April: Inventory Up, Pending Sales Down

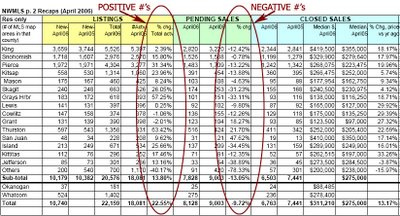

Breaking News: April NWMLS numbers released: King County Median home price surges to $419,500, Listings up 2%, Pending Sales down 12.5% from April '05.

Get ready for the enthusiastic stories from all the usual suspects cheering on the huge price gains and proclaiming that the idea of a bubble in Seattle has been once and for all dispelled. I also predict that they will completely ignore the following fact:

(NWMLS, 05.05.2006)

39 comments:

I just saw this..so I'll repost here:

Looks like another record month in Seattle:

Median Price up 16.56% to 410K

Inventory down 4.18%

Pending sales down 9.42%

Price Drop and Dukes had been reporting all month that most houses were being severely underbid. But the MLS #s tell us the prices are going up.

Do you think NWMLS is actually manipulating the #s to fool us? What a scandal that would be...

Price drop...you're tracking Laurelhust, right?

That is area 710 on the MLS data. The data shows a 7.37% median price increase and a 1.17% increase in pending sales. You had mentioned your research was indicating a lot of underbidding.

DO you think this is some sort fluke...a dead cat bounce or something?

Hey Tim...how do you get the residence only #s? The links you posted only have the combined residence and condo #s. But I see the image you posted has the residence only #s.

'm

The PDF has 3 pages. Page 1 is Res + Condo, page 2 is Res Only, page 3 is Condo Only.

I see...I was looking at the "breakouts" which is only 1 page.

One more question....do they have the "breakouts" in a residence only format?

thanks!

'm

So far as I know, they only provide that one page of breakouts (publicly, anyway). You can see their release with links to the general stats, KC breakouts and SnoHo breakouts here.

Why is the condo market so hot?

This data is puzzling....prices up, sales down, inventory up....bizarre. Even more so, when you consider that the condo market seems to be bucking the greater trends.

If the RE market is declining, wouldn't you expect that condos would lead the way?

Check out the first sentence of the news release: “I assure you we would have more sales if we had more inventory,” proclaimed Mike Skahen, a board member of the Northwest Multiple Listing Service in reaction to April results.

Umm...you did have more inventory than March, but sales were still down. Am I missing something here?

Regarding inventory...we are so far below normal #s for King country right now.

King County inventory was down 1.05% last month (6,802). If you go back to April 2004 there were 9,562 houses for sale. In 2003 there were 11,855 for sale!

So 6,802 houses for sale is really tight....if that # doubles we'll still have a historically healthy market.

In April 2003, when there were 11,855 houses for sale there were 3,454 pending sales.

April 2006 had only 6,802 houses for sale and had 3,827 pending sales!

Way less houses and more sales then two years ago.....tells you how far down we have to go before we get real price cuts. Keep in mind back in 2003 a lot of people were saying there was a bubble and not to buy. But people in King country who bought in 2003 (median price 267K) have on average had 110K appreciation on their house (current median is 377K).

I'm quoting the combined residential and condo sales here...

People are still holding on to their properties until the last minute...

It's a game of DARE... you need guts of steel to survive this one... already zip shows homes being discounted... and staying on the market more than 30 days despite being well priced according to zillow.

True there may still be some money to be made, but it could all come crashing down in the blink of an eye...

The data suggests one thing alone... the true buyer who intends to find a home (not an investment) is taking his time choosing wisely... he will hold off his purchase until early fall knowing that the summer peak will end with a drop in prices...

Once we see 2 or 3 reports of successive declines, then the gates will open... it's a matter of when...

I foresee late August as the break point... the summer buying spree will almost be over and those with remaining properties will become desperate knowing that the winter will drop prices (and the carrying cost of another 6 mos will kill their profits)...

I'm a home buyer and I'm not buying till September!

Tim-

Thankyou for the graph- love seeing that stuff.

Question: when they report median price increases, is that based on sales price or asking price?

Meshugy, Laurelhurst, Broadview, etc. are all in the 710 area. That is one of the 3 areas that the Seattle Times reported as experiencing a YOY median drop in March. And, that follows exactly what my checks on SOLD (not asking) price showed in the county tax records for homes sold in Jan, Feb, and March '06. Overwhelmingly, they sold below asking.

