Mapping Housing Market Health

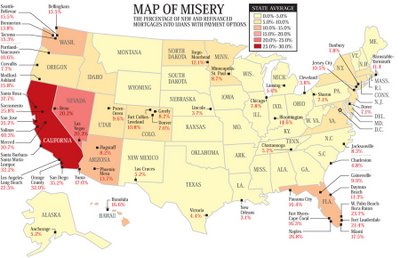

A pair of maps containing interesting statistics surfaced in the past few weeks that are worth sharing here. First is the "Map of Misery" from BusinessWeek, showing "the percentage of new and refinanced mortgages into loans with payment options." This is important to note, because as BusinessWeek explains:

The option adjustable rate mortgage (ARM) might be the riskiest and most complicated home loan product ever created. With its temptingly low minimum payments, the option ARM brought a whole new group of buyers into the housing market, extending the boom longer than it could have otherwise lasted, especially in the hottest markets. Suddenly, almost anyone could afford a home — or so they thought. The option ARM's low payments are only temporary. And the less a borrower chooses to pay now, the more is tacked onto the balance.As you can see, the Seattle area is right up at the top, with only portions of California, Nevada, and Florida having a larger percentage of option ARM loans. Note that this only includes option ARM, and does not include interest-only loans or other ARM products. Who knows how high that number would be if it did.

The bill is coming due. Many of the option ARMs taken out in 2004 and 2005 are resetting at much higher payment schedules — often to the astonishment of people who thought the low installments were fixed for at least five years. And because home prices have leveled off, borrowers can't count on rising equity to bail them out. What's more, steep penalties prevent them from refinancing. The most diligent home buyers asked enough questions to know that option ARMs can be fraught with risk. But others, caught up in real estate mania, ignored or failed to appreciate the risk.

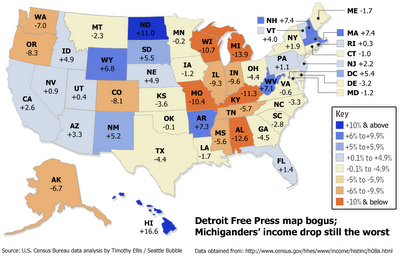

The second map comes courtesy of the Detroit Free Press, and shows the difference in inflation-adjusted median household income from 1999 to 2005. (Correction: The Detroit Free Press used inappropriate statistical methods, leading to incorrect values on the original map. The below map is a corrected version generated by yours truly. See this post for details.)So, during a time when wages have decreased 7.0%, home prices have doubled, defying all logic. How is this possible? Sure, low interest rates were a factor, but they only dropped about two points from 1999 to 2003. That does not explain 100% home price appreciation. No, the primary culprit is certainly the ready availability of adjustable-rate mortgages, including a large number of option ARMs. Too many people have been swept up in home ownership psychosis, and have been all-too-willing to jump head-first into dangerous financing.

And yet there are still those that insist that our housing market is 100% healthy.

(Cover Story, Business Week, 09.01.2006)

(John W. Fleming, Detroit Free Press, 08.30.2006)

41 comments:

Hi Tim...

apparently wages in Seattle actually went up.

Seattle feeling slightly richer

Per-capita personal income in the Seattle metro area in 2004 drops by about $1,635, to $39,999. Growth that year falls to 4 percent, but 2005 growth jumps to 4.2 percent — much closer to the national averages of 4.9 percent and 4 percent, respectively.

The adjusted numbers better reflect the reality of the Puget Sound area's economy, said Dick Conway, economist and co-editor of the Puget Sound Economic Forecaster.

The local area emerged from recession in mid-2004, after the rest of the country, but is now growing faster, he said.

Also, it's worth mentioning that housing supply has lagged way behind job growth in WA.

Close to home: Seattle housing market is cooling more slowly than elsewhere

he number of new jobs has outpaced building permits for single-family homes and condos by 30% the past 15 months.

Growth Management Effects on Real Estate

For example, for every five jobs created in Seattle during the past five years, only one housing unit has been built.

apparently wages in Seattle actually went up.

...from 2003 to 2005, yes. But from 1999 to 2005, I doubt that Seattle wages are up, while statewide wages are down 8.1%.

Also, it's worth mentioning that housing supply has lagged way behind job growth in WA.

