Google Trending The Housing Bubble

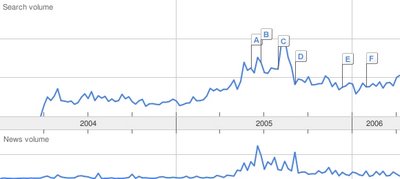

Google just released an interesting new feature yesterday: Google Trends. One of the interesting features of Google Trends is that it gives you a list of the top ten cities that have searched the most for whatever terms you put in. Obviously, I decided to try it out with the search term "housing bubble." Here is the resulting graph:

Not surprisingly, interest in a housing bubble seems to have peaked late summer of last year, around the same time that the housing bubble was getting the most news coverage. Also not surprisingly, Seattle doesn't appear in the top ten list of cities searching for "housing bubble" online. Here's the top ten list, as of today:- Santa Clara, CA

- Pleasanton, CA

- San Jose, CA

- Rancho Santa Margarita, CA

- San Diego, CA

- San Francisco, CA

- Irvine, CA

- Reston, VA

- Washington, DC

- Sacramento, CA

Unfortunately Google Trends only provides the top 10 so we don't have any way of knowing how far down the list Seattle would have come in. I suspect it would have been pretty low. I get the general impression that the thought of a housing bubble hasn't even crossed the minds of most people in our area.

In other Google-related news, does anyone else find it strange that this blog comes in as the #1 result for the search "Seattle bubble" on MSN Search and Yahoo Search, but isn't even in the top 100 on Google? What's with that? I don't know how much good it will do, but Google does provide a quality feedback form that you can complain on if like me, you think that's somewhat bogus.

(Google, 05.10.2006)

38 comments:

Google "ages" sites alot more than the other 2 engines.

A site I launched a few months ago is in the top 10 in Yahoo and MSN, but isn't even in the top 300 for Google.

Public statement: there is no bubble and housing always goes up. I'm not worried.

Private thoughts: WTF? Is this going to burst? I'm totally screwed if it does.

The more I read on the housing bubble, the more binary I think it is. One day, it will just end, and there won't be a buyer in sight, at any price.

When California inverts, the PNW will just die. All the spin and denial that Seattle's best can muster won't save us.

It's too bad that graph is not of percentages as I would think higher populations centers will result in more "housing bubble" searches. No?

In the late 80's there was a lot more animosity directed towards Californians moving into the area and pushing up housing prices.

What's different this time? Not as many? Or is it because more people are benefitting from the equity increase this time via cash-outs and HELOCS?

It's that they are benefitting from the last equity-rich CA fools.

Sheesh. You'd think people would be a bit more careful with their money- no matter how much they've got.

I guess that's the difference between a true millionare and an idiot whose bound and determined to pi$$ it all away.

The dollar's going so low that Russia is repatriating back to rubbles (!!??) and China and India are converting some of their dollars into RUBLES.

Haven't rubles been like the joke currency of the century?

"because more people are benefitting from the equity increase this time via cash-outs and HELOCS? "

I think you are onto something. If 55% of PNW jobs are in the REIC, and a healthy chunk of new residents are from California, and we all know they are floating the housing market, then people might not want to bite the hand that feeds them.

When I talk to BI RE agents, they consistently say 3/5 of the home sales are to out-of-state buyers, and the majority are from California.

RE talk:

Gold Mine: X-Cal with 6 figures of equity.

Diamond Mine: X-Cal with 7 figures to spend.

Look up 7 figure asking prices on BI. Back in '02, there were only two 7 figure houses on the MLS.

"Haven't rubles been like the joke currency of the century? "

Yeah, last century.

very cool. :-)

Interesting that Sacramento is # 10 and Phoenix not even on the list, nor Miami.

It almost looks like the worse the inventory, the more the denial.

If you Google Search

"become a real estate agent"

Seattle ranks...

(drumroll please)

#1

Thank you. Thankyavuhrymush...

Maybe people aren't searching the "housing bubble" idea because they don't believe it any more. The Seattle Times has been predicting a crash for years, at least for 5 years. In those 5 years, home prices doubled around here.ce

Google:

site:seattletimes.nwsource.com "housing bubble"

You'll see what I mean.

Are you kidding me, Mr. Dunn?