So if the median SOLD price in that area is up now, then yeah it's either a dead cat bounce or appreciation is taking off again.

Another interesting thing about my tracking experience: last winter, I could go to the tax site every few weeks and find a pile houses that had sold. So it was worth my while to keep checking.

Starting about a month ago, half of what I plug in doesn't even show up (taken off the MLS but not sold?) so it's starting to feel like a waste of time.

I'm gonna keep checking, just not as regularly.

This is a double post(from the next blog)... it think it is more appropriate for this thread... so I'm copying it over..

-----------

One problem with using the median is that it's very dependent on the kind of homes being put on the market...

it doesn't explain square feet or age of home... just price..

One factor to look at is that as the market cools and corrects the highest hit are usually the luxury homes and more expensive units... so they're likely to hit the market first...

It may simply be that the people selling are the ones with pricier homes, thus driving the median up..

It's very deceiving without knowing all the data...

say for example 100 homes are on the market and the median is valued at 500K... that means there are 50 homes that are sold for less than 500k...

Say for example 10 of the homes under 500K decide not to put their homes on the market... and 10 homes above 500K go on the market...

The median goes up by a factor.. since the previous 60th most expensive home suddenly becomes the median (due to the previous median dropping down to the 40th most expensive home in the list)...

So even with price cuts the median could still go up... simply as a result of the quality of homes on the market

What would be intersting is to peg the data on a fixed entity say a 2000sf home on a 10000sf lot built after 2000... I would expect more fluctuations from that data... and it would reflect real market conditions...

Anon 2:29

Zip has been showing price reductions in Seattle since last Fall. For a couple of months last winter, 30% of the lists for given zips were in "price reduced category".

This month, the percentages of "price reduced have been fewer in most places.

However, there's been some manipulation in that. For a couple of months, homes have been routinely de-listed then back on market with a reduced price and new MLS#.

So those homes do not show up on the reduced price list, although they should.

Yeah, I would definitely wait til Fall '06 at LEAST before buying in to this market.

Hi Price drop...do you have a link to that article?

If you look at the March MLS records it shows a 15.15% YOY gain for the 710 area.

The MLS data is all based on what houses sold for....which is going up a lot, not down YOY in Laurelhurst.

Incidentally, only one area in all of King country had a drop in YOY prices in April..that is area 520 (Bellevue). That area had a 30% drop in March....but in Feb. it had 60% gain and in Jan. had a 30% gain. So it seems that is fluctuates widely...probably all those huge million dollar mansions on the water. I think Bill Gates (the richest man in the world) lives in 520.

One problem with using the median is that it's very dependent on the kind of homes being put on the market...

That, and new construction tends to push up the prices due to the 4:1 house to land price ratio the banks like to lend for on new construction.

If land values go up 10%, the price of the home built on that land will go up by 4 times the increase in land.

A $100K lot would have had a $400K home built on it. But at $110K, it has a $440K home built.

A $10K jump in the lot price pushes the total house price up by $50K.

Meshugy-

I read it in the Sunday April 19 Seattle Times RE section.

You'll have to go to their site and pull it up.

But here's the numbers again:

area 700: -0.2

area 380: -4.1

area 520: -30.5

I never said the median for area 710 went down. I said that homes (widly inflated to begin with) were selling well under asking.

Area 710 has been selling homes for 2 to 3 times what they sold for in late '04. There are tons of million dollar properties up there that sold for 400K in '04. Even if most of them sit for upwards of 6 months (which they do), if just a few sell (and some do) it's going to skew the median UPWARDS.

With price inflation like that, it's going to be while before things move into the strictly negative territory YOY.

However! For March, the 710 median was UP 15.2%, so if it is at 7.34% this month as you say, then it's beginning to move down there also.

Thanks for pointing that out! Who knows, maybe by next month we can shave that sucker down again by half to 3.5%!

Sorry Meshugy-

Too quick in my reply here. You're mentioning 710 as decreasing confused me for a sec. It was 700 that decreased, not 710. Check Seattle Times. 710 was UP March 15.2%, now up only 7.37%.

