Seattle Times: We Are Immune, So Says History

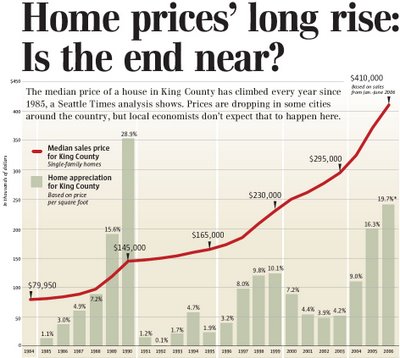

With all the press that Shiller's Home Price Index got last week, I suppose it was inevitable that our region's #1 real estate cheerleader would feel compelled to mount a stirring defense of Seattle's real estate downturn immunity. Amusingly, Elizabeth Rhodes' apparent comeback to Mr. Shiller's frightening graph of home prices since 1890 is to splash a graph of her own across the front page of the Sunday paper. A graph that goes all the way back... to 1984 (conveniently just after Seattle's last price declines). (Edit: FYI, this graph is not adjusted for inflation.)

Princeton economist Paul Krugman, writing in The New York Times, said: "The long-feared housing bust has arrived."There's not a shred of new information in this 1,265-word rant, just the same tired arguments we've been reading over and over again—strong local economy, not as expensive as California, etc., etc., etc... The focus of this particular article is the "it's never gone down before" argument. I wonder if Ms. Rhodes and her lauded "local economists" have heard of the phrase "past performance is no guarantee of future results."

Nationally speaking, anyway.

If history is any indication, King County may escape it, according to a Seattle Times analysis of single-family-home prices. It shows that appreciation rates have risen and fallen, sometimes precipitously.

But not once since 1985 — through recession years, interest-rate spikes, wars and employment downturns — has the countywide median price of a single-family home fallen, although it's come close.

...

A market-risk index compiled by PMI Mortgage Insurance calculates that San Diego faces nearly a 60 percent chance that home prices will fall in the next two years — the highest for any U.S. city.

Boston, Sacramento, Los Angeles, San Francisco and San Jose all have a 50 percent or greater chance of price dips, PMI says.

Then there's Seattle: about 11 percent.

"When we see declines in prices, it's nearly always driven by a local economic shock first," said Mark Milner, PMI Mortgage's chief risk officer. "So what this index is basically answering is how vulnerable Seattle is to a local economic shock: not nearly as vulnerable as Southern California."

Seattle-area job growth is among the strongest in the country, Milner said, and the local unemployment rate is below its long-term average. Equally important, he said, is that Seattle's housing prices, while high, are still more affordable to local residents than prices in other coastal cities.

Since Ms. Rhodes hasn't added anything to the discussion, I really don't have anything to add myself, either. In fact, I addressed the "if history is any indication" argument at length a while back, so I'll just ask you to read that, if you haven't already.

(Elizabeth Rhodes, Seattle Times, 09.03.2006)

36 comments:

Is it possible that this ostrich syndrome in the local press could actually make matters worse? I'm not sure I can articulate my worries... Could the lulling into complacence by the local media inflate demand and make for a harder landing in Seattle than in other areas? Thoughts??

Gosling-

I have thought about this myself and come to this conclusion:

It probably WILL make things worse here. Think of all the people who have continued buying, at hyper inflated prices, this year in Seattle because of all the shady, misleading and downright lying press coverage.

At least SOME of those people could have been "saved" by just a BIT of a cautionary note on the part of the media. Or at least a cut-back on outright lies.

I think my favorite, on the disgust meter, was the 11PM news that immediately followed the FIRST national media attention to the bubble.

It was that 20/20 show end of last winter. Promptly at 10:50, the leader for KOMO 4 news butts in during commercial break with a hysterical "Seattle housing market as red hot as ever!!! Details at 11."

The news then proceeded to spew lies about the Bryant neighborhood being "so hot you had to overbid or you'd never land the deal." etc.

Totally disgusting lies. I had been tracking the Bryant neighborhood for several months previous and it was one where just about everything had been selling under asking, most of it after being price reduced in the first place.

I'm all for personal responsibilty and doing your homework before making major purchases. So if these buyers are FB's, that's the end of it.

But how the media could LIE like that really bugs me.

In the meantime, parts of NE Seattle have seen homes, bought in 2004 for 450K, sold this past year for over a million. Presumably on the notiom that RE was still hot here, a notion planted by a lying local media.