Okay, I did the Google search you suggested. Here are some quotes from the top ten results that are actually original Seattle Times content (not reprinted stories from other news sources or letters to the editor):

#1 & #4 - "Loan regulators discount fears of housing bubble"

#2 - "Housing bubble won't go splat, say analysts"

#5 - "Forbes rated Seattle the most overpriced...But various economists, local and otherwise, aren't buying it."

Oh yeah, it sure sounds to me like they're predicting a crash, all right.

Especially like the one about LOAN regulators discounting the bubble, what with Merit, Ameriquest and WAMU troubles.

I see lots of people are still denying the bubble exists, even though its patently obvious elsewhere. I guess we'll find out. Maybe the dollar and Re will go down as the world tells us to take a hike depite our consumers. They'll still get tanked, but once they get through it, we'll be all alone.

I know, doesnt seem possible. Lots of advisors are saying get into any other currency than the dollar though.

When people start buying rubles, it's time to sit up and take notice.

Yes, I agree that the Seattle Times has been more upbeat lately. But, more thorough scholarship turns up the following: All quotes from the Seattle Times (and let us not forget, the Times is picking what letters to print:)

Last December-

And this brings us to the housing bubble. Rising house prices, fed by low interest rates, have helped keep this economy going. That party's closing down.

Last October-

Craig Wolynez is the kind of homeowner stoking fears about a housing bubble.

Even though he had no steady income, the 33-year-old computer consultant and his wife were able to buy a $416,000 house in Los Angeles' San Fernando Valley two years ago using an interest-only mortgage that guarantees low monthly payments for the first five years.

A letter in July-

Everyone talks about wealth transfers with social security and medicare, but who is going to keep the housing bubble inflated?

Last June-

But homeowners should prepare for the worst. They could get burned if the market switches gears, just as stock investors did.

(Back to 2004)

Such a gap, the economist and New York Times columnist Paul Krugman has written, suggests ‘that people are now buying houses for speculation rather than merely for shelter,’ evidence that he called a ‘compelling case’ for a housing bubble.

(Now let's jump back to 2000)

Then there's the matter of a real-estate bubble.

Veteran Seattle real-estate agent Don Henry is certain the rapid run-up in home prices has put Seattle into bubble territory.

"There are just so many people out here who can continue to sustain these increases," Henry said, particularly when wages aren't keeping up.

"Seattle, once again, took the highest spot on our 'overpriced list' because it's still recovering from the dot.com blowout five years ago," Forbes reported.

(end quote)

So, the publicity has hardly been one-sided. Chicken Little has been cheeping "housing bubble" for at least 5 years at the Seattle Times, and housing has doubled in price. So, I don't think it is rational to believe the Seattle Times is a member of a conspiracy to make people believe that house prices will continue to rise steeply.

Seattle Times was RIGHT in 2000 when it said housing was in a bubble.

That's the scariest thing about this whole thing: Just how far will prices fall when this mess starts really unwinding?

Back to 1999 prices? It could happen.

I think that's why people are calling you to task Mr. Dunn for encouraging buyers at this point.

The Seattle market HAS slowed. Inventory is creeping up, there are a lot of price reductions, sales are fewer.

To many, it looks like the beginning of the bubble bursting.

For people who believe that this bubble is now starting to burst, it seems immoral to drag innocent folks into it.

Lenders in Seattle are closing shop.

Fannie Mae has not released it's quarterly reports for over a year.

People around the globe are dumping dollars to buy gold and, apparently, even rubles!

Wages have not kept up with the cost of houses.

Rents have not kept up with the high cost of houses.

The Seattle area is right up there with CA in % of risky loans that people used to buy in the past year because- they COULDN"T AFFORD A HOME using traditional lending guidelines!

Think about it, Mr Dunn, there are a lot of reasons why this bubble looks about to burst.

There are a lot of RATIONAL reasons for a burst.

And reasons for it's continuance seem very IRRATIONAL.

Last but not least, could you buy the home you live in today at todays price?

Anyway, that's why people are upset with realtors who are nudging buyers into the market at this point.

They really believe that the whole housing market is going to hell in a handbasket. And they have a LOT of evidence to back up their beliefs.

Think about it.