I think a brief sharp rise in median price will be a precursor to a slowdown, although there is no evidence that the current spike is that precursor. In particular, once affordability finally gets too high, the bottom end of the market will slow first, which will bias the mix of sales towards the higher end. This will be especially true if impatient “move-uppers” buy their new house before selling their old ones (to first-time buyers than can no longer afford them). If we could get a decent measure of DOM for different price ranges, we could watch for relative increases in DOM for the lower quartile. Another crude indicator could be the HousingTracker data showing a relative “distancing” of the 25th percentile price away from the median – but it would be hard to tell.

Another reason for this pattern is that according to a study a while back (I think it was Schiller), a strong majority of buyers will buy at their target (maximum these days) price range, even if prices fall. This means that they will by more house for the same price rather than the same house for a lower price. Consequently, even once prices genuinely start dropping, the median will stay high for some time because of this change in housing mix.

lesser seattle:

I agree, the median is a better tool than the mean..

I am merely pointing out to people who are not familiar, that the median can easily be skewed by the quality of homes sold and not necessarily reflect the value of homes on the market...

My post was trying to explain why despite price cuts, the median is going up... with sales volume as low as they are, the median is very sensitive...

if the number of homes sold was 10x as much, the median would be rock solid and more predictive of trend...

The idea of tracking a particular subsegment of the market ie 2000sf homes is merely a tool to show to the disbelievers that the bubble is deflating...

Lesser Seattle-

Exactly. Median Price is a really fudgy way to judge things that really gives no concrete info to speak of as one million dollar sale, or lack of will totally skew the numbers for that month.

This is a super obvious fact.

But since that's what the RE industry uses to judge the market, we keep looking at it.

It also might bear some mentioning when the numbers finally turn negative after yers of only positive, as happened in Seattle last month.

Also, there are probably those times, when the market is very settled (haven't seen THAT in several years) when it could be somewhat useful.

for those that read the entire article, you have to love the writing skills of their spin doctor...

1. buyers shouldn't drag their feet... (that's exactly what I'm doing)

2. We need more properties to sell so prices can go up more (???)

3. There's a shortage of land...

4. Builders aren't building (but new homes were on the market...?)

5. Price will continue to rise.. it won't stop...

Pending sales are down... people are not buying, they're waiting... the amount of spin they've put in that article just suggests that times must be getting more desperate...

only time will tell...

Ultimately, these month to month increases will be completely irrelevant as the rest of the country tanks. Seattle won't hold up as a beacon of rising housing value when the prices are tanking in all the other major metro coastal areas.

I've noticed a huge increase in inventory over just the past week. Also, I've seen hundreds of mortgage agents fired as well as 30% less earnings at Amazon and a weak quarter for Microsoft. In the end, this place is subject to the larger economic forces that the rest of the world is...and currently, the rest of the world is waking up to a huge, huge bubble...look at China, Europe, Australia, etc. they're all beginning to implode. We're due for a very painful correction.

Sit tight and wait out this bubble. These prices won't last.

As Tim and others pointed out, MOM growing inventory and declining pending sales would indicate that the market is slowly softening. If that trend continues, I'd say in about 2 years you might start to see real reductions in price. Right now the median price is still going up at a feverish pace...

For example, Ballard (where I live) had a median price of $407K in March. In April it was $422K! On average, most Ballardites homes appreciated 15K in one month. That's just nuts...and other Seattle neighborhood appreciated even faster.

Also, notice that inventory in King County went down -1.05% and Seattle's inventory went down -4.18%. In fact that's been happening for the last three months.

Jan YOY Inventory

King County: -13.14%

Seattle: -5.32%

Feb YOY Inventory

King County: -6.42%

Seattle: -9.45%

March YOY Inventory

King County: -6.26%

Seattle: -5.53%

So we have lower inventory then last year...which was probably the tightest market in history. I just don't see how we could see any sort real reductions in price until there are at least twice as many homes for sale.

Damn, meshugy, don't you have some 6 figure job you need to get back to as opposed to posting and bragging on this blog about the pot of gold you've discovered under your dingy ballard craftsman?... I'm assuming its 6 figures because, you'd have to have been nuts to buy a house in Ballard last year unless you're leveraged to the hilt.

Or maybe I should just refere to you as 'meshuga'

They are already VERY nervous in Seattle.

Anyone see 20/20 last night?

It was a pretty brutal show on the careening housing market.

So bad in fact that KOMO 4 11 PM news felt it had to do a segment on the "still red hot (!!??) Seattle market".

The KOMO segment was blatant lies. Who is paying their bills anyway?