You're quoting from an article that was shown to be filled with completely bogus figures.

For example, for every five jobs created in Seattle during the past five years, only one housing unit has been built.

The report appears to be speaking about the city proper. Considering that the city population has been essentially stagnant for decades, I have no problem believing that figure. I also don't think it's at all relevant. Show me a similar statistic for King County as a whole, and maybe we'll be getting somewhere. Although I don't see what this has to do with decreasing wages coupled with increasing home prices and more people taking out increasingly risky loans.

The Map of Misery is pretty disturbing, but the spreadsheet on foreclosures is just as distressing. A 33% increase in foreclosures for the nation over the last year is not pretty. Drilling into those numbers and seeing that foreclosures are up 344% in New Hampshire, 179% in Massachusetts, and 213% in Illinois is downright scary. What's surprising, is that given the dour news out of Colorado (up a measley 57%), Florida (down 11%), and California (up a mere 71%), foreclosure rates are as low as they are, so far.

Of course, I am only citing one point of YOY changes, and that hardly makes a trend. I'm sure that next year's numbers will make everyone crap their pants. Time to invest in Depends.

Considering that the city population has been essentially stagnant for decades

Actually, that's wrong. The US Census shows:

Seattle 1990: 150,033

Seattle 2000: 191,822

Seattle 2003: 202,631 (Estimated)

Seattle 2008: 220,252 (Estimated)

I have no idea where the numbers in that table come from, but city sources (based on Census data) place the recent population estimates at around 570,000 people, only just recently surpassing 1960's highs. Therefore the statement that Seattle city population has been "essentially stagnant for decades" is in fact absolutely correct.

For what it's worth, the King County population exceeds 1.75 million, so 570,000+ for Seattle sounds a lot more reasonable to me than a measly 220,000.

Wow! Meshugy has finally become a housing bear.

First he references a piece that states that the per capita income rise from 2004-2005 was .7% lower than the national average (after some mind-bending logic to get it that high).

Then he references an article talking about how the Seattle market is cooling slowly, and states that a flood of condos is on the way (to drive down prices as supply overtakes demand).

Then he comes across with a 5-year-old piece on growth management in King County that relies on a 1997 study for much of its argument. Obviously little or no growth has been occuring since then (in fact King County population has increased about 1%/year since 2001), so we must be all caught up now, housing-wise.

Finally, he references estimations by the US Census for 2003 and 2008, when actual numbers are available in the King County Annual Growth Report, and show population growth of about 1% annually since 2000:

Year Population Growth

1980 . . 1,269,898

1990 . . 1,507,319 . . 18.70%

1995 . . 1,613,600 . . 7.05%

2000 . . 1,737,034 . . 7.65%

2003 . . 1,779,300 . . 2.43%

2004 . . 1,788,300 . . 0.51%

2005 . . 1,808,300 . . 1.12%

Woo hoo! Bull capitulation complete!

This data shows a huge jump in Bellevue-Evert-Seattle from the 1960s:

POPULATION GROWTH

1960: 1,126,851

2000: 2,414,616

OT -

Major jumps in inventory in Redmond and Seattle area as a whole over the weekend:

Date Redmond % Seattle

9/7/06 204 30685

9/11/06 227 +11.3% 31357

This data shows a huge jump in Bellevue-Evert-Seattle from the 1960s:

I never said that the greater Seattle area wasn't experiencing population growth. I said that the report you linked to, the one that claimed "for every five jobs created in Seattle during the past five years, only one housing unit has been built" was irrelevant because housing outside the city has grown at a much faster rate than inside the city proper, where population has been stagnant anyway.

I should also point out that your first article, that showed rising wages from 2003 to 2005 did not account for inflation (the map in this post did), which stands at 8.31% for the Jan. 2003 - Dec. 2005 time period.

Let's see, from your article, what was the total increase in per-capita personal income during that time? $38,460 (2003) to $41,661 (2005) is a grand-total increase of 8.32%. Wow, so Seattle-area wages outpaced inflation by a whopping 0.01 percentage points. They really do mean slightly richer.

Thankyou Tim for a very powerful and well-written post that clearly illustrates what we are up against in this neck of the woods.

BTW, I know couple people whose salaries have gone down over the past few years in Seattle- and that wasn't even inflation-adjusted. They took a hit in the amount of dollars they brought home each month, in the same industry.