I have to think that yes, a lot of these people who bought during Seattle's "last hurrah" this past year are going to be well and trully f@cked.

And the Seattle Times articles encouraging young people to throw caution to the wind and buy tiny condos at double what their rent is. Disgusting. Ruined lives.

And encouraging people to "buy with friends". More disgusting.

The local media has definitely contributed to an increase in the coming misery.

Again, Mark Trahant, editor of the PI is the only one who has shown a hint of concern and responsibilty.

And in their defense, there HAVE been honest reports of the American RE mess every Sunday for months in the Times. So anyone with half a brain could have extrapolated out and ignored the "we're different" local articles on the same page.

But that would take developing a healthy dose of mistrust towards realtors, brokers, RE cheerleaders, etc. Something that many people do not yet have. Tho I bet they WILL have it in the coming years.

Hold your disgust. If people don't lose their jobs, they aren't going to lose their homes either, overpriced and all. They won't be happy sitting with a loss but that is a far cry from going back to their parents. Many people plan to live in their homes for awhile, not flip them.

One example of our healthy job market, Expedia is hiring left and right.

I wonder if Ms. Rhodes and her lauded "local economists"...

You made a good point here and prob didn't know it. Dick Conway is the real deal (Phd economist, has covered the Pug Sound region for years), but G..dner is...let's just say - relatively new to Seattle. Does a lot of "market studies" for condo developers - ya dig? Can't say much more - first prize is a Cadillac Eldorado...

I had to be medicated after reading this article.

This "analysis" is one of the most amateurish, hackneyed, odious pieces of effluvium that has ever washed down the pike. This is the stuff of rotting whale carcasses.

Dick Conway says that "Appreciation will slow, but prices not likely to fall."

OK, fair enough, Dick. Just what do you include in your analysis?

Further down the article we find out:

Economist Conway doesn't include the adjustable-rate loan scenario among the possibilities that could cause a local dip.

That's like camping on a railroad track, and the scoutmaster spots a 75 car freight train headding for you at top speed, and says "You will be just fine, as long as this train doesn't hit you."

Honestly, the musings of a drunk in Pioneer Square would be more enlightening than this drivel.

The sage continues...

"It would take some combination of a recession, a jump in inflation and a jump in mortgage rates to cause a big drop."

Well, Dick, just WTF do you think is coming to an economy near you? Real Estate IS the economy, so any stalling would spell curtains for the economy-at-large. Inflation is raging, but the FED underreports it because HOUSING COSTS, FOOD, and ENERGY are not counted!!!!!

BTW, how many MBS have been marked 'Return to Sender' in recent months? We will need higher rates to schlep these MBS - much higher rates because the lending industry has been lending trillions to absolute morons and the collateral at the margin sucks.

Finally, the Piece de Resistance...

If that happened, he's confident the Federal Reserve would take measures to stimulate teh economy, allowing Seattle to again escape a sustained decline in home prices.

The FED will rescue us? I needed a sedative after reading that about 100X.

Hey! Dick. Newsflash: The FED is in the process of washing its hands of this mess. They can't save Seattle anymore than they can save San Diego. Once the dollar tanks, the FED will lose any credibility is has left and it will be off the cliff for the economy - SEATTLE INCLUDED.

I recommend that anyone that has an extra $10/mo to spend dial up Bill Fleckenstein. He has been the most vocal of a very small group that has been decrying the FED over the past two bubbles. He has routinely bitch-slapped Easy Al, and B-52 Ben all over the place. It is good reading at 10X the price.

So, this all boils down to:

-We are fine. No sudden movements...Seattle is fine...no sudden movements...

-The "professional" analysis does not include a slipping economy, inflation, rising rates, an uncooperative FED, or ARM INTEREST RESETS!!!!!

There was a bunch of twaddle centering around how our job growth makes us bullet-proof. I wonder if these "experts" considered just how many of our jobs are directly related to the REIC or retailing via the HELOC?

I have repeatedly seen the PMI Group go on about price declines in various markets. Their analyis always looks good, but is revised as events go into the rear view mirror. That's like forcasting the stock market based upon yesterday's WSJ.

Has anyone but yours truly given any thought as to WTF is going to happen to the PNW RE market when all of these vulnerable California markets invert? They list San Diego (60%), San Francisco (56%), LA (57.5%) as primed for a downturn.