Mr Dunn-

Check out this brokers' site. It's not just ordinary joe schmoes who think this bubbles going to burst and burst bad, lenders also think so.

http://tinyurl.com/ho4kp

dukes, realtors are middlemen just like lenders. Nobody forces Joe Public to buy homes. Nobody forces Joe Public to buy JDSU at 300. Nobody forces Joe Public to have 3 kids on a $50,000 income and therefore he can't afford a home without going the interest only route and further stressing his financial health. Remember, people can always rent. RENT.

I put the blame on stupid people who make poor decisions and more importantly, don't plan ahead.

Ah, you say just rent, but there's a problem there.

There was a time (not so long ago!) when most Americans knew that if they worked hard and were responsible, they could attain a dream. The dream of home-ownership.

It's a good dream. It stabilizes society. It keeps people working hard to build something in their lives.

Take that dream away, by turning homes into stocks or a Las Vegas gamble, and there's going to be some real damage coming down the pike.

People who own and cannot get out from under the debt of owning.

And people who will never, in their wildest dreams, be able to own.

Debtors and people without hope. Great combination for societal meltdown.

Do you really not see a problem with home prices completely out of whack with wages?

I'm not talking about you personally, I'm talking about for society as a whole.

I'm going to make an assumption here.

I'm going to assume that people who say "just rent" or "you're whiners" are either standing on slightly to massively shaky ground financially as concerns their home purchase OR they're doing OK financially but have been counting on their home to make them feel they're doing GREAT financially.

Do you not see that you are as big a "whiner" as anybody else?

Did you really believe that house prices never falter?

Did you really not take that into consideration when you made your purchase?

Have you really never heard of "buy low, sell high"?

Do you expect that people will rush in to save you when home prices go down?

Are you not willing to take responsibility for your own decisions?

Anyone notice inventory is dropping quick this week? But at the same time the number of reduced listings has shot up almost 10%.

Increased sales? or people pulling places off the market?

People were pulling houses off the market all winter.

I know because I was checking the tax records for "solds". If a house that goes off the MLS hasn't shown up in 3 or 4 months on the tax records, it's a good bet it was pulled from the market.

So yes, it could still be happening now.

It is indeed very simple. What is wrong with renting?

People shouldn't feel that they have to own a home to complete the American dream. If they can afford it, great. If not, rent. It is not a big deal.

Again, there is a feeling of stability that comes with owning. Granted, it is just a feeling but, as we know, feelings are in fact real and have real consequences.

And remember, there was a time when nearly all Americans , including teachers, nurses, truck drivers, store clerks, KNEW that if they worked hard they could own.

Frankly, I shudder to think what will become of this society when all of those people KNOW that, no matter what they do, they will never have a prayer of owning.

Again, it's a societal issue. It has to do with the health of our society.

Inventory was rising last week...it's been dropping steadily all of this week.

The houses I've been tracking in Ballard are all getting sold in less then a week with multiple offers and heavy over bidding.

From what I'm seeing, I think it's likely that the median price in N.Seattle will go up a lot this month...

'm

Perhaps Seattlelites are simply avoiding the bubble issue because they think they're personally benefitting from these price increases for real estate? How many local WA people are investing in RE? That would be a good thing to know before feeling too immune.

meshugy,

Do you just copy paste this same commetn week-to-week, month-to-month about the camelot that is your beloved Ballard?...

"The houses I've been tracking in Ballard are all getting sold in less then a week with multiple offers and heavy over bidding."

To me you sound nervous, really nervouse, otherwise you wouldn't be watching inventory listings hour-to-hour and constantly posting 'good news' on a seattle housing bubble site.

I can see your white knuckles from here.

It looks as though some people jumped into a bid just before interest rates went up- should look like a blip in a few weeks.

Hi anon,

Personally, I'm not particularly nervous about the market...I already have a house that I can afford with a 30 year fixed. I'm just following the market...as we all know it's a crazy time.

I'd prefer if housing prices leveled off and dipped a little. The current rate of inflation isn't good for anyone. New buyers can't afford to get in...and current owners have sky rocketing taxes. Also, I think the exorbitant prices are changing the character of a lot of neighborhoods for the worse.

As we all know, you don't really make money on your house unless it appreciates faster then whatever you buy next. If you stay in Seattle, that's unlikely unless you bought in a undesirable neighborhood for cheap and then it became trendy later. So I don't have much to gain from rapid appreciation.