If adjusted for inflation, obviously they are even worse off than it looks. One is in banking and the other IT.

And I can truthfully say that I can't think of one friend in Seattle who feels RICHER now than they did in the late 90's.

Maybe I'm not thinking about it hard enough? There's got to be SOMEBODY!!

At any rate the toxic loan situation for Seattle appears to lend credence to either the drop in income or the fact that housing has outstripped ability to buy sensibly, or both.

Tim,

That "seattle feeling slightly richer" article is a total puff piece -- as I pointed out yesterday, it draws a conclusion that even it's own (highly manipulated) data fails to support.

From the article:

"The Bureau of Economic Analysis...reported Wednesday that personal income in the Seattle-Tacoma-Bellevue area last year was $41,661 per person, a mere 0.06 percent above 2004 — and a growth pace that was 355th out of 361 metro areas studied."

So, income growth, according to experts, is essentially flat....

Next paragraph:

"But those figures include billions of dollars from Microsoft's special $3-a-share dividend in late 2004. Because Chairman Bill Gates, Chief Executive Steve Ballmer and other Microsoft insiders and large shareholders live in metro Seattle, analysts say, the dividend inflated personal-income figures in 2004."

Now we see the Times starting to pull a fast one....does the data say that income growth is flat? No problem! It's Bill's fault.

So what does the Times do? They arbitrarily subtract the 2004 income due to the Microsoft dividend (which hasn't gone away since, mind you...), and come up with the following:

"Per-capita personal income in the Seattle metro area in 2004 drops by about $1,635, to $39,999. Growth that year falls to 4 percent, but 2005 growth jumps to 4.2 percent — much closer to the national averages of 4.9 percent and 4 percent, respectively." (emphasis mine).

So, basically, once the Times plays fast-and-loose with the numbers, they arrive at figures that...wait for it...still show average wage growth.

Does this deter the Times? Ha! Next paragraph:

"The local area emerged from recession in mid-2004, after the rest of the country, but is now growing faster, he said."

The secret to Quality Reporting: if the numbers are bad, manipulate them 'till they're average, then say that they're actually good.

If you're really brilliant, you then undermine the very premise for manipulating your numbers in the next paragraph:

"The extra Microsoft money had little impact on the local economy, Conway and Bertolin said."

The article is a complete, transparent joke -- Drew DeSilver must be Elizabeth Rhodes' intern or something....

US Census shows Seattle 2000: 563,375

Grew to 573,911 in 2005.

Over 10 thousand more people....

See: US Census

Seattle population has not been stagnant for decades -- why do you say that, Tim? Stagnant means unchanging, right? The overall population of the city increased a little over 9% between 1990 and 2000 (that's about 50,000 people). You also have to factor in the fact that their are fewer and fewer young children in Seattle, so that affects the overall population numbers. There has not been a population explosion, by any means, but there has certainly been steady growth.

Seattle population has not been stagnant for decades -- why do you say that, Tim?

For the record, I said (quite intentionally choosing my words) essentially stagnant for decades. Note that I did not say "stagnant for a decade." Yes, it has been slightly on the rise since 1980. However, if you look at this graph you will see that the statement "essentially stagnant for decades" does indeed apply.

Back to the 2 maps that Tim's focused on:

There are not many states that have BOTH high percentage of ARMs and high income drops.

Besides Washington, what other states have a high number of option ARMs, AND wage loss?

Let's see...

Arizona (Phoenix)

Florida (Ft. Lauderdale, Miami)

Colorado (Denver)

Nevada (Vegas)

The cities in these states that have similar stats in ARMs and income drops as Washington are considered as having extreme housing bubbles. Bubbles that are for the most part, popping right now.

I think these two maps clearly state that seattle *is* special - it's special only like 4 other bubble states that are popping.

Add Washington to the mix and that's only 5 states out of 50 with this combo. Yes, that is special.

However, if you look at this graph you will see that the statement "essentially stagnant for decades" does indeed apply.

That is a very peculiar reading of that graphic. I don't see that showing an essentially stagnant population level at all. It shows huge growth until the 1960s, then a sharp decline, and then a couple decades of steady growth through the 2000s. How is that stagnant? It shows a very positive trend in population -- not a boom but healthy growth. Your bias is extreme!

tim, tim , tim. Although population has only slightly increased, the number of people per household HAS dropped. Thus, the demand for housing has actually increased because of the larger number of DINKs, smaller families, and empty nesters.

