Seattle Buyers Not Immune to Credit Crunch

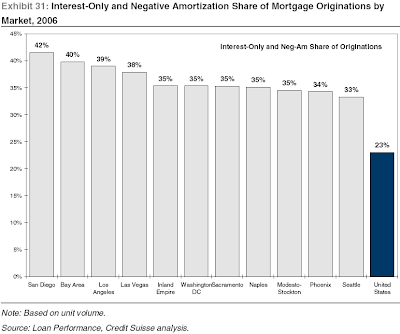

As you know, I haven't said much on this blog about the ongoing collapse of lending as we've known it the last few years. This is primarily because the issue is being covered quite thoroughly at many of the other bubble blogs linked on the sidebar. However, a reader sent me a pdf report by Credit Suisse titled "Mortgage Liquidity du Jour: Underestimated No More" that contained the following chart:

As you can see, home buyers in Seattle have turned to interest-only and neg-am loans just about as frequently as most of the other "bubbly" cities.As this easy money rapidly dries up, where does that leave the buyers? Well, I'll defer to the opinion of a "Mortgage Expert" on that one (comment #2):

It’s a real feeling of panic for buyers.Uh-oh, it looks like we may not be as special as we thought. It would appear that all of Seattle's pretty scenery and "world class" amenities don't count for diddly when loans are no longer being handed out like bread crumbs at the duck pond.

P.S. (I have the report in pdf format, thanks to the reader that emailed it to me, but since I could not find a web link to it, and I don't know the copyright status of it, I have not posted the report online. If someone finds a link to the full report I will add it to the post.)

52 comments:

Yes, it definitely seems as if Seattle has been caught up in the credit bubble sweeping the nation. However, the report cited here doesn't specifically talk about subprime. Many of these no money down, option-ARM, "exotic" loans, have been in the prime (or Alt-A) space.

I point this out because the Seattle area has had far fewer actual "subprime" loans than the national average. Thus, I think we might not see the same immediate fall-out from subprime as elsewhere. I am sure the chill winds will eventually hit us as the pain moves up into Alt-A mortgage categories, but I am thinking that Seattle might be one of the last castles to crumble to the barbarian onslaught...

It’s a real feeling of panic for buyers.

Hahaha... I guess it really is a 'priced out forever' scenario if you're a deadbeat without 2 pennies to scrape together for a downpayment and are honking on to the %100 financing death-trip.

27039331 MLS price say 649950, but builder website say 679950!

You can't put lipstick on a pig...

What's the difference between a credit score of 620 and 630 if that happens to be the sub-prime cutoff? Mr. 620 and 630 both purchase the same toxic mortgage product, doesn't matter, you're still going to be up sh*t creek when your boat anchor resets.

"I point this out because the Seattle area has had far fewer actual "subprime" loans than the national average."

I don't think that is the case. Source please.

Nevermind, I found a link from a previous post. However, while that is the case, I think the main issue is not subprime, vs Alt-A, vs Prime. But instead the use of the riskiest loan types. Interest Only, Neg-AM loans. And seattle is up there with the highest.

Adam said: "I think the main issue is not subprime, vs Alt-A, vs Prime. But instead the use of the riskiest loan types. Interest Only, Neg-AM loans. And seattle is up there with the highest."

While I agree with this sentiment, I do think that it might take longer for the real-estate debacle to play-out in the Seattle area since we have a relatively low number of subprime loans, which is the first class of mortgages currently getting thrashed in the markets. Eventually this pain will move into the "exotic" prime categories as well, but it will take a little longer.

Mikhail- you keep saying this:

I point this out because the Seattle area has had far fewer actual "subprime" loans than the national average.

What is your data to back this up? I did a bit of searching around, and the best data I could find was a report on forecasted foreclosure rates on subprime loans from the Center for Responsible Lending. They show Seattle at 112 out of 387 markets in terms of exposure. That doesn't sound "far fewer than average"

Do you have a source for this?

here is the source for the Center for Responsible Lending report

http://tinyurl.com/ylzvq3

anybody keeping up with the lender stocks today?

fmt

lend

cfc

nfi

new

pretty ugly

Good article from today's Wall Street Journal debunking many housing-as-an-investment myths

This is currently listed as the most popular article on the Journal today.