Please, ask any PNW RE agent what would happen to their business if they lost the influx of Californians, and then ask them what would happen if they lost all the Texas business. One is a REALLY, REALLY, REALLY BIG player in our market, and one isn't.

People think I'm nuts when I make predictions, but these vaunted economists pull some prediction out of their ass and say "only 2 to 3%" and we drool all over ourselves in hushed reverence.

Here is another quote:

"If owners who can't refinance their adjustable-rate mortgages flood the market with for-sale homes, that could do it [cause price drops], some experts say."

You need to be an "expert" to proffer this colossial no-shitter?

I'd better go take my Thorazine.

This reminds me of a Far Side cartoon where a scientist is drawing out some elaborate proof or equation.

The scientist had every conceivable mathmatical symbol and function in his proof, and right in the middle, there was a giant box surrounding the words "AND THEN A MIRACLE HAPPENS."

Finally, there were more math functions and the conclusion.

Rod Serling could not have come up with this. We are a nation of morons. Even my 7yo knows there is no Easter Bunny, Tooth Fairy, and Santa Claus, yet 100,000,000 adults think the Real Estate Fairy will leave another $100K under their pillow - just because they believe.

Here is another insane Eleua prediction:

In 2010, when real estate is trading anywhere from 20 to 40 cents on the dollar, the local real estate "experts" will be saying they warned us of this back in 2006. My bet is Dick Conway, Mark Milner, Matthew Gardner, and Lizzie Rhodes will all be telling us how prescient they were.

I will be saying that it is now time to buy, and they will all go on to tell us what a loser investment real estate is.

Self-serving jackass, moronic, wastes-of-sperm...

My "new price paradigm" is based on the chart in this article (notice slope change in 1997) and also this chart.

The rise in home prices since 1996/1997 is extremely anomalous. A subsequent crash is inevitable.

Here are the steps for determining the fair value of a home assuming that values will return to historical index values.

1) Using Zillow find out what the house was worth in 1996/1997 as these are the last couple of years before "gravity switched off" on prices.

2) Take the 1996/1997 and assume a fixed appreciation rate of 4% from then until now.

3) The number you arrive at will be +/- 10% of fair value based on the historical values for housing.

Examples (based on 4% appreciation schedule):

100K in 1996 worth 148K 2006.

150K in 1996 worth 222K 2006.

200K in 1996 worth 296K 2006.

250K in 1996 worth 370K 2006.

300K in 1996 worth 444K 2006.

350K in 1996 worth 518K 2006.

400K in 1996 worth 592K 2006.

450K in 1996 worth 666K 2006.

500K in 1996 worth 740K 2006.

Upgrade costs should be added on top of these estimates (e.g. if a 100K home had 20K in upgrades then instead of 148K the fair price would be 168K).

Given that some places have seen house prices double or triple since 1996 you can see that even these graphs are "conservative".

I stand by my theory that the above numbers prove that price corrections of up to 70% will be what it takes to get back to "normal" in the more extreme bubble areas.

Moose,

I think you are correct when you use the '97 prices as your benchmark. However, I don't think you need to add 4% for every year thereafter.

'97 was the beginning of the previous (stock) bubble, and Seattle was disproportionately benefitting from it. The Housing Bubble was slipped into the mix, just as the wheels were about to come off the bus as the stock bubble imploded. Again, Seattle disproportionately benefitted from the housing bubble.

Since '97, what has happened in Seattle that isn't one step removed, or directly related to the internet build-out and the housing bubble?

I don't think there is any "there" there when you look at the aftermath of both of these bubbles. The internet build-out was a vapor, Microsoft is no longer doing stock options, and capital has been so misused by this housing bubble, I think we will be worse off than we would have been if neither bubble occured.

History shows that the aftermath of bubbles is always worse than if the bubble had never taken place - in other words - the lumps you take avoiding the bubble are less severe than the lumps you take after the bubble bursts. I have no doubt that will play out in this scenario, but we need to "square" the damage, due to the implosion of two bubbles.

You are correct with using '97 as your benchmark.

Here is a case study for the above pricing paradigm.

Address: 215 34th Ave E, Seattle WA

1) 1996 price=$260K

2) 2006 "Fair Price" assuming 4% per year=$385K

3) Improvements=$150K (I know the owner)

4) 2006 "Total Fair Price"=$385K+$150K=$535K

Zillow Zestimate=$1040K

Overpriced by 49%

e pluribus unum.....