RE Seattle population:

Most of the price appreciation in the local market that this bubble site focuses on has happened since 2000.

If you look at population growth in Seattle since 2000, it is only 2%.

You can argue that 2% is indeed "growing", but I don't think you can argue that population growth in Seattle the last 5 years is a reason for sustainable price appreciation at the current levels - based on such a small increase in population.

People here don't seem to realize that overall population is not a particularly meaningful statistic in this context. If you have a city of 100,000 people but 40,000 of them are under 18, you have a very different situation where you have a city with 100,000 people but only 20,000 of them are under 18. Obviously the housing demands are completely different. Seattle now has the lowest percentage of children after San Francisco. I'm sure you have heard about the closing of public school in Seattle? Well it's because there are less kids than there used to be. Seattle is attracting many young professionals and empty nesters who do not have children. Very different from the Seattle of a couple decades ago.

I think these two maps clearly state that seattle *is* special - it's special only like 4 other bubble states that are popping.

so Seattle is a state now?

if you guys are going to use state data to make points about seattle - well sorry, but you can't expect to be taken seriously!

Austinbell, I agree that there are less kids in Seattle, and that should correlate to a larger percentage of the population being adults - and thus potential homebuyers.

Do you have any data that shows # people per houseold in Seattle over time?

We could take that data, and compare it to the number of total housing units in Seattle over the same time period.

We would have to account for new units that have been built - and see if they offset the decrease in people per household.

It would be interesting data.

so Seattle is a state now?

Ok, my bad. I was taking a bit of broad swipe there without explanation.

But IMO, Seattle drives a large percentage of the State economic data.

I have nothing to prove it, but I am guessing that wages fell in Seattle comparative to the rest of the State.

I'll try to find some hard data.

Denver, Phoenix, Miami, and Las Vegas are experiencing a popping of a realestate bubble.

Do you see any correlation to these events and the ARM and wage data in Tim's graphs?

Thanks for pointing out the obvious relationship between the extreme bubble places and the wage/ARM data, Nolaguy.

Looks like Forbes was probably on to something when they called Seattle America's most overpriced city last summer.

Also looks like there is absolutely nothing that can be done to convince some housing bulls that Seattle is in the crapper along with the crappiest.

They have their credo, their religion: The Seattle market is built on solid fundamentals and will not go down.

They will believe that all the way down to the bottom. They're the ones who will buy back in on the "dips" and watch the market falter ever lower.

I'm not going to worry about them. They'll recoup their investment in 20 years.

Honestly, I think it will take that long.

But for you RE believers, have at it! The market's all yours now, nobody else wants it!

I don't have stats going too far back for this, but since 1980, the avg. household size has decreased about 5% in Seattle, from 2.15 to 2.05. So in the period when the population has been increasing, the household size has been shrinking.

I would like to see the data back to 1960 or 1970, but I don't have it handy.

It kind of reminds me of the Internet Stock Craze..

Werent we Just several Years ago basing our beliefs on Growth... Not earnings.. we kept believing that these companies were for real with there massize growth with no real earnings to show for.

Today we keep looking for reasons that real estate is based on some new logic other than Wages~! Bottom Line its wages and what we really can afford. It only works until it doesn't work.. then finally people realize that the bottom line is affordabiltiy. What Can People really afford? can Most people in seattle afford a average price house at 400,000. ???

Denver makes just several Thousand dollars less than us on a yearly wage, however they can not afford there average home price of something like 220,000. dollars..

Denver has 1 out of 60 houses in some form of foreclosure at this moment.. Whats the difference, its called appreciation to cover your ass. When we run out of appreciation were potentially going to much worse than Denver Colorado.

All the "it can't happen here" crowd will soon become the "prices can't go any lower" crowd everytime there is a slight pause in price decreases.

Seattle is doomed. Prices will be half of what they are now by the time the "correction" is over.

It's "in the bag"...

Seattle is attracting many young professionals and empty nesters who do not have children. Very different from the Seattle of a couple decades ago.