Everyone can do the math and estimated this without any report. Unless there's a lot of "old money" sitting around in the Seattle metro area, average medium income cannot possibly afford housing in this market with traditional 20%, 30year fixed mortgage.

Here's a link to a registration-free version of the WSJ article linked above.

It's curious to note the differences in percentages listed on the graph in Tim's post and the often referenced Map of Misery

Please give me 1 source that says Seattle does not have as many subprime loans as the rest of the U.S. If you are going to continuously state that we have fewer subprime loans than the rest of the nation, post a freaking link for the love of God.

I find it hard to believe that we are near the top in terms of IO and Neg Amort loans but yet lag the RofUS in terms of subprime. Post a link to back up your claim or stop repeating it.

Observations:

Up through late 12/06, there was almost no talk of any problems in the subprime lending sector.

As company after company shuttered thier doors, Wall Street all said "this is contained."

A big WS brokerage house upgraded New Century about a microsecond before it cratered. The stock was selling for $15, and had set a price target for $17-19. Less than a week later, the stock is below $2. Many of the big houses were speaking favorably about how NEW could recover. None of them saw it going below $10, much less $2.

Question:

Does anyone believe the Wall Street spin about how alt-A and the RE market as a whole will not be dragged into this dark vortex?

Remember, all the enlightened, hip-n-trendy buyers in the PNW borrow money from the same pools as the slack-jawed cretins in Flyover Country.

To say that we are insulated in the rest of the country is pretty stupid/arrogant.

People in the PNW tend to pride themselves on how open minded, and ahead of the curve they are. In reality, I find most to be pretty insular and petty.

Just to lighten the mood...

What we thought of RE agents back in the '50s.

I cannot see how Alt-A or Prime can avoid this mess. I know plenty of people that have great credit and are in the same over-their-head predicament as the sub-prime buyers. It might not be until the next leg down in the economy but they will be hurt just like everyone else.

I see the same behavior in the good credit consumers as the sub-prime. The only difference is that they were able to leverage themselves even more. I have some peers that have bought 2 or 3 houses over the past couple years. I assume they have done this with their "good" credit.

I see lots of two income households where both are derived from the REIC. You want to see a house of cards, go down to the Puyallup/South Hill area. The entire economy is real estate. It isn't the military that is driving that market. Sorry, a little off topic.

Greed is as prevelant in the above 650 FICO score as below it IMO. They are smarter and more stable but will be hurt just the same.

The real estate pyramid scheme is over. There are no FB's left to sell too and now the "investors" will get stung.

I read a comment by a blogger so if it is someone here I apologize, anyway, they were talking about how a lot of sub-prime and Alta-A buyers ahve "moved up stream" so to speak in the credit game which I can see. How long does it take to improve your credit when you refinance and pay off all your debt and stay current for 12 months. I would bet this euphoria has covered up a lot of personal mismanagement.

I do remember during the dot com craze the noise over margin accounts. There were a lot of figures thrown around but you never knew for sure similar to the sub-prime/foreclosure stats. The amount of people that were actually on margin was awesome. It blew me away. People, smart people, well educated people.

I am not saying the average stock investor is smarter than the average homeowner, well yes i am. My point is the market then and now erased the risk factor from the investors mind. And I think that extends to the Prime as well as Sub-prime.

Those posts from Ardell on RCG are absolutely hilarious: when did she start giving an "RA" about finance?

I guess, when the writing is on the wall in BIG BLOCK LETTERS, even the most deluded amongst us have to finally admit that they can read....

Here is why I decided to purchase over the weekend.

I have been reading this blog and you guys almost convinced me to wait. But I started doing some math and felt now was as good of time as any to purchase. This is a second home not my primary.

Im borrowing 500k at 5.5% for 30 years. Payment will be $2838

I feel that interest rates will go up faster have heaver then home prices will fall. MMHO.

So if I waited and rates went up to 8% the most my $2838 could get me would be $386,902. And I would end up paying an additional $117,000 in interest at the end of the loan.

I am not a flipper and I paid off my last house in 18 years by just making one extra payment a year.

