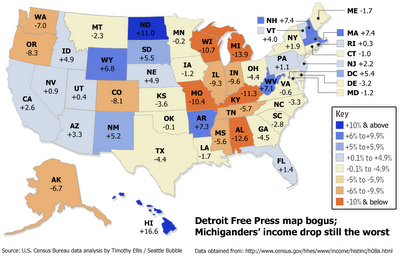

Correction: Income Decline Map

I'd like to make a correction to an earlier post. It was pointed out to me by the ever-vigilant Richard that the income map I posted earlier this week used data sets from two different sources for the two years they compared. The discrepancy was discovered by a pair of reporters at The Examiner.

More surprisingly, these figures didn't match those in the Census Bureau's Current Population Survey, or CPS, which showed that median household income in the US had fallen only 2.8 percent — and had risen in around 20 states, not four. Where, we wondered, had they gotten their figures?Whoops. So what was Washington State's actual change in median household income from 1999 to 2005? According to the US Census Bureau's inflation adjusted household income table, incomes in Washington State fell only 7.0% from 1999 to 2005, not the 8.4% reported by the Detroit Free Press.

An e-mail exchange with the journalists gave us the answer: They had taken their 2005 numbers not from the CPS, but from the American Community Survey, a new research product that is scheduled to replace the detailed “long form” census collected every decade. But they hadn't taken the 1999 figures from the ACS — in fact, the ACS is so new that it didn't even publish nationwide data for 1999. Instead, the journalists had taken the 1999 income figures from the official 2000 census.

Bad news for Michigan residents, though. Not only is their income drop still the worst, but it's actually worse than reported by the Detroit Free Press. Here's the entire map, corrected by yours truly using the same data source for both years.Overall it is a less grim picture than the bogus map, but Washington still sticks out as a loser among the western states. It should be noted that this does not change the point of my original post. Incomes have gone down in Washington, and thanks in large part to risky loans, during the same time period home prices have gone up. That's just not healthy.

(Stuart Buck & Megan McArdle, The Examiner, 09.14.2006)

17 comments:

Thanks for putting that together....although it has also been noted that Microsoft stocks have thrown the data off. Incomes, at least in Seattle are up.

Seattle feeling slightly richer

But those figures include billions of dollars from Microsoft's special $3-a-share dividend in late 2004. Because Chairman Bill Gates, Chief Executive Steve Ballmer and other Microsoft insiders and large shareholders live in metro Seattle, analysts say, the dividend inflated personal-income figures in 2004.

"The growth in 2005 looks weak because you had this bulge in 2004," said Bret Bertolin, senior economic forecaster with the state Economic and Revenue Forecast Council.

Bertolin estimated that about $5.2 billion of the $32.4 billion Microsoft paid out went to insiders in King, Pierce and Snohomish counties. Take that out of the calculations, and a very different picture emerges.

Per-capita personal income in the Seattle metro area in 2004 drops by about $1,635, to $39,999. Growth that year falls to 4 percent, but 2005 growth jumps to 4.2 percent — much closer to the national averages of 4.9 percent and 4 percent, respectively.

The adjusted numbers better reflect the reality of the Puget Sound area's economy, said Dick Conway, economist and co-editor of the Puget Sound Economic Forecaster.

All right, you can repost an article you've posted like two or three times before... But I'm going to repost my comment about it that you never replied to...

The article you link to, that shows rising wages from 2003 to 2005 does not account for inflation (the map in this post did), which stands at 8.31% for the Jan. 2003 - Dec. 2005 time period.

Let's see, from the article, what was the total increase in per-capita personal income (different than median household income, btw) during that time? $38,460 (2003) to $41,661 (2005) is a grand-total increase of 8.32%. Wow, so Seattle-area wages outpaced inflation by a whopping 0.01 percentage points.

I guess they really do mean "Seattle feeling slightly richer."

I notice the big "bubble states" always talked about on here are actually in positive territory: California, Nevada, Florida, etc. Interesting...

"Washington still sticks out as a loser among Western States."..

Ummm, at -7%, there are only 8 states that are worse than WA.

Considering that there are 50 states, WA. sticks out as a loser , period.

"All right, you can repost an article you've posted like two or three times before... But I'm going to repost my comment about it that you never replied to..."

Same for me...this article is just as bogus as the first time you posted it, Meshugy.

Great update! I was disappointed to find out the very widly circulated DFP map was flawed. Given how close the Census figures were, it makes me wonder why they even used the other group's data.

Whatever the case, the negative real income growth indicates that the money sucked out of consumers pockets as arms reset will have a greater effect in Washington than other states.