Right, so they have $900-$1600 more in disposable income per month than Seattle parents with very young children in daycare do, so they can afford more expensive housing.

That is a very peculiar reading of that graphic. I don't see that showing an essentially stagnant population level at all. It shows huge growth until the 1960s, then a sharp decline, and then a couple decades of steady growth through the 2000s. How is that stagnant? It shows a very positive trend in population -- not a boom but healthy growth. Your bias is extreme!

Okay I'll make one more go at explaining what I'm trying to say. I aplogize for not being more clear up to this point. Meshugy linked to a report (based on data from the mid to late '90s) that said:

For example, for every five jobs created in Seattle during the past five years, only one housing unit has been built.

Presumably the point he was trying to make was that today's high home prices are (at least partly) justified because supply (number of housing units available) has not kept up with demand (jobs being created / people moving in).

Here's the point I am trying to make with that graph. The population of Seattle when the 1960 census was taken was 557,087. For the next two decades, the population declined. Since 1980, it has been on the upswing, only just recently passing that 1960 level. Now, I could be wrong (and I can't locate hard data to back this up), but I have serious doubts that the number of housing units declined from 1960 to 1980 as the population declined. I'm guessing that the number of housing units either increased slowly or remained fairly steady, and likely has been steadily increasing the whole time.

So, if the number of housing units in 2000 was at or above the number of housing units in 1960, that wouldn't be a shortage of housing, would it? Certainly not a significant enough shortage to drive the wild price increases we've seen, anyway.

just shows how information can be spinned to make it look how you want it...

simply there was little new housing being added at that time because there was still a surplus of homes from the 1960's...

and look at how old most homes are and you'll see most date back to the 60's and beyond...

So, if the number of housing units in 2000 was at or above the number of housing units in 1960, that wouldn't be a shortage of housing, would it? Certainly not a significant enough shortage to drive the wild price increases we've seen, anyway.

Tim

You refuse to address the fact that household size has dwindled in the past decades in Seattle -- I am guessing a huge drop since 1960. So just because there are the same number of houses (if that is indeed true) does not mean there isn't a housing shortage. The overall population numbers might be similar in 1960 and 2006, but the number of children has dropped and the number of singles and childless couples has grown. That is not a stagnant population, it shows an important demographic shift. And that would still equal a shortage of housing. I guess you just dispose of the facts if they don't fit the theory!

The reason I ignored those remarks is because the only numbers that were provided to back up the assertion that household size was a major factor were so small as to be insignificant. But I don't expect you to just take me at my word on that. Here is some math:

avg. household size has decreased about 5% in Seattle, from 2.15 to 2.05.

1980

population: 490,000

household size: 2.15

# of households: 227,907

2000

population: 563,374

household size: 2.05

# of households: 274,817

Total increase in # of households, 1980-2006: 20.6%

In order to sufficiently house 20.6% more households than 20 years prior, we can reasonably assume that 20.6% more housing units are needed. So, what is the necessary average yearly growth in housing units such that we have 20.6% more housing units in 2000 than in 1980? Less than one percent growth per year (0.94%, to be more precise).

This of course assumes that housing supply was at 100% capacity in 1980, which I believe is a foolish assumption. What if in fact housing supply was at 100% capacity in 1960, and simply held steady for 20 years?

1960

population: 557,087

household size: 2.25 (guess)

# of households: 247,594

So the assumed number of housing units in 1960 with 100% capacity would be 247,594. If it was the same in 1980, then the growth rate in number of housing units would only have to have been 0.52% per year from 1980 to 2000 to keep up with demand.

So yeah, I ignored the decreasing household size, because whichever way you crunch the numbers it just doesn't make that big of a difference.

another factor to consider is the desire for larger square footage of the housing unit themselves. Too many 900-1200 sq. ft. clunkers on 5,000 sq. ft. ( and 3,333 sq. ft) lots in this town.

Tim

Unsurprisingly, your guess of 2.25 is much too low.

The average household size in Seattle in 1960 was 2.70 -- so the change to 2.05 is over 24%.

The percentage of people in Seattle living alone or with an unrelated person increased from 29.6% in 1960 to 68.1% in 2000. That is a 130% increase in non-family households.

In 1960, children under 15 were the largest block of population in the city. In 2000, the largest block of population was young adults 20-34, followed by middle age adults 35-54.