Sorry if my posts seem repetitive...it's only because the market is.

'm

When California inverts, the PNW will just die. All the spin and denial that Seattle's best can muster won't save us.

Thu May 11, 10:33:33 AM PDT

Howdy, sailor. Your own ship is all secured, I take it? Take it easy.

I've said it before, and I'll say it again. If you own a home and are afraid it the house price market will crash, I'll be happy to sell your home, at a discounted seller's agent's commission. See dunnanddunnrealtors.com.

There is not one word on my website discussing the future of the housing market. I do, however, publish the sales figures of the recent past compared with 12 months before, for markets where I work. I am not beating a drum predicting future growth in home prices.

As I have said before, my best guess available on the information currently available to me (No, I don't own a chrystal ball) is that prices will probably remain stable or decline very slightly in the next few months.

Some have focused on my M.A. in psychology. From a psychology standpoint, I am guessing that the most aggressively bearish posters are renters. They probably always felt real estate was overpriced, and they probably have been telling themselves for years that they will someday buy when prices become "reasonable."

They are still waiting, and they are getting mad. No big drop in housing prices, and they will feel like fools for letting the train leave the station without them. So, there's the source of the anger, outrage, invective, suspicion, etc.

Or, alternatively, they really never could afford to buy a home. Their choice is now to believe that the real estate market is unreasonable, or they are losers in the economic competition that is a capitalist economy. Tell someone that they are a looser and they are going to get mad, and probably insult you back.

So, from the standpoint of the angry posters, I am calling them losers or fools. No wonder they say bad things about me. From my own standpoint, of course, I am just expressing an opinion regarding the housing market based on my real estate practice, and am not saying anything at all about the skeptics and pessamists.

Hey, if I'm wrong, and the market crashes, and you holdouts decide it's finally time to buy a home, I will give you a 1% rebate on your purchase of any home in which the buyer's agent is being offered the usual 3%, if you buy using my services. See dunnanddunnrealtors.com for details.

Now, back to the facts. Let us examine the question of a reasonable" price for real estate. Joe Buyer, a software programmer, wants to buy a house, and he and his wife, Jane Buyer, a graphic artist, have an after tax income of $120,000. Big lenders reckon that it's O.K. for them to spend (say) 50% on houseing. So, the anticipated property tax, plus the anticipated fire insurance, plus mortgage payment must be less than or equal to $60,000 per year.

So, let's say that that leaves $52,000 for a mortgage after subtracting an allowance for insurance and property taxes. Currently, that will get you a 30 year fixed loan for $670,000.

Joe and Jane look at a few houses, agonize about spending all of that money, but ultimately decide that what really matters is having the nicest home in the nicest neighborhood with the best schools, and so they buy a house for $670,000 plus whatever down payment they can come up with.

That transaction, times the number of real estate deals, based on the varying amount of income available to the buyers, is the basis of the market price. If the number of buyers and sellers aren't well balanced, then supply and demand will press prices up or down, but the fundamental context is how much the lenders will lend.

And, by the way, I have never once been asked by a home buyer or a home seller if I think that this is a good time to buy or sell a home. Either they don't care the market, or they don't care what I think, or they think my answer will be based on self-interest. Nobody is relying on my estimate of the market's future.

Anon 5/12, 11:39

Thanks for taking such an interest in my personal welfare. It is nice to know there are such caring, thoughtful people in this world.

I'm holding zero debt and (her is the part I'm sure you are wondering about) enough thorozine to get me through all my neighbors whining about how their housing dreams went "poof."

All is well (so far) at the Eleua household. Thank you for asking.

Tim Dunn,

$120K/yr is, by far, the exception for household income in the PNW. Yes, many do make that kind of money, but they do not have the numbers to float the market.

When Bainbridge Isl.'s median household income is under $75K, and Mercer Isl. chimes in in the mid-$90K range, you just don't have the numbers to keep it all afloat.

50% devoted to PITI is economic suicide. This is what you are asking: freakish income with freakish ratios, at a time when income and lending standards are at their most outta-whack with historical norms.

When the median income is under $60K for King County, and the 75th percentile is not much higher, you are looking at a catastrophic drop in RE values.