House 2 doors down was just about 2 months ago purchased by a early 20s guy.. 550,000 dollars.

I Pulled up the King County records and behold 100% interest loan on something like 500,000. ... King county records only show the main loan the other loan is most likely the other 20% with maybe the closing costs rolled into it.

2000 square foot house in Bellevue.. older home built in the early 70s.

Guy has something like 4 others living there maybe more, with something like 5-6 cars on a calm night. Hes moving his boat cars parked on the side streets just to make more room... I cant stand outside the back door and hear several people on his deck this moment.

Every weekend the parties get bigger and bigger- now beer bottles are starting to end up in the neighbors yards ... just last night there had to be maybe 100 people drinking well into past 3 o'clock in the morning.

My room renter came in about that time and told me he heard arguing in the frontyard with several people. This appears to almost be minors or maybe they are.

The neighbors are up in arms.. with all the cars and traffic.

I cant believe they would give a loan like that to some guy that doesnt appear to be managing anything other than a party 2-3 days a week...whens the party over?

Eleua - easy tiger. Like I said, Conway has a good track record and should not be the topic at hand - well respected private sector economist - not some cheap Gary Watts with Orange County Realtors Assn. I have ordered it for years. Conway-Pederson Forecast uses the Blue Chip Economic Consensus (since 1976) along with a proprietary input-output model for the region. It deals with a baseline scenario, as well as a high and low projection. The focus however, is not on house prices but the broader regional economy.

Anyway, you appear to be waiting for the same thing I am. Agreed that Fleck is a good contrarian viewpoint. I am heavily invested in cash and metals. However, you are talking about something major (structural) which is very hard to specifically forecast with all this "funny money". Common sense points to the case for a correction, but wherever you take it after that is hard to say. Also, this is the MSM (and local yocal at that), what do you expect? At least she made a nice color chart with a scary headline "Is the end near". Credit bubble, then housing bubble.

How would you factor in depreciation?

I would look at median income to median house price at historic interest rates. If King County's median income is $55K, and the traitional ratio (prior to the speculative booms in RE over the past 20 years) is 3:1, then we are looking at $165K for the median house.

Mercer Isl would be $275K, Bainbridge Isl would be $225K.

Sketch out how a family of 4 would spend $55K/yr, and see if $165K @ 9% (gift) would fit in traditional ratios (28% max) of their income. Could the median family find $33K for a down payment?

Any worthwhile analyis needs to be done without consideration of "AND THEN A MIRACLE HAPPENS" money. Internet stocks, Microsoft stock options, X-Cal equity, inheritance, meth sales, bank robberies, HELOC, etc...

What can a stable family afford, and still live within their means, while affording a budget-conscious, normal existance?

"I don't think you need to add 4% for every year thereafter."

I know. I was being "conservative" for the sake of Baby Blue and the other bulls.

I think this bubble is far worse than any in history because the economic fundamentals are uniformly bad across the board.

Also, the same "herd psychology" that caused prices to go up so much will cause price drops to overshoot in the negative direction.

The "perfect storm" of cheap money, toxic loans, sleazy RE/Loan practices, speculation, and a media fed "feeding frenzy" caused gravity to switch off for a few years.

Combine this with record government debt, endless war, record oil prices, a FED who is in a catch-22 (raise rates and kill the economy or cut rates and kill the dollar), and record consumer debt...and we have the makings of a disaster.

"But you and I, we've been through that, and this is not our fate,

So let us not talk falsely now, the hour is getting late.

All along the watchtower, princes kept the view

While all the women came and went, barefoot servants, too.

Outside in the distance a wildcat did growl,

Two riders were approaching, the wind began to howl."

B. Dylan.

anon 1113,

True. I should take a deep breath. I've seen better "analysis" on bathroom walls.

My predictions are based upon an entirely new paradigm of how real estate will be valued. Right now, people (primarily Baby-boomers) view real estate as a trust fund, or a Swiss Annuity, when it is no more of an investment than a Beanie Baby.

Just how 77,000,000 people plan to retire in style by selling their McMansion is truly a wonderment. Just who is going to buy them out so they can live the Golden Girls version of La Vida Loca? GenX? Great! Taquerias and nail salons will float the Baby-boom.

