Trend Marches On: Supply Up, Demand Down

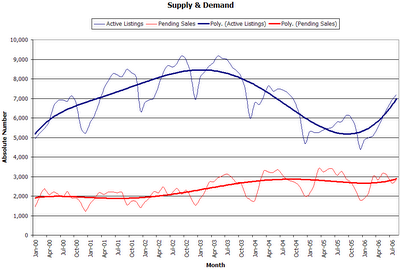

August figures from the NWMLS have been posted. Inventory continued its climb, up 23.91% from last year, while sales were up slightly from July, but still down 13.29% from last year. Median sales price for single-family homes in King County was unchanged from last month, at $435,000. As is traditional, I have uploaded an updated version of the Seattle Bubble spreadsheet for your number-crunching pleasure.

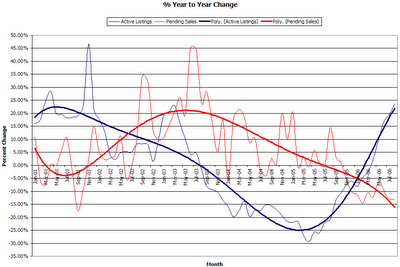

Here are a few graphs from said spreadsheet.

28 comments:

Talk about things blowing up. That % inventory trend line is brutally steep. Combine that with 4 months of negative pending sales growth and the month's supply numbers must be skyrocketing. It will be 5-7 years before we dig out from under this mess.

That % inventory trend line is brutally steep.

Inventory is still way below 2004 and 2003, etc. In fact, other then 2005, we have the lowest inventory ever right now.

KC Residence Aug 2006: 7,199

KC Residence Aug 2005: 5,810

KC Residence Aug 2004: 7,326

KC Residence Aug 2003: 8,488

KC Residence Aug 2003: 8,780

We're also seeing 12% YOY appreciation for KC residences. Still looks like a very strong market

Exactly, meshugy. Again a strong market, especially for neighborhoods close in. Just saw some more houses in the 98117 and 98103 list and sell within a week. Cali plates on two of the three buyers

It also appears that the "Aspen" Condos are ready for sale up on Greenwood around 78th. Condo conversion done in about five months . Low 100s to mid 300s. So definitely some nice units coming online in a cute neighborhood.

Something for the renters: Y'all can pool your nickels and buy this gem:

MLS 26088893

8500 9th Ave NW

Seattle, WA 98117

$1,099,000

seven units. Bought last year for $784,300 and four years ago for $50,000 ??? ( I hope the King County site is wrong ).

Inventory is still way below 2004 and 2003, etc. In fact, other then 2005, we have the lowest inventory ever right now.

Uhm...no offense, Meshugy, but do you know how to read a graph? Right now, active listings are at 2004 levels. Not below them.

A more cynical person might also point out that the current "historically low" inventory is about the same as the inventory in January 2001 (and trending upward at a much faster clip).

In case you've forgotten, the local economy was doing a swan dive into the toilet in 2001.

In case you've forgotten, the local economy was doing a swan dive into the toilet in 2001.

without a discernible effect on prices...next!

I see we have a new troll.

Why don't you post non-anonymously, so that we can all ignore you?

Anonymous said...

I see we have a new troll.

Why don't you post non-anonymously, so that we can all ignore you?

pot..kettle...kettle..pot

without a discernible effect on prices...next!

Except for the stall in price appreciation from 2001 to 2003, at a time when interest rates were nearing all-time lows.

NEXT!

Housing still appreciated above the rate of inflation in King County from 2001 to 2003. Look further down on Tim's blog for the Seattle Times graphic

more inventory=lower prices.

the US turned on a dime and seemingly overnight, the same will probably happen with Seattle.

"Except for the stall in price appreciation from 2001 to 2003, at a time when interest rates were nearing all-time lows."

only this time affordablity is going to top out and keep prices from going up.

I'm with you, Meshugy. Everything is wonderful. Borrow as much as you possibly can and buy just beyond your means. The real estate can never drop, so you can't lose. Otherwise, within a few years you'll be renting a parking space for three grand a month. And you won't demand higher wages to pay for it, either. You'll simply just change your lifestyle and like it. A 3 Bedroom, 2 bath house will cost 2 million bucks and Burger King will still have hamburgers for 99 cents.

Besides Seattle, I own property in New Mexico and Temecula, so I happen to track real estate news in those places. I found this little gem today:

Firm finds advantage in offering custom touches

New Mexico Business Weekly - September 1, 2006

"The National Association of Realtors predicts housing starts, nationwide, will be down 9.1 percent in 2006. But one New Mexico-based homebuilder is bucking that trend in three states.

Vantage Builders, the umbrella corporation managing the construction of new homes under three companies -- RayLee Homes, RayLee Luxury Homes and Vantage Homes -- sold 1,015 houses in the Albuquerque, Houston and Phoenix markets in 2005, and expects to sell about that same number this year. Business is so good the company is considering expanding and is looking into Dallas, San Antonio, El Paso, Denver and Las Cruces as possible new markets."

What's the message? No bust, if you know your market? Seattle might actually be different? Meshugy is son of Nostradamus?

The thing the inventory numbers don't reflect is all the new housing coming on the market in the next 12 months. It takes a LONG time to conceive a project, design it, get permits, etc. There is a huge amount of in-process building going on right now, all of it about to dump on the market in an already slowing real estate atmosphere. The steepness of that curve is just the beginning, lots of people in this area still have their heads in the clouds. But as things stack up, it snowballs. Just watch, we're spiralling down fast.

Just a little perspective on those "hot" zips where 2 Californians recently bought homes:

98103..June 20

total inventory: 112

amount reduced: 29

98103...Sept.6

total inventory: 140

amount reduced: 37

98117..June 20

total inventory: 54

amount reduced: 13

98117...Sept.6

total inventory: 70

amount reduced: 21

(Per Zip Realty)

Hard to miss the trend. One or 2 houses selling in a week does not a market make.