BTW...yes many bears are renters. I certainly am. My landlord is an X-Cal equity refugee that was born on 3rd base and thinks she hit a triple. She subsidises my rent to the tune of $2500/mo, and that is without any maintenance or management fees. $30K+/yr in negative cash flow is not real estate brilliance, IMHO.

As for the bulls...many are nervous nellies that hope, pray, and fast for a rising RE market to keep them solvent. They are 1 paycheck away from a NOD. Disparage the renters all you want (not enough money, poor economic timing, losers in the economy), but many of the bulls can't think for themselves, and rely on "professionals" to do it for them. It never occurs to them that the game is rigged for the professional, and that economic history repeats. They can't remember an economic downcycle of any consequence, so they assume that recessions are extinct.

Many had money from mommy and daddy, or are on the RE bubbleator, and think they are making money. They look down their noses at renters with that "tsk, tsk..." attitude, but fail to realize that a 10% retracement (perish the thought!) would put them completely underwater, and that is before RE fees. All of daddy's money and all of their equity vanishes at the Title Company.

How much debt do bulls have? Debt, in case anyone forgot because of the Greenspan era, has to be repaid. Sorry to be the wet blanket. Leverage gets you into a house, and it also pops you out. Many bulls don't realize that leverage works just as well in reverse as it does going forward.

Many of the economic "winners" are people that make money in the REIC. RE agents, brokers, builders, lenders, landscapers, designers, retailers (thanks HELOC money), etc., are going to be the first ones out of a job when the SHTF. You can bet that home ownership in the REIC has to be closing in on 100%

I do love the "train left the station" phraseology. It is a classic tool to install panic in the potential buying public. Personally, I like to use the "trainwreck" analogy, as watching the housing market is like watching a trainwreck - one frame at a time.

ALL ABOARD!!!!

Tim Dunn, RE

I have nothing against you, or any RE agent that can look herself in the mirror without wanting to smash it. Make your living. Enjoy all that life has to offer.

If you substitute tech stocks for real estate, and back up your posts 80 months, they would read almost word-for-word what the stock pimps were saying back in the glory days of the .com era.

Many, including me, were losers for not buying into the tech rally back in '98. Of course, Warren Buffet was in our camp, but that didn't worry the stock shills, as they were smarter than WB.

It was a new paradigm, or as the WSJ put it: the "New Economy." They actually capitalized the words "new" and "economy" to signify that it was something more than just a concept.

The bears were brought onto CNBC so people could laugh at them. We were left behind in the rapture of the New Economy. TIME magazine captured the top with their stories on daytrading and "Everyone is Getting Rich, But Me" articles and headlines.

Sports bars were tuned to CNBC, not ESPN. Vacationers in Hawaii would watch the ticker, rather than the waves (I lived in Hawaii at the time). The Super Bowl had commercials that were advertising financials. Remember, "He's got money coming out the wazoo!"?

Didn't Ameriquest sponsor much of Superbowl XL?

Same story.

Different subject matter.

Same morons.

Same result.

American stupidity and arrogance is a bankable combination.

All of you folks who compare the housing market to the stock market just don't get it. The usual reason to buy a house is in order to have a nice place to live, not to make a fortune in real estate. The folks who buy rentals are comparable to people who buy stocks, but there aren't that many of them around here.

And yes, if we run out of buyers who can afford these prices, the market will stall out, or decline slightly - which is what I have predicted for the next six months or so.

My comments about psychology are just that. They aren't meant to suggest anything about the future of housing prices.

I'm 55 years old. I remember when Hershey bars were a nickel, and so was a Coca-cola. Of course houses are in a long range up trend. Everything is on a long range up trend.

It has been U.S. government policy to cause slight inflation since the great depression, in order to keep the economy chugging along. Therefore, the long term trend line in any form of real goods will trend upwards.

Tim Dunn,

Most people SHOULD buy stocks for a dividend. However, back in the bubble, people were buying stocks for the capital gain, and if it paid a dividend, that was a bonus.

Anytime something is purchased for capital gain, rather than underlying value, you get a high propensity for a bubble to form.

The modern housing market is exactly that. The spec premium that is paid on many homes here is just laughable.

BTW, without inflation of income, there is no inflation of housing.

My stock analogy stands as originally written.

Post a Comment