...and Janet Reno will be a best selling porn star...

In the same Sunday Seattle Times, there is a pull-out Sunday Magazine that features how aging workers will keep on the job. IOW, the Baby-boom will not retire.

Duh.

They can't. The average amount saved, outside of their home equity, is less than $20K per Boomer. How long will $20K last at these interest rates? The housing myth has caused them to sink all their savings into their homes, and if we hit an air pocket...?

Nope, the Baby-boomers will leave the office with a toe tag, and not a minute earlier. Virtually none of the 77,000,000 have paid off their home, and most have levered-up to extend their real estate "wealth."

Once people look at homes as a necessary EXPENSE, not an investment, prices will fall in line with incomes.

I guess living in suburban Dallas has given me perspective on this. In the Southern Denton County area (Flower Mound, Highland Village, Double Oak, Copper Canyon), you have some VERY nice homes. People buy homes for living, not investments. It's not that they can't afford high priced homes, as that region has a higher income than any comparable region in the PNW, it is just not an investment priority.

If that paradigm hit the PNW, you would see prices get cut by 50% overnight, and probably drift down to 1/3 of what they now are. That is with a healthy economy. Good luck finding a healthy economy when people are $300K underwater on their "investment."

Let's use the inflation calculator at http://www.westegg.com/inflation/ to see these prices in 1984 dollars:

1984: 79950 -> 79950

1990: 145000 -> 78337

1995: 165000 -> 89142

1999: 230000 -> 124259

2003: 295000 -> 159375

2005: 410000 -> 221505

It appears the price increased by a factor of 2.77 in real terms over 21 years, or about 4.98% per year.

People will overpay for a house, and beat their chest with pride. We all stand aside in awe of their financial brilliance.

FB: "I paid $900K for a 2 bedroom craftsman in a vibrant neighborhood."

Joe Public: (hushed)"Wow! You are now on the real estate escalator. What a brilliant financial move."

----------------------------

FB: "I paid $75K for a '05 Volvo S60."

Joe Public: "What a moron! They MSRP for $30K!"

Moose,

You are talking about what I'm talking about. This is a perfect storm.

I'm more of a Van Halen kinda guy than a Dylan fan. Here is a Van Halen song that fits:

Dream Another Dream

(Words by Van Halen)

Psst!

Hey, come on man. Wake up

Yea-yeah!

I see the power changin' hands

Risin' from the streets

A self-made businessman

Knows how the system can be beat

Oh, we're the lost generation

Have no place to go

The road to destruction

Is all we need to know

'Cuz it's a rip-off

We're stepped on and cheated

We're flat stone cold lied to

We're not defeated. No!

It's ah, easy money

It's a way out

Join the family

No middleman. No IRS

Your ticket out of poverty

Oh, we're the lost generation

I hold fate from a string

Lookin' for a direction

Reachin' out for anything

So, dream another dream

This dream is over

Dream another dream

This dream is over

Dream another dream

This dream is over

Over, yeah

So dream another dream!

(obligatory Guitar Solo)

What does Heloc mean?

HELOC = Home Equity Line Of Credit

("When we see declines in prices, it's nearly always driven by a local economic shock first," said Mark Milner, PMI Mortgage's chief risk officer. "So what this index is basically answering is how vulnerable Seattle is to a local economic shock: not nearly as vulnerable as Southern California.")

so why the heck is the rest of the nation's housing market in shambles?

this chart says Seattle has seen price declines

words from mr. toll

"In his 40 years as a home builder, Mr. Toll says, he has never seen a slump unfold like the current one. "I've never seen a downturn in housing without a downturn in employment or... some macroeconomic nasty condition that took housing down along with other elements of the economy," he says. "This time, you've got low unemployment, you've got job creation, you've got a stable stock market and relatively low interest rates."

-WSJ

"What can a stable family afford, and still live within their means, while affording a budget-conscious, normal existance?"

Who gives a shit about the average faimily anynore?

Having come from South Florida I was no stranger to rosey outlooks on the RE market. Still, I was surprised that the article in the Seattle Times was so glib about things and had so little actual data or even a counter opinion in it......

Yeah, people will be shocked when they see that they aren't protected by some mysterious "bubble" thing here.

I guess they don't call it Emerald city here for nothing do they?