Tim, new PI/Times April numbers article's out

Seattle future homebuyers must be getting dizzy!

Headlines continually contradict economy and housing. Who's fibbing?

-----------

1) Saturday's Seattle Times Business Section headline:

"Roaring Job Growth Slows"

Front page Sea. Times, "Even high-end homes get snatched up quickly."

(Um, yeah,to lock in low rates before they rise more...see 10Yr Bond activity Last week)

2) Mike Skahen (Lake & Co Real Estate Broker/owner/NWMLS Director):

From today's Everett Herald Busines Section, Skahen remarks, "I think fears of a bubble in Seattle have vanished with recent news about our strong economy and above average rates of appreciation."

(um, did Mike know the Times was going to run an article contradicting that statement?)

Meanwhile....

3) Merit Financial of Kirkland, Wa. lets go over 300 staff as Department of Financial Institutions steps in. CFO remarks filing bankruptcy due to misteps and that refinancing has 'slowed.'

4) Consumer spending drops to lowest level in four months according to the Federal Reserve. (Everett Herald Business, Sat. May 6,2006 & Seattle Times Bus. Section)

5) "Job Picture suggests growth is moderating" - AP story Everett Herald, Sat. May 5, 2006)

6) Job picture slows, so DOW takes off to close the week with major gains, anticipating the FED will not raise interest rates at the next meeting.

Strange how job growth moderates,consumer spending decreases, interest rates rise, the DOW takes off and King/Snohomish median prices attain all-time highs as inventory slowly rises, overall sales slow, pending sales slow--and this is May, not early-mid December, when real estate is seasonably slow.

It's like Bagdad Bob :"The Americans are not here, everything's under control...as US GI's walk behind him, small arms fire overheard in the background and M-1 Abrams tear down Sadaam's Statue."

I am LMAO.

FB Alert:

This property has been on my list for months now. Nice looking place on University View and 48th that has gone on and off the MLS, changed pictures, etc. the whole bit.

It came on the market in Jan (or maybe before, who knows):

MLS# 26040592....689,500

March 21:

DOM roll back to "1", price reduced to 649K

April 15:

presented AGAIN as "New on Market!!"

new MLS#: 26055050

price reduced to 639,990

It's off list again, so I looked it up to see if it sold and for how much.

It's not in the tax records as sold yet for '06.

But it sold in July '05 for 637,500.

Can't even squeeze a $2,500 profit out of this one. Paid more than that in property taxes and insurance, never mind the mortgage.

I'm starting to wonder if maybe these props that go on and off and change MLS#'s are in this FB situation in general. Like that's a sign of desperation.

Because some are cool calm and collected and let the props sit for 200 days with same MLS#. While others start within a month to monkey around, changing #, pictures, etc. to keep property looking "Fresh!" and "New on Market!"

BTW: I believe this is the same general neighborhood that KOMO hghlighted last night as RED HOT.

Yes, that was a trully disgusting broadcast. It's clear they are not a professional news organization.

inventory is creeping up, but not as fast as some of the other markets such as SoCal/Phx/Vegas. My thought is simply Seattle will go thru the cycle later than those other markets.

Would love to see some data on prior inventory record, both for high and low. If anyone knows, pls post here and on my blog. Thanks.

Bubble Markets Inventory Tracking

Don't expect any balanced news coverage of these NWMLS numbers from the local media, especially the Times. I'm sure Ms. Rhodes will have a glowing article tommorrow or Monday in the Times which focuses on the YOY price gains rather than the rising inventory (especially in the South Sound). A 31% YOY increase in SFH inventory in Pierce Co., along with significant declines in YOY closeds and pendings indicates the makings of a serious market slowdown there (a lot more houses and fewer buyers). My sense is that working- and middle class families in the area looking to buy their first home have largely given up even trying to start looking with prices as ridiculously high as they are now (who wants to pay $275,000 for a 2 bedroom house in a crack neighborhood in Skyway or South Park with interest rates rising). The only "motivated buyers" right now are the hipsters and DINKs who are bidding up houses in trendy central city neighborhoods because "real estate always goes up." Regular folks outside of the central core are getting hit hard with gas prices possibly permanently spiking and without this demographic buying anything the market cannot stay propped up for long.

Mr. B

Would love to see some data on prior inventory record, both for high and low. If anyone knows, pls post here and on my blog. Thanks.