I was just looking at the MOM Res inventory for some of the trendy North Seattle neighborhoods.

Queen Anne/Magnoloa Jul: 158 Aug: 159

Laurelhurst Jul: 230 Aug: 230

Ballard/Greenlake Jul: 347 Aug: 345

U.District Jul: 214 Aug: 202

From July to August basically nothing has changed...that's why these areas are still so competitive. There still aren't enough houses to meet the demand.

South Seattle is even worse...I guess because it's more affordable so people are grabbing what they can. Inventory is actually going down there.

Leschi Jul: 167 Aug: 151

Georgetown Jul: 91 Aug: 85

Build up of inventory seems to mostly be happening in the outskirts of King County. Here's were it's going up:

Bothell Jul: 98 Aug: 109

Kent Jul: 207 Aug: 233

So far it looks like the trendy areas have kept their allure.

One thing to keep in mind - all new construction is not listed on NWMLS. Not a huge portion of the market (just like FSBO's aren't), but something to remember. Builders don't need to formally list every home in the plat when market is/WAS so strong, also a lot of pre-sales dont get input.

Below is a chart from appraiser Alan Pope (don't know how to link). New construction for all NWMLS which now includes all kinds of BFE counties. One thing for sure, big upswing in inventory through '06. If you dig further, you can see 60% of it is concentrated in King/Snohomish, so 40% is scattered throughout remaining counties/BFE sub-markets - new construction does/WILL affect resales activity. In effect, greed is good Gordon Gecko - will allow me to move up to that dream custom in BFE.

Since there are still not a lot of national builders in Puget Sound (nationals have gotten a lot more efficent and disciplined compared to past decades thanks to Wall Street), the market remains comprised of a lot of locals and regionals who should of learned their lesson in prior cycles.

http://www.alanpope.com/PugetS_NewCon_Res.pdf

Go to pg 2, 2006 is highlighted in green

One thing to keep in mind - all new construction is not listed on NWMLS

Actually, it is. They have a whole special section for new res and condo construction.

Also, Pope's comment on his website is generally true -

"In the analysis of the total market at all price points and neighborhood locations, when pending offers exceed some 30% of the listing inventory for three consecutive months, home values are generally appreciating. Absorption rates between 20% and 30% reflect a generally stable housing market. When absorption rates fall below 20% for three consecutive months, a buyers market prevails. The absorption rate is the relationship between pending sales and available inventory, a percentage that measures the strength of the housing market."

Have a ways to go before net absorption consistently trends to below 20%, but we are headed in that direction. You can chart this ratio (pending sales for the month / total active inventory at that particular time) yourself for any county, MLS statistical area, etc, and see what's happening in your neck of the woods.

When considered in its entirety, the Puget Sound (NWMLS definition) is actually approaching the upper limit of a balanced market - net absorption down to 28% in 7/06, from high of 43% in 3/06 and the craziness through early to mid '05 (50%+ range).

http://www.alanpope.com/Puget.pdf

To Meshugy's credit, King County alone remains far less balanced (net absorption still in the low 40% range coming down from a high of 65% in 3/06). And the neighborhoods he speaks of will always be highly competitive in my opinion (caveat: when priced appropriately). Take a look at Laurelhurst in particular.

Basically been stuck in a seller's market since early '04. Time to move on - here's to a buyer's market in '07!

PS - Meshugy, actually its not - if a home is sold directly from the builder to customer, or builder has in-house marketing, it may not be formally listed and would not show up in the stats obviously, just like FSBO's dont show up. Like I said, not a sig portion of the market here, but wow Thurston County look out - they must not like paying agents down there.

PS - Meshugy, actually its not - if a home is sold directly from the builder to customer, or builder has in-house marketing, it may not be formally listed and would not show up in the stats obviously, just like FSBO's dont show up.

That's probably true...I don't think the MLS catches everything. But you said ALL new construction...that's not true because the MLS does track new construction.

Absolutely they do - I meant to say "not all" new construction.

Also, the new construction inventory stats should be reviewed closely, b/c some of the listings may be 1) proposed (pre-sales) or 2)under construction. In other words, its not standing inventory. Thats why you have to look close at marketing times - is that a true marketing time of 125-150 days if it also includes a sign up (ie - formally listed w/ MLS) from the get-go (during construction)?

I must state that when looking at NWMLS price reduction data in neighborhoods such as those shown earlier, please include the median or average price of those listings being reduced. Just looking at the number of price reductions in a certain area does not tell the whole story.I have a difficult time believing that listings under $600,000 are drastically being reduced in these areas. Also, the NWMLS only tracks a minimal portion of actual new construction listings in the area, as many spec. builders and condo developers do not feel the need to try to list to outside agents. A quick search of a few popular developments will show this indefinitely. New Home Trends is probably the only company in the area that actually tracks all of the new construction developments in the Puget Sound region through visiting every development monthly. They also track pipeline inventory.

Anon 8:45-

I'm not going to do all your homework for you!

Get a Zip Realty account (it's free) and check price reduceds for yourself.

Price reductions in Seattle are across the board in all price ranges.

Any would be buyer who is not tracking this info is taking huge risks with their money and future.

Does MLS cover FSBO's?

Here is a nice site:

Forsalebyowner.com

It lets you search your zipcode.

Have fun.

One more thing.

Forsalebyowner.com lets you get a little better picture of what's out there.

The number of homes that are FSBO in Seattle are staggering.

Have fun.

About that second chart: it doesn't look too different than areas in CA, albeit offset by a few months. Coming soon to puget sound nabes: YoY price reductions.

Post a Comment