Tooting Seattle Bubble's Statistical Horn

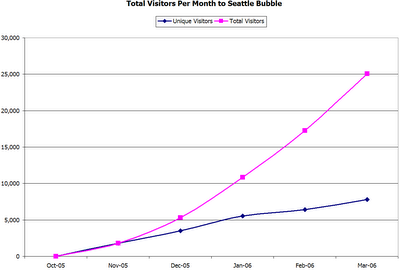

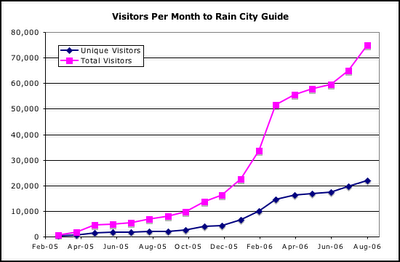

I noticed that Dustin posted the latest visitor stats for Rain City Guide, and I just couldn't resist posting the same stats for Seattle Bubble. Before I get to the current stats though, I thought it would be interesting to look back at the last time Dustin posted RCG stats, in March. Here are the RCG and Seattle Bubble hit graphs through March '06:

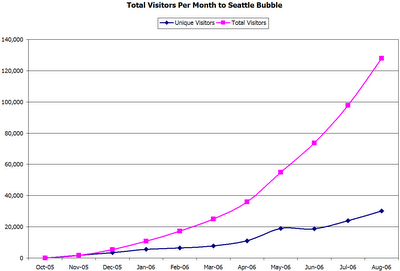

With a five-month head start on Seattle Bubble, Rain City Guide was pulling in about twice as many unique visitors per month in March—roughly 15,000 to Seattle Bubble's 7,500. Now let's fast-forward to the present. Here are the most recent visitor graphs for RCG and Seattle Bubble:Woo-hoo! Not only did we catch up with Dustin and crew, we passed them up, and pulled in approximately 30% more visitors last month. The August stats for Seattle Bubble show just over 30,000 "unique visitors" to Rain City Guide's 23,000 (my rough guess based on Dustin's chart). I'm using Google Analytics as the source of the data for these graphs (in order to directly compare to Dustin's graphs from the same source), however you can poke around the public Statcounter stats for yourself if you're interested.Since I'm totally and unashamedly copying Dustin on this post, here are a few interesting tidbits from the Google Analytics stats:

- 24% (7,185) of visitors in August arrived through Google searches.

- 23% (6,979) of visitors last month came through their bookmarks or typed the address in directly.

- The top three blogs referring traffic to Seattle Bubble in August were The Housing Bubble Blog (5,235), Vancouver Housing Market (1,604), and Bubble Meter (747).

- Many of you are tech-savvy, as 31% of you are using the superior web browser Firefox. Firefox + Adblock + Filterset.G Updater FTW!

- The top 10 search phrases that landed people on Seattle Bubble account for 40% of all search engine traffic.

- Of all the unique visitors in August, 3,622 visited Seattle bubble more than 200 times.

Congrats to Dustin & the Rain City Guide crew on their continued growth. Since our "target markets" are quite different it's not really fair to directly compare graphs like this, but I enjoy some good-natured competition. And besides, now I can say that Seattle Bubble is "Seattle's most popular real estate blog." :^)

18 comments:

Congrats, Tim. Looks like the world is beating a path to your better mousetrap.

This is due partly to your (and S Crow's) good posts and partly to the excellent data and analysis by dukes, synthetik, peckhammer, eleua, and others (make sure you get a cut when Tim gets corporate sponsorship and sells out).

Thanks in advance for everyone's continued good info/analysis.

Absolutely, most of the regular commenters here provide excellent insight and analysis, that add quite a bit to the quality of this blog. Thanks to all of you. And don't forget, the invitation is still open to additional regular posters like S Crow.

Congrats! You're definitely pulling people in!

Out of curiosity, how much of your traffic is coming from Google searches?

Sign of the times.