That WSJ article you posted makes it sound like it's never a good idea to buy a home.

That WSJ article you posted makes it sound like it's never a good idea to buy a home.

Not quite. It makes it sound like it's never a good idea to buy a home as a financial investment, which is entirely true.

AB,

why do you feel that interest rates will rise?

Im borrowing 500k at 5.5% for 30 years. Payment will be $2838

30 yr fixed today is 5.8%, if you're on a 5.5% you must be on an ARM.

"So if I waited and rates went up to 8% the most my $2838 could get me would be $386,902. And I would end up paying an additional $117,000 in interest at the end of the loan."

Mmmhmm. And I believe you're sincere...why?

Yes, interest rates are still historically low right now. They're not at their lowest, certainly, but still low.

But even if you think that interest rates will rise in the near term (and that's not a safe bet, by the way), you're forgetting something else: home prices are at an all-time high.

Look at it this way: yes, money is cheap right now (interest rates are low) -- but houses are more expensive. In fact, houses are currently way more expensive than money is cheap, at the moment.

The only way that your argument works is if you believe that home prices will not drop, and that interest rates will continue to rise. Under any other scenario, it just makes sense to wait.

ab,

"I'm borrowing 500k at 5.5% for 30 years. Payment will be $2838"

Looks like you have a great track record and I'm sure you will do fine, but 500k.... man, that's a lot of scratch to pay back for Joe six-pack types, even with a low interest rate.

-slow

Grivetti :

Washington Federal Savings locked in last Wednesday. 30 year fixed.

matthew:

The fed continues to talk recession in my experience that means drastically higher rates.

Misterbubble:

I feel housing prices will go down but I feel the lower interest rate will be the best long term security against that. Whatever value the house takes a dip I feel I will get it back over time. This is a lifestyle decision not an investment. The funny thing is I am far ahead on my lifestyle investments. If I could have purchased at 4.5% I would be feeling even better about my decision.

Let's not confuse ARM with subprime and Alt-A.

Strong borrower in ARM is not in the same category as subprime or zero down alt-a borrowers.

30 year fixed is not the best mortgage scenario in most borrowers' cases.

Misterbubble says:

”The only way that your argument works is if you believe that home prices will not drop, and that interest rates will continue to rise. Under any other scenario, it just makes sense to wait.”

Well while Im out on my dock this summer,waterskiing with my kids, and drinking beers you can sit at your computer waiting to make your next purchase. I am only getting older I am not going to worry about the things that are out of my control. I am however going to enjoy what I do control. Now I have to start monitoring the boating bubble blogs .

AB,

traditionally when the FED feels a recession coming on they tend to cut rates to spur economic growth, not raise them. This scenario may be different due to the plunging dollar, but I do not think that a rate increase is in the near future.

One more thing, if you bought a house now, with all the lending implosion, the MSM covering all the troubles in the market, AND you come to www.Seattlebubble.com and you STILL bought a house.... well the sympathy meter will be ZERO when you are underwater without an oxygen tank!

Here is a little light reading for the evening.

Report back to me tomorrow. There will be a quiz.

matthew;

the home i purchased rents out for 2700 a week for 12 weeks of the year.

I could have paid cash but having my money tied up in a house doesnt make any sense. I get a much higher return then 5.5%. And I remember 1980 - 1985 recession = 13% to 18% interest.

AB-

WOW.

5.5% 30yr fixed at Washington Federal (a long term very conservative bank) ....that is a superb rate. Please inform me if you paid to buy down that rate.

If you didn't buy that rate, I'll be contacting Wash. Federal tomorrow to refinance. Contact me via e-mail if you wish.

Thanks,

S-Crow

AB,

I too remember history. The rise in interest rates in the early 1980's was due to OPEC doubling the price of oil. If the housing market deteriorates like some predict, it will take more than the doubling of oil for the FED to raise.

The rest of your post makes little sense to me. Can you explain? Thanks.

E-

I read that article earlier. Over on Mish's blog he reported that RealtyTrac has logged defaults at 130,000+ for January 2007 ALONE (up 19 percent YOY). 1.5 million could be on the low end.

Brace yourself!

