited land' arguement much trumpeted by the RE industry in this town.

Condos are a different animal altogether, they decouple the land v. price quotient where the SFR ties itself directly to it....

ergo, if things are shifting with regard to the SFR we can cull what contributing factors are adding to the housing boom/bubble in our fair city.... e.g. alleged Robust Jobs/Immigrants/ain't makin' more land/Boomer retirees vs. Suicide Lonas/Loos lending standards/Psychology.

and as for your arguement 'Gen-X'ers don't like mowing lawns', again anecdotal nonesense that contributes nothing to the numerical analysis presented by The Tim. Why buy a condo when you can claim your own 4-walls... this is not a generational trait.

Usually the spike is March or April and then again in July August if I isolate lower price range condos from single family homes. Never a straight monthly average without these two "spike" periods.

Again, not a casual arguement tied to a demographic group. Price spikes could be a result of confluence of many contributing factors convolved over an integral period, but unless you tie this to a statistical survey taken for 'reasons you're buying condo/house in Spring/Summer' on a sampling of age binned homebuyers, the 'wag' with regard to inocme tax refunds occuring at specific times or older people going from house to condo is mere speculation

Its a logical fallacy...

Ardell,

Nearly all King County numbers that I quote, refer to, or present charts of on this site refer to the NWMLS "residential" (SFH) category. I choose to present this particular dataset for the following reasons:

1) SFH prices tend to be less volatile than condo prices.

Since 2001, the YOY change in SFH median price has ranged from 0.35% (Mar-01) to 20.00% (Oct-05), a total spread of just under 20 points. Condos: -5.21% (Aug-02) to 22.08% (Jul-06), a total spread of over 27 points. The maximum month-to-month change in the SFH YOY figure was a 6.32 point drop (April to May '01), with 10 months experiencing a greater than 5 point change from the previous month. Condos: a 21.54 point jump (Dec-01 to Jan-02), with 19 months experiencing a greater than 5 point change.

2) Consistently quoting SFH figures provides an easy comparison.

The monthly reports in the newspaper often seem to cherry-pick whatever statistic supports the "angle" that they chose to take for the story. By picking one dataset and sticking with it, I feel that I provide the readers with a better baseline for what's really going on.

3) Frankly, I'm just more interested in SFH's.

I make no value judgments regarding any person's choice of whether to buy a condo or a SFH, but for me personally, I'm just not all that interested in condos. That is not to say that a condo buyer and a SFH buyer are "not equal in [my] eyes," or that condo purchases aren't "worthy," just that what goes on in the condo market doesn't interest me as much. That being said, I do have a number of charts of the condo numbers in the Seattle Bubble Spreadsheet, which is always available to anyone who bothers to click the link on the sidebar.

If you believe that the statistics and charts I am providing are "skewed," "irrevlevant," (?) and "bogus," because I'm not including condos, then obviously that's your prerogative. However, you have said in the past that you feel any county-wide statistics are useless and tell us "both everything and nothing," so I rather doubt that including condos in my charts would satisfy your concerns.

I'm honestly not trying to be rude, but I can't help but get the feeling that you're grasping at straws for reasons to dismiss my data-driven analyses. But maybe that's just me.

By eliminating condos, and why you do that I do not know, You render all of the stats and info gleaned from the facts, skewed and irrevlevant.

Pay attention, Ardell: condos sell at different mean and median prices, and generally represent a more volatile market than single-family homes. Didn't they teach you this at Realtor School?

Another thing...as someone who has never heard a logical fallacy that she didn't repeat, you should probably ease up on your use of words like "skewed" and "irrelevant," mmkay?

Oh and by the way, your comments about certain things happening consistently in certain quarters doesn't make any sense to me with respect to these graphs.

The March '06 spike that I referred to did not occur in March '05 (or April, or May), so I don't see how it can have anything to do with your theory about certain buyers purchasing during certain times of the year.

Ardell:

"the turquoise line going down like that, reflects the fact that there are fewer properties in the under $250,000 category."

No it doesn't. It indicates that proportionally fewer sales were made for prices below $250,000 over time.

"Not because of fewer people buying, but because many had to spend more to get the same thing as time progressed.

Maybe, maybe not. That's what Tim was talking about at the end of his post -- it's impossible to know from this data alone whether or not the decline in sub-$250,000 sales reflects a lack of supply, or lull in demand.

Coupling this data with listing prices from the same period would help to resolve that question. So would a consideration of sales price/sq.ft.

"So the red line is more reflective of the trend, than the turquoise line, and combining those two categories will give you a less skewed result."

No. They'll give you a line that reflects the sales of all properties below $350,000. Nothing more, nothing less.

2006 YTD: <$250,000

4,101 condos sold; 1,407 SFR

74% of the closed real estate transactions were condo sales.

grivetti,

I like your analysis about 1st-timers being dependent upon money supply. It's definitely worth investigating, even though it's heresay at this point. Let's not be too hard on Ardell. I usually learn from her posts, even if it entails lots of work to validate her statements (or otherwise).

billiruben,

What I would find useful is using inventory as the denominator within each group.

Great idea. We can easily run with that one on extant data.

The Tim,

I would like to both thank you and apologize for my comments on this post.

By "arguing" with you I figured out how to do my own stats better. It has helped me tremendously.

By definition, my head needs to be more "up my butt" than yours, as this is my business. Forget what I said about condos and spikes and people filing their taxes, blah, blah, blah. Here's where it's really at, for me and me alone.

Largest market segment for Kirkland, Bellevue and Redmond is the condo market up to $500,000. 1,819 sales with 18 median days on market. The condo market drops off significantly to only 271 total sales above $500,000.

The second largest market segment for Kirkland, Bellevue and Redmond single family residences from $400,000 to $600,000 with 1,301 total sales with 17 median days on market. The market drops off significantly after that with 699 between $400.000 and $500,000, 602 between $500,000 and $600,000 and 393 from $600,000 to $700,000, 297 between $700,000 and $800,000, then in $100,000 drops to 216, 120, 75, 59 etc...

More significantly for me in the SFR stats is that median days on market increases significantly after $600,000. Up to $600,000, median days on market is between 16 and 19. After $600,000 it increases to 25 to 42.

Some very interesting stats at the high end when I separate Bellevue, from Redmond, from Kirkland. Bellevue is the clear winner by far in both market segments.

My frustration. misdirected at you for eliminating condos from your stats, was simply my inner voice telling me that I, personally, cannot do that. Too much of the market I follow involves condo sales. So by arguing with you and testing "my truth", I found my focus for 2007.

Thank you again, and my sincere apologies. I was yelling at myself :-)and it worked.

Post a Comment