As more would-be buyers become concerned about the bubble, more will visit the bubble sites in an effort to figure out what the heck's going on out there with the Miracle Housing Run of the past several years.

I might add:

At this point they can watch the network news and read national publications, watch CNBC cable, etc.

The news is all "bad" (or "good" depending on your point of view!) when it comes to RE.

They're all reporting what the bubble blogs have been reporting for the past year.

Better late than never.

Dustin,

The stat you're looking for is in the bullet list near the end of the post: 24% (7,185) of visitors in August arrived through Google searches.

For the entire range of my Google Analytics history (Oct. - Present), Google accounts for 17.66% (23,683) of all hits.

I must have read right through that... I read your post and then was looking for the corresponding chart to compare Google/MSN/Yahoo, etc, but what you provided definitely does the trick... Very interesting stuff!

The "loyalty" you're getting is awesomely impressive (over 3000 people more than 200 times! WOW!)

There is obviously nobody on the agent side driving traffic like the bubble blogs. I only wish there was someone driving me 5,000 hits a month! :)

Yeah, like I said, very different "target markets." You guys are pretty much blazing new trails, whereas I jumped in on an already-established and fairly active scene, with a local take on a national issue.

Who said this?:

"People who bought this year with the intention of flipping are likely to get burned".

1) a nutcase off of one of the bubble blogs?

.......or.....

2) NAR just quoted on CNBC?

If you guessed 2) National Association of Realtors, you are RIGHT!

Other notable headlines from todays' CNBC:

"Housing Horror" (love that one)

"Playing the Housing Mess" (in relation to buying/selling Homebuilder stocks)

...Still contemplating a squeeze into overpriced housing? On the "off chance" that RE always goes up?....

Whoops- should have posted above in open thread- Sorry.

Come on Seattle Price Drop, they're sealing off the borders, Seattle will soon declare its independance from the rest of the country and seal off our borders... if we're not really that different, we'll make ourselves different... Time for the housing bubble's last stand!

< Gollum voice >must keep precious's equity from the national bust, must, different my precious, different< /Gollum voice >

Yep, the Seattle media RE pumpers make the top 5 in N. America I'm sure.

Heard Baltimore and Phoenix (LOL) are also really bad.

There are always those who wake up last.

Nice to hear Vancouver is not as prone to lies and exaggerations.

Must be because Vancouver's such an undesirable place to live compared to Seattle. LOL

"There are always those who wake up last."

Seattle's fall could be made worse by ending up "the last place anyone could afford to move to".

Think about it.

San Diego values fall first while Seattle values stay high. hmmmm...best climate in the country or 8 months of cold dreary rain?

Companies leave Seattle for "anywhere else" because they can't get anyone to move here because nobody can afford a home and cost of business is cheaper.

My point is you DO NOT want to be the last bubble market to burst because EVERYWHERE ELSE ends up looking like a relatively better place to live.

They could cause the crash in Seattle to overshoot in the negative direction.

Here you go - go ahead and piss your money away ($938K)

http://windermere.com/index.cfm?fuseaction=Listing.ListingDetail&ListingID=15541691

Kondo konversion - neat location, but crappy 60's building. Note how they dont have any pics of the outside. Nice job on the inside, but this type of product will get hit the hardest going forward. Almost $1 mill for a glorified pimped out apartment in a marblecrete 60's building?

Please, the last person out of this hubba bubba brand bubbleliscious South Sea turn out the lights.

Congrats to The Tim. I originally found your site from Ben's blog. I remember not too many months ago you were only getting a couple of comments per item posted. Perserverance pays.

There seems to be lots of talk in my office from co-workers who want to sell now. Some relocating, retiring or downsizing. I keep telling them you're past the peak, pull the trigger now. We're going to run out of those vaunted California buyers.

Great work Tim...you've come a long way baby!

I think this goes right along with that talking head who was pointing to increased internet searches of housing as being a sign of interest from buyers. I think it's the opposite, more and more people are cluing in to the fact that things aren't rosey anymore.

Post a Comment