Eleua...

this was my favorite part..

``What we're seeing in this narrow segment is the beginning of the wave,'' Bies said. ``This is not the end, this is the beginning.''

All the predictions IMHO are just as nearsighted as those that were made for Katrina...We'll take far more than a 250B hit.

My guess is the amount of foreclosures will feed upon themselves and accelerate as the year progresses.

I must admit that I was pretty bearish on all this stuff, but this is really surprising to me just how little resiliance the market and economy have shown in the face of just the leading edge of trouble.

This thing is coming apart.

"Well while Im out on my dock this summer,waterskiing with my kids, and drinking beers you can sit at your computer waiting to make your next purchase."

Brag. Brag. Brag.

(yawn.)

"I am only getting older I am not going to worry about the things that are out of my control."

Then we have something in common: I'm not worrying about you, either.

Ab,

Congats. I think it's great to see when people have worked hard enough and have been fortunate enough to be able to purchase a second home as a retreat. Clearly you are making an informed decision that you feel is in your best interest. I seems clear that you're purchase is more personal than investment.

Contrary to what some have said to you (and I think they are a little jealous as am I) I think your place will be more insulated than others. A home on the water is much more rare than a home in the middle of the city or in the 'burbs. I was fortunate enough to grow up living on a lake and I had so many great times there. Good luck.

NYSE is seeking to delist New Century this morning, and they appear headed for bankruptcy

WSJ is reporting that Accredited Home Lenders is seeking ways to increase liquidity, announcing layoffs, and they have "...paid about $190 million in margin calls" since the begninning of the year, of which "...about two thirds of those calls have been received and paid since Feb. 15"

Accredited's stock is down over 50% this morning.

Folks - AB is a classic troll. Ignore.

I don't know that AB is a troll, but I am curious how you can get a non-primary residence financed at 5.5% without a buy-down? If so, I'd like to pass on the news to the public that Wash. Federal has some really good financing programs (for those with good credit).

Mydquin, I loved your post. I think it really brings us back to what Tim's orginal point of this blog was. And inspired me to really think about these points. I started writing a response, but it's getting really long. I'm working on it over the course of work today and will try and post it tonight. In the meantime, I'm looking forward to what some of the more prolific posters on this blog say.

mydquin--

I apologize if my comments seem snide or snippy. I'm not intending to be a jerk, but have a tendency to lean towards snideness.

1. I don't think anyone here has said that housing starts are up. The fact that housing starts are down is a sign that the game is over. The fact that developers are scrambling to complete construction before its too late suggests a climate of desparation about the market.

2. The liquidity leftover from the subprime blowup will be used to cover the 1.5 million foreclosures next year. The prime market is hardly the picture of health, since there are still trillions of dollars in ARMS due to reset.

3. The wealth of foreigners is dependent on US Consumers buying foreign goods, and the speculative mania of their own nations (or did you miss the 9% crash in China a couple of weeks ago?). Many are suggesting that the Chinese market may continue to correct. Additionally, who is losing all that money in subprime? Foreigners.

4. I agree. There is likely to be a premium on SFHs in the future. But this is a gradual global trend, and will take decades to amount to anything significant.

5. MS is turning into a dinosaur (unless you think Vista was worth it, or that Zune is a winner). Boeing isn't hiring. In fact I've heard rumors of a contraction once 787 starts hitting the lines. Also, WaMu (a major subprime lender) is a big employer the area, too. When the recession officially hits how will Starbucks fare? Or T-Mobile? Or Nordstrom? Or Eddie Bauer? Or REI? How many construction jobs are there here? How many RE agents? How many retirees are living off the stock market (which also stands to do poorly during the bust) and bonds (interest rates are still pretty low and likely to remain that way due to the liquidity trap).

6. I see hordes of people in the $600k market getting into the $400k market because their homes will lose at least 30% of their value since lending standards are likely to return to the 30-year fixed, 20% down, lender requires a body cavity search, and wages aren't rising.