Hi OC,

First, thanks for your great site! Keep up the good work.

You can get historical inventory data from the mls records. Tim posted links here:

NWMLS King County Breakouts

It looks like a normal amount of inventory for Seattle is about 3,000 houses for sale. If you look at the April 2003 records you'll see that. We have only about half that number for sale right now...

'm

Hi anon 9:15

I wish I had a craftsman...maybe someday. I also wish I made 6 figures...I'm a professional jazz guitarist. Do OK, but I'm not getting rich doing it.

Actually one reason I really don't want prices to go up much more is because it will really change Ballard. Right now it has a lot of artistically minded folks like me...if it gets too expensive it'll be all lawyers and computer people. I have nothing against them...but I don't relate to their lifestyle.

'm

The MLS reports, especially the breakout reports are interesting. I'd like to look at the numbers differently from they way they do.

Specifically, I want to trend thier summary data on a month-to-month and county/mls map area specfic basis for a more granular perspective. So far I've found no resource that does this for the Seattle area.

Thier reports are in PDF format - which makes it quite tedious to manipulate the data. Does anyone know if/how/where to access their raw numbers?

Thanks,

~pete

Pete-

Dukes may be able to help you with this. Let's hope he gets the message.

Are you out there Dukes?! We need you!

I inherited money in 2004, just enough to not be able to waltz into the Seattle market and just late enough to not be able to buy what I was looking at the previous five years. Its been crushing dealing with this market, but I am an active looker, and I'm waiting at least until fall or winter, because I've seen better priced stuff at that time of year. I've been looking a lot at south seattle, what with the train coming, it's been appreciating, although parts of it really do remain truly lame and I expect will depreciate back to garbage if this market does actually break. Looking again at say Interbay, there are lots of homes for sale, but all over 400k. Hope thats a sign that something will come down eventually. Of course, the real crush is gonna happen when the boomers cash in for their retirement, and, if this thing keeps unravelling, like its defeinitely doing elsewhere, all I can do is hope for a panic. Of course, that will destroy the job market and value of my parents home, but up here down there.

I'm pretty tired of this topic, but its just not worth signing up for $3000 a month, just isnt. Also, as an apt dweller, the thought of nobody living past the next wall is very appealing, so house all the way.

I hear ya Mr Wallace. also have a big downpayment but not worth it to spend in this market.

I fully expect it to crash by fall/winter. '05 and '04 gains right off the top. then continue down from there.

lender layoffs, lying media, the USD in general, interest rates. It's gonna happen.

Good luck

It takes half a brain to conclude why MLS/Real estate agents would spin the statistics (higher prices=>higher commission, misinformed/scared buyers keep the market activity) – they are targeting perception, not reality.

if one relies on MLS/RA statistics as real technical economic analysis is a complete fool (imagine a car salesperson talking down his/her product). There was an article recently saying that realtors in Florida were inflating the sales price when reporting sales to mls since county real sales value takes 'a while' to be processed. Also, omission is not strictly ‘lying’. There are contradictions in some of the reports, anyone with basic statistics knowledge and raw data can tell (here is the problem, since they ‘produce’ the data).

Now, the question is: are realtors liable for spinning stats in order to influence market forces (the self fulfilling prophecy thing...). Is there any legal device to make them more trustworthy? A class action? SEC?

For those who are looking, I think John L Scott lists more cheap properties than Windermere. Areas I've been watching for two years or so are stagnating, and this is a peak time of year. Houses over 300k in the south end are sitting, unless they're exceptional. Wonder what kind of offers the ones that sell are taking. From my (tired) realtor, I note that anything under 250k seems to go rapidly, and others linger. I just saw some stupid stuff today, like 800k for a new townhome near discovery park, and 165k for a houseboat with unmentioned sq ft, prob 300 or so.

I can buy a cruiseahome with more sq ft than that for 50k and travel the area, so bite me. Fed Way is cheap relatively, but its gonna be the next tacoma when things turn anyway, so not....LOTs of auburn, kent and bremerton cheap. Of course, they always were dumps. Where are all the newspaper articles telling us to buy there because its the next thing and the only places left? Homesellers, can you feel the buyer's wrath? Its the wave coming...I hear pins dropping...

I know, it's eerie quiet isn't it?

that's exactly the feeling I get when I look at the MLS list everyday- no movement. It's been happening for about 2 weeks now.

Post a Comment