MLS 26142194 sums up everything that is wrong with current Seattle area prices.

Ft2=1240

Bed=3

Bath=1.75

1) 1996 price=$177K

2) 2006 "Fair Price" assuming 4% per year=$262K

3) Improvements=$25K (a guess)

4) 2006 "Total Fair Price"=$262K+$25K=$287K

Zillow Zestimate=$590K (Overpriced by 51%)

MLS List Price=$749K (Overpriced by 62%)

What am I missing here? This is a small crappy 1950's rambler!!!

Economist Conway doesn't include the adjustable-rate-loan scenario among the possibilities that could cause a local dip.

"It would take some combination of a recession, a jump in inflation and a jump in mortgage rates to cause a big drop," he said.

OMFG! Yeah, that sounds as unlikely as martians coming down from outer space and hitting Ballad with a Death Ray doesn't it?... crazy talk there, wow, talk about wildly hypothetical arguements, geez...

In all seriousness, ignoring the adjustable-rate-scenarie? Is this dude serious? Too bad you can't be dis-barred from practicing 'economics', what a joke! That's like analyzing World War II without dismissing the events of World War I....

Somebody's been putting extra tint in those rose-colored glasses Liz Rhodes wears...

Wow, Seattlemoose, I haven't been paying attention to Bellevue lately, but those are some ridiculous prices... ala www.burbed.com type stuff. 1 Million for a split level? Geesh... "Brazen Realty" indeed!

If that happened, he's confident the Federal Reserve would take measures to stimulate the economy, allowing Seattle to again escape a sustained decline in home prices.

Hahaha, good one dude! That a joke? ... no serious.

Yeah, I'm sure the Fed's looking at its 'misery map' right now and going...

"Yeah, South Flordia, Boston, D.C., SoCal, yeah those guys can hang but Seattle... we must make sure there's no price drop in Seattle! Seattle's the housing-bubble's Stalingrad, we mustn't let it fall! Here's a blank check for the bailout!"

Let's see... hmmm... up interest rates to keep the stock market afloat, or save the miserable numbskull barrowers that submarined on their neg-ams?... Ha! that's a good one!

Is this guy kidding? The Fed will let the average F'd barrower fold on his mortgage quicker than Superman on Laundry Day. I give Berneke 2 seconds to throw the homeowners under the bus. If you think the Fed's looking out for the little guy, I've got some swampland in the Duwamish to sell you...

Yawn, don't you people get it? Seattle is still going to appreciate. White flight out of California, coupled with the most incredible outdoor opportunities ( and varied ) in the country... Go home to your apartments and cry

RE: MLS # 26142194 (long and possibly offensive)

I'll tell you what your missing - amateurs and stupid foreigners still trying to make a quick buck, I see it more and more, even this late in the game. No offense to the Middle Eastern folks on this blog, but there is a helluva lot of them and what looks to be the Russian mafia flipping/building garbage, mostly in S King County. Looking for the American dream.

Do everyone a favor and DON'T bid on this kind of nonsense. I'm sure you wouldn't even look, but spread the word and maybe the potential list of FB will shrink.

Sale Date 3/6/2006 Sale Price $605,000

Seller Name

SAUVAGE ALAN W

Buyer Name

ARAVA ASA+KHORDIAN AVRAHAM+SHACHAF ZIVA

That is mostly land value - amateur hour made the cardinal mistake of remodeling the POS instead of demo and build. Prob bailed on the idea or bank said no thanks (plans come with the place). New const loans are different from all the funny money (existing SFR) that is out there - if you dont have your shit together (plans, specs, costs, experience), no dice.

Just recently, many pros and custom builders started to dump high-end lots/tear-downs on the Eastside (leading indicator for softness in the $1.0-2.0+ million range). Just want to get rid of them at little to no profit. 3 "scrapers" I looked at this weekend listed for exactly 7-8% above recent closed price. Comprende? Builder's cost basis plus expected closing and sales costs. All are negotiable and there will be even better deals going forward.

Looks like they thought improvements were worth about $100K, as fair price was prob $500K for the dirt based on what is (WAS) supported there, a 4,000 SF custom @ $350-$375/SF, or $1.4-$1.5 million (33-36% lot-house ratio).