You like to downplay this change but the fact is, it is a huge shift.

The average household size in Seattle in 1960 was 2.70 -- so the change to 2.05 is over 24%.

Thanks for doing the research on that...I thought this might be the case. We simply require far more houses for the same population now. Furthermore, the population is rising...it's pretty obvious that we still have a severe shortage of housing in this town.

It's also worth noting that the population of the surrounding areas had surged over the last 40 years. Part of the reason the Seattle population has remained steady is that there is simply is no more room...hence the huge increase in outlying areas.

So, even with little population increase in Seattle, demand can skyrocket because you have large #s of people in the outlying areas vying for in-city property.

Unsurprisingly, your guess of 2.25 is much too low.

The average household size in Seattle in 1960 was 2.70

First off, I'll take your numbers at face value, but I'd really appreciate it if you linked to your source. Assuming your 2.70 figure is correct, let's revise my math:

1960

population: 557,087

household size: 2.70

# of households: 206,329

So the # of households in 1960 was lower than 1980 by 10.5%. So if we assume that construction merely kept pace with the apparently increasing housing demand during those years of declining population, then the number of housing units would have needed to increase an average of just 0.50% per year during 20 years. Then, once the population started to increase again, the number of housing units would have needed to increase at the rate of 0.94% per year.

That still doesn't seem like very much to me, and I have yet to see anyone provide data to show that housing supply has not sufficiently kept up with the demand created by increasing population (since 1980) and decreasing household size. All you're doing is insisting that demand for housing has gone up. I am not disputing that. I just don't think it has gone up so drastically as to significantly outpace supply. And furthermore, all of the insane price run-ups in Seattle have been since 2002, so I fail to see how any of this even really comes into play.

...it's pretty obvious that we still have a severe shortage of housing in this town.

Actually no, it's not obvious at all, and still no one has provided actual data to show that this is the case. Please provide links to reliable data sources containing the following information for Seattle or King County as a whole (yearly is preferred, decade census data is minimum):

- Household size

- Population

- # of available housing units

- Median home price

Only when looking at the entire picture created by that data can we determine whether there is any shortage of housing, severe or otherwise.

tim

you make a lot of assumptions in your argument -- and just like your assumption about household size, they could be totally off. i don't know if they are but i think you should do the research before you make the argument. go talk to the nice gov. docs. librarians at the SPL or UW, they can hook you up.

And furthermore, all of the insane price run-ups in Seattle have been since 2002, so I fail to see how any of this even really comes into play.

dude, you're the one who made the population being stagnant for decades assertion! if these aren't relevant issues, why bring them up?

you make a lot of assumptions in your argument -- and just like your assumption about household size, they could be totally off.

Feel free to point out the specific assumptions that you have a problem with, and/or do the math with your own different set of assumptions. Simply saying that I "make a lot of assumptions" without pointing out what they are is not an argument against my point.

dude, you're the one who made the population being stagnant for decades assertion! if these aren't relevant issues, why bring them up?

I brought it up only in response to Meshugy's comment about how much housing was being built. And if you'll look, I said from the start that I didn't think it was relevant. Meshugy spun off on a tangent, and I attempted to point out that the assertions he was making did not make sense.

Feel free to point out the specific assumptions that you have a problem with, and/or do the math with your own different set of assumptions. Simply saying that I "make a lot of assumptions" without pointing out what they are is not an argument against my point.

You make assumptions about construction keeping pace with demand, historically, in Seattle. You even call them assumptions so I didn't think I'd need to point that out. I have no idea if you are right or wrong - my only problem with the data is that you don't know if you're right or wrong! It isn't my job to do your research for you. I think if you are going to make an argument, at least have your data to base it on.

Great job of allowing Meshugy to hijack this thread all.

A post goes up, a really IMPORTANT one, IMO, about inflation adjusted wages and toxic loans and quickly gets diverted to population and inventory levels.

This guy is being paid by realtors to infiltrate this blog. Can you not see that?

It's a well-paying part time job that he is very good at (congrats Meshugy) and NEEDS as a self-employed musician.

How he sleeps at night knowing that he's about the business of screwing present homebuyers out of their hard earned cash is another matter altogether.

but I suspect he's paid well enough to more than make up for any ethical doubts he may have.

Post a Comment