7. I would guess that most of the $600k market have been bought up by speculators from California, people who cashed out their equity for Hummers, gas, vacations, and inflation, and new hires at Microsoft pulling in 80-160k household income (which cannot support a $600k mortgage). In short, I don't see much reason to believe that the top of the market would be any less kinky than the bottom. What about all those $600k condos that you see collapsing in price? Do you think that foreclosures and giveaways on those as 20-30 somethings relocate might impact the prime market buyers?

In short, I appreciate your arguments, but I disagree with your conclusions. Personally, I think the "30-minute drive to downtown" homes will suffer the most. Neither MS or Boeing are located downtown, and while I don't think either of these behemoths are set to grow much, they are the largest employers in the area. When the S&Ls implode, downtown will become a ghost-town like Dallas in the late 80's.

Chris, I'm looking forward to your take on mydquin's arguments as well.

to mydquin:

1. Whether you want to believe it or not, sfw's and condos are both part of the same market. If one drops 50%, the other is not going to stay static.

2. Um, right. And I'm sure there are plenty of people holding the down payments necessary to get in on those primes. No, you can not count on them having equity, especially once a correction gets underway. Even people who bought in the 90's are largely maxed out from taking HELOC's.

3. This is an unstable relationship that can not persist indefinitely, not with our debt the way it is.

4. The scarcity of sfw's in Seattle might allow them to maintain a little more of an edge over condos but they are still overpriced by a lot. Stop trying to think intuitively about what people want in a house and recognize the credit bubble. Prices got where they are all over the country because bums could walk in from the street and get mortgages. I'm not kidding. Recognize the insanity.

5. Irrelevant. The job market here does not make Seattle special. If the job market stays strong, it just means the collapse will be slower.

6. Well, those who can genuinely afford to be in the $600k market will either buy the same house for less money or get something that is currently in the $1,000k range. Those who can not genuinely afford this will go bankrupt and get out of the way.

7. If 33% of the market is using non-traditional, I would estimate that the percentage of $600k+ people using non-traditional was also 33%. There are still many, many speculators in that range.

I don't know that AB is a troll, but I am curious how you can get a non-primary residence financed at 5.5% without a buy-down?

Well, I'm hedging the Troll bet on AB, but 5.5% on a 30yr fixed seems dubious

mydquin,

Others have been going point-by-point over your arguments, and I'll leave that to them. I wanted to say that I find your focus on the $600K+ market a bit odd. According to HousingTracker, $600K is about the 75th percentile for asking prices in Seattle. So you seem to be suggesting that 75% of the market might have problems, but 25% won't. Not only is that implausible, one wonders why the majority of people would care that things are going OK for an economic bracket that they don't belong to.

In any case, the housing market is not divided into discrete classes. I agree that people seeking $600K+ homes are not likely to suddenly switch to sub-$400K homes instead. That would suggest a drop of more than 33%. Even if such a drop happened, it would be over the course of years due to the "stickiness" of home prices during a downturn. More likely is that the $600K buyers would start looking at homes around, say, $570K. That isn't a huge drop -- just 5% -- but it is still a drop. Then the next year, the $570K bracket becomes the $550K bracket. And so on for 3-5 years until the market stabilizes.

I posted my answers on today's open thread. I thought I would bump it up and see what others would respond with.

Mydquin,

the answer is based on what REALLY drives housing market prices. Real Estate theory tells us that all homes will be sold...eventually. (Does it sound Like I am repeating myself? I am. I will state again for you.) What really drives up prices is liquidity of money. so the influx of foreign money does play a part in this, but how long do you think foreign money will come into a dying market? You can have job growth, and everything else you have listed, but without liquidity, housing will stay at a stable price with-in median income level affordability prices. We here, as almost everywhere else, are well beyond that.

Liquidity is drying up. Period. Many here and elsewhere predicted it would, at the risk of being chided by the over exuberant.

There has been way too much speculation in this and every market, too many flippers. Just look at the number of homes on the market currently were purchased recently.

Myquin. If you think the microsfties can afford to buy the 600k homes, who do you think is gonna buy their home? And who will buy the home of that person? Is this gonna be just a Microsoft pyramid scheme, each selling their own homes to each other until the last ones are left holding the debt? Or maybe you think they can hold two mortgages for an indefinite period of time?

But, I thought that Seattle was special? What with Pearl Jam here and all?

Post a Comment