PMI: Seattle Increasingly Risky

Mercer Island Guy pointed out that I haven't yet posted on the latest PMI report that was released last week.

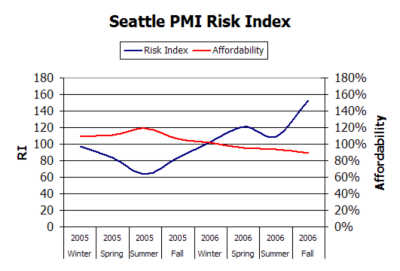

Rapidly slowing appreciation and declining affordability contributed to a marked increase in the risk of home price declines in cities across the country, PMI Mortgage Insurance Co., the U.S. subsidiary of The PMI Group, Inc. reported today, but strong economic fundamentals continue to underpin many areas.For those that don't know, PMI stands for Private Mortgage Insurance, and the PMI group is "one of the largest private mortgage insurers in the United States." Although Seattle's latest Risk Index of 153 is low compared to most PMI-tracked cities in California, it is worth noting that it has more than doubled from its Summer 2005 low of just 64.

...

[Chief Risk Officer of PMI Mortgage Insurance Co. Mark F.] Milner commented, "Over the past five years, house prices in the United States have appreciated more than 56 percent, on average, and much more in some areas. In the same time period, incomes increased just 25 percent. That's why affordability has decreased so much in many areas. Going forward, house prices and incomes need to come back into balance so that more Americans can afford to buy homes without resorting to loans that expose them to interest rate risk and the risk of payment shock."

Taking info from past PMI quarterly reports, I produced the following graph that shows Seattle's Risk Index as well as Affordability Index for the last two years as calculated by PMI.

(Press Release, PMI Group, Inc., 09.19.2006)

5 comments:

SEATTLE AVERAGE HOUSEHOLD INCOME SALARY FOR FIRST TIME HOME BUYERS WAY TOO HIGH

I see a lot of $60k-70K household average household incomes reflected verbally by Bloggers pushing real estate as low risk in Seattle, but they never give me written "proof" that first time home buyer households make that kind of money. Come on, find me an URL in writing, verbal don't work.

I did an independent search for you realitors on a Yahoo recommended Seattle Job Site URL:

http://www.allseattlejobs.com/jobseekers/searchresults.asp

I put in "No Experience", all jobs in Seattle. The result: No jobs exist in Seattle.

I will say this, if you want to drive a truck in Seattle, there's jobs galore in the $7-12/hr catagory, some with little or no experience.

So, I went to the Wall Street Journal on average entree level college degree wages for "customer service":

http://www.collegejournal.com/salarydata/customerservice/

The result in writing from the WSJ, approximately $10-12/hr.

These jobs apparently don't even exist in Seattle. No experience, no job, according to allseattlejobs.com.

Now, you realitors telling us Seattle Bubble bloggers the college kids are marrying $200K incomes, that may be true. But you know, that "$200K middle aged man" that married the young "Barbie Doll type" out of college, already bought a home decades ago. So what, even that family isn't in the real estate market anymore either.

Its all smoke and mirrors, using Seattle Area average household income data to push risk as low and you know it.

Pop went the real estate bubble.

With a name like "softwarengineer," why would you limit your search to jobs that require no experience?

I don't claim to know the average income of first time homebuyers in Seattle, but I do know that there are more than a few young families in the area pulling down over $100k per year.

(Note: I do not believe that these families' incomes justify current prices. I'm just sayin'...)

I think the argument that RE risk should be based (at least somewhat) on the disconnect between wages and prices is valid as it's one of the principal fundamentals of housing value.

That said, home prices have left the fundamentals behind long ago across the nation. Just comparing risk in Seattle to nationwide typical housing risk is a weak indicator of true risk. With the national housing bubble that has been built by irresponsible credit/money creation over the last 20 years, true risk has been dramatically understated.

The fact that Seattle housing is very risky compared to a super-risky national housing bubble should be freaking people out of their minds. Frankly, I'm surprised that anyone bothers trying to insure any mortgages anymore, given the risk/reward.

HI MISTERBUBBLE:

I did see some average data in writing on average first time home buyer incomes on the east coast a year ago, and they were approx $30,000 per family. I do think that's a bit low now, perhaps not.

Your $100,000 figure is fine, but are those families in the market (my guess is most, if not all, of the $100K households bought a house 10-20 years ago)?

Perhaps two younger professionals stayed renting for 5-10 years, both got lucky jobs (the wages have been stagnant for BA professionals the last 5 years too) and saw rare wage increases, so decided to buy in.

They may be two BS degreed young engineers, but you know, even a good percentage of the younger ITs and engineers have been bumped by H-1B Guest Workers lately. Ask Boeing and Microsoft. Older high paid workers laid off too in 2001 and never got back in to their old permanent jobs.

Welcome to the NWO.

Most of us aren't high paid technicals with permanent employment, as engineering isn't the degree of choice anymore. That's the excuse they give to bring in H-1B Guest workers in hoards, engineering shortage....lol

CNN had a good expose' on H-1Bs destroying our wage fabric too lately. Unknown numbers of them too. My guess is 10s of millions of 'em in this country.

First time homebuyers start the ball rolling, without them, you can't usually buy up. Its the root cause for a bubble.

H-1Bs make about 1/2 pay.

softwareengineer - So let me get this straight:

Home prices have nearly tripled in most major employment centers in the face of real wage declines, and a savings rate lower than at any time in the economic history of the US. Lending risk has never been greater. Money and credit-creation are at a world-wide peak, sparking double-digit asset inflation from copper to oil. China and India are the only people left manufacturing any goods at all, and the US is buying them at a record rate, widening the current account balance.

But in your opinion, immigrants here on H1-B visas have been stealing high paid jobs from Americans for the last 5 years. That's why there are no first-time buyers left in America?

As a tech-worker I feel your pain, but I think you're on the wrong track here. The problem is not that wages haven't risen. The problem is that lending risk is disassociated from lending behavior, that "creative wealth-creation technologies" have been loosed upon the general public, and greed, hype, and a broken RE industry have driven prices unrealistically high.

Post a Comment