It may also mean that Washington has been more dependent on equity withdrawls to fuel consumer spending the last few years. I'd love to see some stats on that broken out by state.

and remember, because owner's equivalent rents(among other things) were counted in the CPI and not record housing increases, the CPI is low. so real wage gains and etc. are actually worse than the numbers show.

"It gets so tiring to sift through M's. crap to get to anything of value".

Agreed. That's the problem in a nutshell. He detracts from the blog. In a big way.

Income Decline Map / JOBS

The 'map of misery' seems to originate with an article from the Detroit Free Press.

This is a town that in very concerned with JOBS.

This is a newspaper that also has headlines like this

"DETROIT (AP) -- Ford Motor Co. said Friday that it plans to cut 10,000 more salaried jobs and offer buyouts to all hourly workers as part of a dramatic restructuring plan designed to rein in expenses and restore the struggling automaker to profitability."

Until we see headlines like this in the Times or PI, the Seattle housing market will be fine. JOBS drive the housing market - seattle is fine.

The map of misery is irrelevent for the area - especially considering it's data is skewed(according to the poster).

Jobs drive the housing market in a normal market. In a market that's up as much as ours is, speculation and dangerous loans are the main drivers. It's kind of silly to argue when you look at the affordability numbers. When incomes are growing so much less than housing, it's obviously unsustainable, no matter if the jobs in the area are strong.

As long as JOBS are here we will not see a Decline from these current levels.

Wow Anon 10:15!-

Until we see headlines like 10,000 Seattle jobs lost (in one day!) we'll be fine?

You have a VERY high threshold for pain!

Actually, in a way I envy optomists such as yourself.

You have the ability to party on, oblivious, til the last possible moment.

On the other hand, that mindset pretty much precludes that you'll do any responsible planning for the inevitable, using the facts at hand.

Maybe you'll "luck out" and not get burned.

Frankly, I think it's important to hear out Meshugy...after all, the market is made up of people. People's opinions are their own private reality and they make decisions based on those opinions. Some of the surprisingly rapid drops in some local RE markets elsewhere can't be accounted for by sudden demographic or financial shifts, but by sudden psychological shifts in the mob-brain of parts of the market. Meshugy's opinions currently still reflect a large portion of the rank-and-file folks out there who may be considering buying or selling. The question is when will the 'magic' amount of info/rumor/sentiment be present for the mob mentality to change?

Excellent editorial again today (Sunday) by Mark Trahant of the Seattle PI.

He describes the situation as a "credit bubble" that has led to the housing boom.

This is what economists (outside of the NAR of course!) have been saying for a year.

The only reason prices got so high, and continue to be so high, is because of lax lending standards.

So, even withOUT -7% income, we'd be screwed.

Think about that before signing up for an ARM or other "creative" loan just to squeeze yourself into an overpriced home or condo.

People have been warned now about this shakey housing market by the media, the Fed, many economists and now the Homebuilders and managers of REITs for the stock market.

If you still decide that now is the time to buy, and run into financial difficulties when your home goes down in price next year, just know that it is youir OWN FAULT.

It's not your lying realtors' fault. It's not your lying brokers' fault.

Those people are PAID to lie to you.

These loans are beginning to be returned by the MBS buyers to the original lenders.

Once that begins on a big scale, credit will tighten and the housing market will plummet.

No bank wants to keep those crap loans on it's books. Nor are they able to.

I am very optimistic. Why not? - as long as I am empoyed and can pay the mortgage.

Interest rates will stay low.

Inflation is starting to show signs of weaking which will allow the Fed to NOT raise interest rates next week.

And for all the people worried about ARM's resetting.

People have had plenty of time to REFI to a fixed - anyone that can't refi out of there arm to a fixed shouldn't be a homeowner anyway. Whats so wrong with that?

It seems that the housing slowdown is "Orderly" as predicted

Party ON!

@ anon

"People have had plenty of time to REFI to a fixed - anyone that can't refi out of there arm to a fixed shouldn't be a homeowner anyway. Whats so wrong with that"

Well, one thing wrong with that is that we have no idea how many sales have been made on that basis, no true idea of the staying power of the market.

It's true that there are a lot of folks who should not be homeowners,

we may find out soon how many of them are very tenuously attached to their properties.

No one commenting on this HUGE story on the front page of the Seattle Times this morning?

If the real-estate industry is "powered" by illegals, then so is the restaurant industry, the landscaping industry and the "moving heavy shit" industry.

I just hope these guys are getting paid proportionally to what is being charged to build the crackerbox particle-board homes that they're slapping together....

Post a Comment