Regardless, crappy flip overall. Even if it does sell for $749K (best case), take out a 6% commish, 2.5% closing costs, that leaves net proceeds of $685K. Less 6-month hold (100% financed based on the lie that it's owner occupied, interest only @ 6%), thats down to $675K. So if they did the work themselves on the cheap, that's another $25K ($20/SF). That leaves an overall basis in the property near $650K and a best case net profit of $45K (6% of list price). These are soft costs they don't teach you on "Flip That House".

Sorry, that's not a win-win IMHO. Need a minimum profit of 15-20%. I can't wait till these morons exit the market stage left. BTW, this particular "flipper" is from - you guessed it: La La Land.

Let's recap -

-No housing price drop since Boeing almost closed in the 70's and took the Seattle economy with it.

-It took 2 decades for prices to recover.

-Californians can't sell their houses so no more rich retirees moving up here.

-Rest of the country thinks it rains all the time in Seattle (thank you Hollywood) and wouldn't want to live here.

--I'm betting prices will drop again.

Has anyone here taken the time to sit down and write Ms. Rhodes a nice email about how INSANE and DAMAGING her cheerleading will be to many people?

I have numerous times, but she usually answers with the "I guess we'll have to wait and see!", and "I only report the numbers", etcetera... you can never her engage her in any fundemental questions, especailly the ARM question which she blows off wholesale.

Anon 01:20:10

This country has gotten weak in so many ways and being "politically correct" is one of them.

I prefer a big stick and boots over "oratory" any day. Guess I spent too many years in Texas. Rural Texans don't put up with limp wristed BS and I like that about them.

As I have posted before we have scoured King country checking out rentals and of 30 places we physically looked at, about 25 of them were "flips" and of those 20 were "foreigners" (asian or arabic sounding names.)

And I concur with one you on another point. A lot of the contact phone numbers on Craig's List were...you guessed it....LA.

I believe that speculation is the 800 lb gorilla in the room with respect to this bubble. I think it is vastly understated. I met one guy who had a dozen properties. He was mid eastern and probably in his mid-20's.

You take all these bozos out of the market and all of a sudden the "tight supply" is looking about as tight as the employees of the ol Chicken Ranch in LaGrange TX.

"Yawn, don't you people get it? Seattle is still going to appreciate. White flight out of California, coupled with the most incredible outdoor opportunities ( and varied ) in the country... Go home to your apartments and cry"

whomever's website that is is ok in my book

Has anyone here taken the time to sit down and write Ms. Rhodes a nice email about how INSANE and DAMAGING her cheerleading will be to many people?

Yeah, I tried to respond, but after I read it back to myself, it sounded like Lee Ermey auditioning for Full Metal Jacket.

I'm working on a more avuncular draft.

The thing that's so very dangerous about the coming decline is that it's an abnormal one. It's not going to be initiated by job losses or recession. That means that prices have gone up WAY more than they have in previous crashes, because there were no brakes. Now we're going to get the job losses, the recession, and the housing crash all rolling into a ball and feeding off of each other. Usually they happen in sequence, this time we're going to get them in parallel, which makes the whole thing very unpredictable.

Anon 8:31-

re: "Relax, a lot of people bought homes to live in, not flip"...

So, that makes it okay to actively encourage people to go out and mortgage to the hilt on a depreciating asset? Just because they're going to live there for a long while?

Great logic. Tell that to the girl who bought the overpriced condo in Ballard, 1/2 the size and twice the monthly payment as her rental.

Can't go out now, no extra money to spend.

She thinks she got in on the bottom wrung and will be trading up for a house some time in the future.

Here's a prediction: She's going to be stuck in that tiny condo for YEARS while friends who had the sense to keep renting go out and buy a house in a couple years. Their mortgage on a house will be the same as her mortgage on a POS overpriced condo.

Granted, she could have used her head a bit and done some research before jumping in.

But she had a LOT of encouragement from the local lying rah rah Seattle media.

SPD,

I'm with you. Never underestimate the power of peer pressure.

Markets are about the movement of the herd. When the herd moves one way, it takes a lot of guts to go against it.

When you are a contrarian, or against the herd, you are essentially telling everyone that you know something they don't, and they are being foolish. They are telling you the same.

That is why "buy low - sell high" is a helluva lot more difficult than it seems. "Buy high - sell low" is far easier (and more commonplace).

By definition, the peak is the best place to sell, but is also the very point the herd mentality is screaming "buy" the loudest.

The RE shills know what they are doing.

Post a Comment